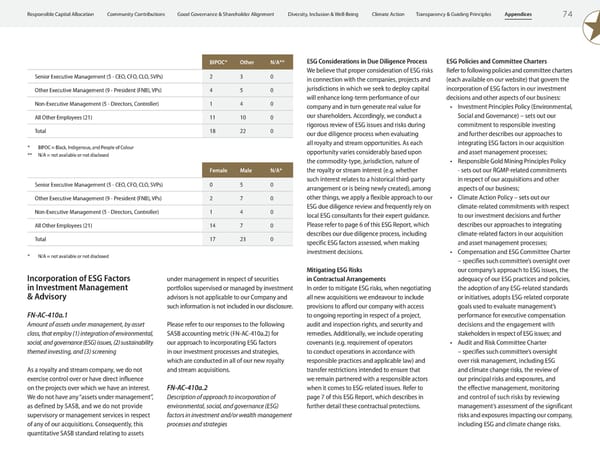

7 4 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation BIPOC* Other N/A** Senior Executive Management (5 - CEO, CFO, CLO, SVPs) 2 3 0 Other Executive Management (9 - President (FNB), VPs) 4 5 0 Non-Executive Management (5 - Directors, Controller) 1 4 0 All Other Employees (21) 11 10 0 Total 18 22 0 Female Male N/A* Senior Executive Management (5 - CEO, CFO, CLO, SVPs) 0 5 0 Other Executive Management (9 - President (FNB), VPs) 2 7 0 Non-Executive Management (5 - Directors, Controller) 1 4 0 All Other Employees (21) 14 7 0 Total 17 23 0 * BIPOC = Black, Indigenous, and People of Colour ** N/A = not available or not disclosed * N/A = not available or not disclosed ESG Considerations in Due Diligence Process We believe that proper consideration of ESG risks in connection with the companies, projects and jurisdictions in which we seek to deploy capital will enhance long-term performance of our company and in turn generate real value for our shareholders. Accordingly, we conduct a rigorous review of ESG issues and risks during our due diligence process when evaluating all royalty and stream opportunities. As each opportunity varies considerably based upon the commodity-type, jurisdiction, nature of the royalty or stream interest (e.g. whether such interest relates to a historical third-party arrangement or is being newly created), among other things, we apply a flexible approach to our ESG due diligence review and frequently rely on local ESG consultants for their expert guidance. Please refer to page 6 of this ESG Report, which describes our due diligence process, including specific ESG factors assessed, when making investment decisions. Mitigating ESG Risks in Contractual Arrangements In order to mitigate ESG risks, when negotiating all new acquisitions we endeavour to include provisions to afford our company with access to ongoing reporting in respect of a project, audit and inspection rights, and security and remedies. Additionally, we include operating covenants (e.g. requirement of operators to conduct operations in accordance with responsible practices and applicable law) and transfer restrictions intended to ensure that we remain partnered with a responsible actors when it comes to ESG-related issues. Refer to page 7 of this ESG Report, which describes in further detail these contractual protections. ESG Policies and Committee Charters Refer to following policies and committee charters (each available on our website) that govern the incorporation of ESG factors in our investment decisions and other aspects of our business: • Investment Principles Policy (Environmental, Social and Governance) – sets out our commitment to responsible investing and further describes our approaches to integrating ESG factors in our acquisition and asset management processes; • Responsible Gold Mining Principles Policy - sets out our RGMP-related commitments in respect of our acquisitions and other aspects of our business; • Climate Action Policy – sets out our climate-related commitments with respect to our investment decisions and further describes our approaches to integrating climate-related factors in our acquisition and asset management processes; • Compensation and ESG Committee Charter – specifies such committee’s oversight over our company’s approach to ESG issues, the adequacy of our ESG practices and policies, the adoption of any ESG-related standards or initiatives, adopts ESG-related corporate goals used to evaluate management’s performance for executive compensation decisions and the engagement with stakeholders in respect of ESG issues; and • Audit and Risk Committee Charter – specifies such committee’s oversight over risk management, including ESG and climate change risks, the review of our principal risks and exposures, and the effective management, monitoring and control of such risks by reviewing management’s assessment of the significant risks and exposures impacting our company, including ESG and climate change risks. Incorporation of ESG Factors in Investment Management & Advisory FN-AC-410a.1 Amount of assets under management, by asset class, that employ (1) integration of environmental, social, and governance (ESG) issues, (2) sustainability themed investing, and (3) screening As a royalty and stream company, we do not exercise control over or have direct influence on the projects over which we have an interest. We do not have any “assets under management”, as defined by SASB, and we do not provide supervisory or management services in respect of any of our acquisitions. Consequently, this quantitative SASB standard relating to assets under management in respect of securities portfolios supervised or managed by investment advisors is not applicable to our Company and such information is not included in our disclosure. Please refer to our responses to the following SASB accounting metric (FN-AC-410a.2) for our approach to incorporating ESG factors in our investment processes and strategies, which are conducted in all of our new royalty and stream acquisitions. FN-AC-410a.2 Description of approach to incorporation of environmental, social, and governance (ESG) factors in investment and/or wealth management processes and strategies

ESG Report 2023 Page 75 Page 77

ESG Report 2023 Page 75 Page 77