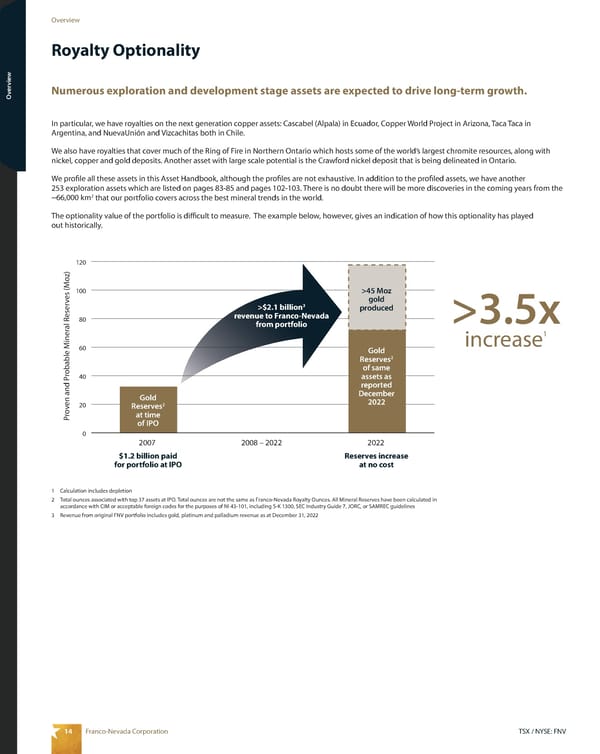

14 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview 1 Calculation includes depletion 2 Total ounces associated with top 37 assets at IPO. Total ounces are not the same as Franco-Nevada Royalty Ounces. All Mineral Reserves have been calculated in accordance with CIM or acceptable foreign codes for the purposes of NI 43-101, including S-K 1300, SEC Industry Guide 7, JORC, or SAMREC guidelines 3 Revenue from original FNV portfolio includes gold, platinum and palladium revenue as at December 31, 2022 Royalty Optionality In particular, we have royalties on the next generation copper assets: Cascabel (Alpala) in Ecuador, Copper World Project in Arizona, Taca Taca in Argentina, and NuevaUnión and Vizcachitas both in Chile. We also have royalties that cover much of the Ring of Fire in Northern Ontario which hosts some of the world’s largest chromite resources, along with nickel, copper and gold deposits. Another asset with large scale potential is the Crawford nickel deposit that is being delineated in Ontario. We profile all these assets in this Asset Handbook, although the profiles are not exhaustive. In addition to the profiled assets, we have another 253 exploration assets which are listed on pages 83-85 and pages 102-103. There is no doubt there will be more discoveries in the coming years from the ~66,000 km 2 that our portfolio covers across the best mineral trends in the world. The optionality value of the portfolio is difficult to measure. The example below, however, gives an indication of how this optionality has played out historically. Numerous exploration and development stage assets are expected to drive long-term growth. 0 20 40 60 80 100 120 2022 2008 – 2022 2007 Gold Reserves 2 at time of IPO Proven and Probable Mineral Reserves (Moz) >45 Moz gold produced $1.2 billion paid for portfolio at IPO Gold Reserves 2 of same assets as reported December 2022 Reserves increase at no cost >$2.1 billion 3 revenue to Franco-Nevada from portfolio >3.5x increase 1

2023 Asset Handbook Page 15 Page 17

2023 Asset Handbook Page 15 Page 17