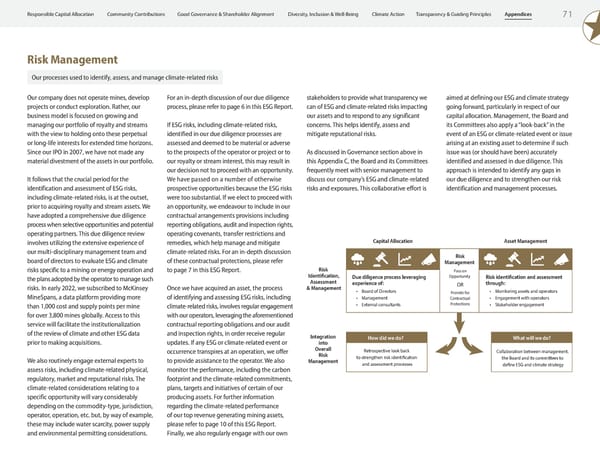

7 1 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Our company does not operate mines, develop projects or conduct exploration. Rather, our business model is focused on growing and managing our portfolio of royalty and streams with the view to holding onto these perpetual or long-life interests for extended time horizons. Since our IPO in 2007, we have not made any material divestment of the assets in our portfolio. It follows that the crucial period for the identification and assessment of ESG risks, including climate-related risks, is at the outset, prior to acquiring royalty and stream assets. We have adopted a comprehensive due diligence process when selective opportunities and potential operating partners. This due diligence review involves utilizing the extensive experience of our multi-disciplinary management team and board of directors to evaluate ESG and climate risks specific to a mining or energy operation and the plans adopted by the operator to manage such risks. In early 2022, we subscribed to McKinsey MineSpans, a data platform providing more than 1,000 cost and supply points per mine for over 3,800 mines globally. Access to this service will facilitate the institutionalization of the review of climate and other ESG data prior to making acquisitions. We also routinely engage external experts to assess risks, including climate-related physical, regulatory, market and reputational risks. The climate-related considerations relating to a specific opportunity will vary considerably depending on the commodity-type, jurisdiction, operator, operation, etc. but, by way of example, these may include water scarcity, power supply and environmental permitting considerations. For an in-depth discussion of our due diligence process, please refer to page 6 in this ESG Report. If ESG risks, including climate-related risks, identified in our due diligence processes are assessed and deemed to be material or adverse to the prospects of the operator or project or to our royalty or stream interest, this may result in our decision not to proceed with an opportunity. We have passed on a number of otherwise prospective opportunities because the ESG risks were too substantial. If we elect to proceed with an opportunity, we endeavour to include in our contractual arrangements provisions including reporting obligations, audit and inspection rights, operating covenants, transfer restrictions and remedies, which help manage and mitigate climate-related risks. For an in-depth discussion of these contractual protections, please refer to page 7 in this ESG Report. Once we have acquired an asset, the process of identifying and assessing ESG risks, including climate-related risks, involves regular engagement with our operators, leveraging the aforementioned contractual reporting obligations and our audit and inspection rights, in order receive regular updates. If any ESG or climate-related event or occurrence transpires at an operation, we offer to provide assistance to the operator. We also monitor the performance, including the carbon footprint and the climate-related commitments, plans, targets and initiatives of certain of our producing assets. For further information regarding the climate-related performance of our top revenue generating mining assets, please refer to page 10 of this ESG Report. Finally, we also regularly engage with our own stakeholders to provide what transparency we can of ESG and climate-related risks impacting our assets and to respond to any significant concerns. This helps identify, assess and mitigate reputational risks. As discussed in Governance section above in this Appendix C, the Board and its Committees frequently meet with senior management to discuss our company’s ESG and climate-related risks and exposures. This collaborative effort is aimed at defining our ESG and climate strategy going forward, particularly in respect of our capital allocation. Management, the Board and its Committees also apply a “look-back” in the event of an ESG or climate-related event or issue arising at an existing asset to determine if such issue was (or should have been) accurately identified and assessed in due diligence. This approach is intended to identify any gaps in our due diligence and to strengthen our risk identification and management processes. Risk Management Pass on Opportunity OR Provide for Contractual Protections Retrospective look back to strengthen risk identification and assessment processes Due diligence process leveraging experience of: • Board of Directors • Management • External consultants How did we do? What will we do? Collaboration between management, the Board and its committees to define ESG and climate strategy Risk identification and assessment through: • Monitoring assets and operators • Engagement with operators • Stakeholder engagement Capital Allocation Risk Identification, Assessment & Management Integration into Overall Risk Management Asset Management Our processes used to identify, assess, and manage climate-related risks Risk Management

ESG Report 2023 Page 72 Page 74

ESG Report 2023 Page 72 Page 74