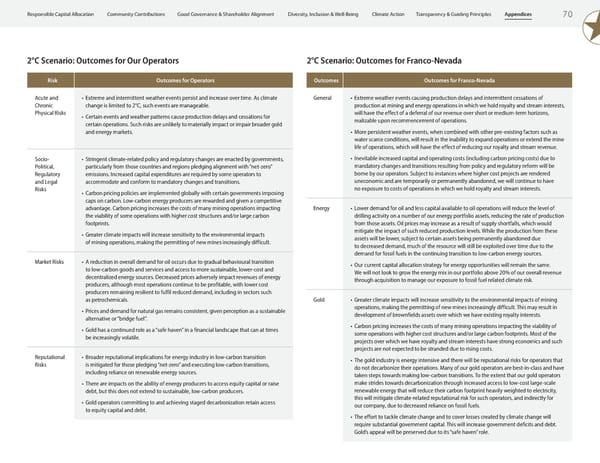

7 0 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Risk Outcomes for Operators Acute and Chronic Physical Risks • Extreme and intermittent weather events persist and increase over time. As climate change is limited to 2°C, such events are manageable. • Certain events and weather patterns cause production delays and cessations for certain operations. Such risks are unlikely to materially impact or impair broader gold and energy markets. Socio- Political, Regulatory and Legal Risks • Stringent climate-related policy and regulatory changes are enacted by governments, particularly from those countries and regions pledging alignment with “net-zero” emissions. Increased capital expenditures are required by some operators to accommodate and conform to mandatory changes and transitions. • Carbon pricing policies are implemented globally with certain governments imposing caps on carbon. Low-carbon energy producers are rewarded and given a competitive advantage. Carbon pricing increases the costs of many mining operations impacting the viability of some operations with higher cost structures and/or large carbon footprints. • Greater climate impacts will increase sensitivity to the environmental impacts of mining operations, making the permitting of new mines increasingly difficult. Market Risks • A reduction in overall demand for oil occurs due to gradual behavioural transition to low-carbon goods and services and access to more sustainable, lower-cost and decentralized energy sources. Decreased prices adversely impact revenues of energy producers, although most operations continue to be profitable, with lower cost producers remaining resilient to fulfil reduced demand, including in sectors such as petrochemicals. • Prices and demand for natural gas remains consistent, given perception as a sustainable alternative or “bridge fuel”. • Gold has a continued role as a “safe haven” in a financial landscape that can at times be increasingly volatile. Reputational Risks • Broader reputational implications for energy industry in low-carbon transition is mitigated for those pledging “net-zero” and executing low-carbon transitions, including reliance on renewable energy sources. • There are impacts on the ability of energy producers to access equity capital or raise debt, but this does not extend to sustainable, low-carbon producers. • Gold operators committing to and achieving staged decarbonization retain access to equity capital and debt. Outcomes Outcomes for Franco-Nevada General • Extreme weather events causing production delays and intermittent cessations of production at mining and energy operations in which we hold royalty and stream interests, will have the effect of a deferral of our revenue over short or medium-term horizons, realizable upon recommencement of operations. • More persistent weather events, when combined with other pre-existing factors such as water scarce conditions, will result in the inability to expand operations or extend the mine life of operations, which will have the effect of reducing our royalty and stream revenue. • Inevitable increased capital and operating costs (including carbon pricing costs) due to mandatory changes and transitions resulting from policy and regulatory reform will be borne by our operators. Subject to instances where higher cost projects are rendered uneconomic and are temporarily or permanently abandoned, we will continue to have no exposure to costs of operations in which we hold royalty and stream interests. Energy • Lower demand for oil and less capital available to oil operations will reduce the level of drilling activity on a number of our energy portfolio assets, reducing the rate of production from those assets. Oil prices may increase as a result of supply shortfalls, which would mitigate the impact of such reduced production levels. While the production from these assets will be lower, subject to certain assets being permanently abandoned due to decreased demand, much of the resource will still be exploited over time due to the demand for fossil fuels in the continuing transition to low-carbon energy sources. • Our current capital allocation strategy for energy opportunities will remain the same. We will not look to grow the energy mix in our portfolio above 20% of our overall revenue through acquisition to manage our exposure to fossil fuel related climate risk. Gold • Greater climate impacts will increase sensitivity to the environmental impacts of mining operations, making the permitting of new mines increasingly difficult. This may result in development of brownfields assets over which we have existing royalty interests. • Carbon pricing increases the costs of many mining operations impacting the viability of some operations with higher cost structures and/or large carbon footprints. Most of the projects over which we have royalty and stream interests have strong economics and such projects are not expected to be stranded due to rising costs. • The gold industry is energy intensive and there will be reputational risks for operators that do not decarbonize their operations. Many of our gold operators are best-in-class and have taken steps towards making low-carbon transitions. To the extent that our gold operators make strides towards decarbonization through increased access to low-cost large-scale renewable energy that will reduce their carbon footprint heavily weighted to electricity, this will mitigate climate-related reputational risk for such operators, and indirectly for our company, due to decreased reliance on fossil fuels. • The effort to tackle climate change and to cover losses created by climate change will require substantial government capital. This will increase government deficits and debt. Gold’s appeal will be preserved due to its “safe haven” role. 2°C Scenario: Outcomes for Our Operators 2°C Scenario: Outcomes for Franco-Nevada

ESG Report 2023 Page 71 Page 73

ESG Report 2023 Page 71 Page 73