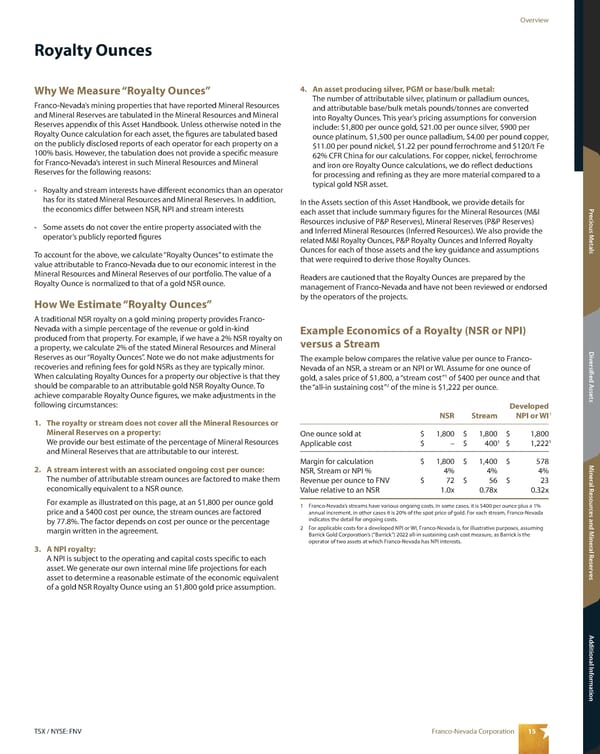

15 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Royalty Ounces 4. An asset producing silver, PGM or base/bulk metal: The number of attributable silver, platinum or palladium ounces, and attributable base/bulk metals pounds/tonnes are converted into Royalty Ounces. This year’s pricing assumptions for conversion include: $1,800 per ounce gold, $21.00 per ounce silver, $900 per ounce platinum, $1,500 per ounce palladium, $4.00 per pound copper, $11.00 per pound nickel, $1.22 per pound ferrochrome and $120/t Fe 62% CFR China for our calculations. For copper, nickel, ferrochrome and iron ore Royalty Ounce calculations, we do reflect deductions for processing and refining as they are more material compared to a typical gold NSR asset. In the Assets section of this Asset Handbook, we provide details for each asset that include summary figures for the Mineral Resources (M&I Resources inclusive of P&P Reserves), Mineral Reserves (P&P Reserves) and Inferred Mineral Resources (Inferred Resources). We also provide the related M&I Royalty Ounces, P&P Royalty Ounces and Inferred Royalty Ounces for each of those assets and the key guidance and assumptions that were required to derive those Royalty Ounces. Readers are cautioned that the Royalty Ounces are prepared by the management of Franco-Nevada and have not been reviewed or endorsed by the operators of the projects. Why We Measure “Royalty Ounces” Franco-Nevada’s mining properties that have reported Mineral Resources and Mineral Reserves are tabulated in the Mineral Resources and Mineral Reserves appendix of this Asset Handbook. Unless otherwise noted in the Royalty Ounce calculation for each asset, the figures are tabulated based on the publicly disclosed reports of each operator for each property on a 100% basis. However, the tabulation does not provide a specific measure for Franco-Nevada’s interest in such Mineral Resources and Mineral Reserves for the following reasons: • Royalty and stream interests have different economics than an operator has for its stated Mineral Resources and Mineral Reserves. In addition, the economics differ between NSR, NPI and stream interests • Some assets do not cover the entire property associated with the operator’s publicly reported figures To account for the above, we calculate “Royalty Ounces” to estimate the value attributable to Franco-Nevada due to our economic interest in the Mineral Resources and Mineral Reserves of our portfolio. The value of a Royalty Ounce is normalized to that of a gold NSR ounce. How We Estimate “Royalty Ounces” A traditional NSR royalty on a gold mining property provides Franco- Nevada with a simple percentage of the revenue or gold in-kind produced from that property. For example, if we have a 2% NSR royalty on a property, we calculate 2% of the stated Mineral Resources and Mineral Reserves as our “Royalty Ounces”. Note we do not make adjustments for recoveries and refining fees for gold NSRs as they are typically minor. When calculating Royalty Ounces for a property our objective is that they should be comparable to an attributable gold NSR Royalty Ounce. To achieve comparable Royalty Ounce figures, we make adjustments in the following circumstances: 1. The royalty or stream does not cover all the Mineral Resources or Mineral Reserves on a property: We provide our best estimate of the percentage of Mineral Resources and Mineral Reserves that are attributable to our interest. 2. A stream interest with an associated ongoing cost per ounce: The number of attributable stream ounces are factored to make them economically equivalent to a NSR ounce. For example as illustrated on this page, at an $1,800 per ounce gold price and a $400 cost per ounce, the stream ounces are factored by 77.8%. The factor depends on cost per ounce or the percentage margin written in the agreement. 3. A NPI royalty: A NPI is subject to the operating and capital costs specific to each asset. We generate our own internal mine life projections for each asset to determine a reasonable estimate of the economic equivalent of a gold NSR Royalty Ounce using an $1,800 gold price assumption. Developed NSR Stream NPI or WI 1 One ounce sold at $ 1,800 $ 1,800 $ 1,800 Applicable cost $ – $ 400 1 $ 1,222 1 Margin for calculation $ 1,800 $ 1,400 $ 578 NSR, Stream or NPI % 4% 4% 4% Revenue per ounce to FNV $ 72 $ 56 $ 23 Value relative to an NSR 1.0x 0.78x 0.32x 1 Franco-Nevada’s streams have various ongoing costs. In some cases, it is $400 per ounce plus a 1% annual increment, in other cases it is 20% of the spot price of gold. For each stream, Franco-Nevada indicates the detail for ongoing costs. 2 For applicable costs for a developed NPI or WI, Franco-Nevada is, for illustrative purposes, assuming Barrick Gold Corporation’s (“Barrick”) 2022 all-in sustaining cash cost measure, as Barrick is the operator of two assets at which Franco-Nevada has NPI interests. Example Economics of a Royalty (NSR or NPI) versus a Stream The example below compares the relative value per ounce to Franco- Nevada of an NSR, a stream or an NPI or WI. Assume for one ounce of gold, a sales price of $1,800, a “stream cost” 1 of $400 per ounce and that the “all-in sustaining cost” 2 of the mine is $1,222 per ounce.

2023 Asset Handbook Page 16 Page 18

2023 Asset Handbook Page 16 Page 18