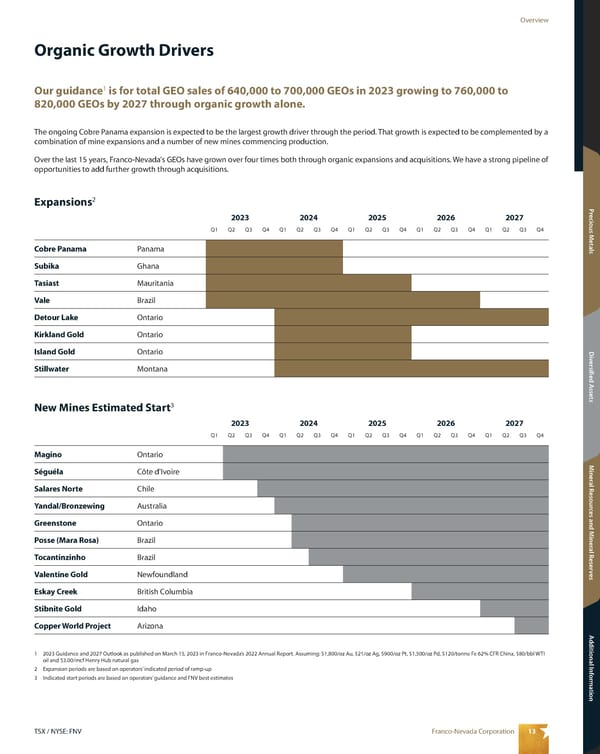

13 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals 2023 2024 2025 2026 2027 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Magino Ontario Séguéla Côte d'Ivoire Salares Norte Chile Yandal/Bronzewing Australia Greenstone Ontario Posse (Mara Rosa) Brazil Tocantinzinho Brazil Valentine Gold Newfoundland Eskay Creek British Columbia Stibnite Gold Idaho Copper World Project Arizona 1 2023 Guidance and 2027 Outlook as published on March 15, 2023 in Franco-Nevada’s 2022 Annual Report. Assuming: $1,800/oz Au, $21/oz Ag, $900/oz Pt, $1,500/oz Pd, $120/tonne Fe 62% CFR China, $80/bbl WTI oil and $3.00/mcf Henry Hub natural gas 2 Expansion periods are based on operators’ indicated period of ramp-up 3 Indicated start periods are based on operators’ guidance and FNV best estimates Organic Growth Drivers The ongoing Cobre Panama expansion is expected to be the largest growth driver through the period. That growth is expected to be complemented by a combination of mine expansions and a number of new mines commencing production. Over the last 15 years, Franco-Nevada's GEOs have grown over four times both through organic expansions and acquisitions. We have a strong pipeline of opportunities to add further growth through acquisitions. 2023 2024 2025 2026 2027 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Cobre Panama Panama Subika Ghana Tasiast Mauritania Vale Brazil Detour Lake Ontario Kirkland Gold Ontario Island Gold Ontario Stillwater Montana Our guidance 1 is for total GEO sales of 640,000 to 700,000 GEOs in 2023 growing to 760,000 to 820,000 GEOs by 2027 through organic growth alone. Expansions 2 New Mines Estimated Start 3

2023 Asset Handbook Page 14 Page 16

2023 Asset Handbook Page 14 Page 16