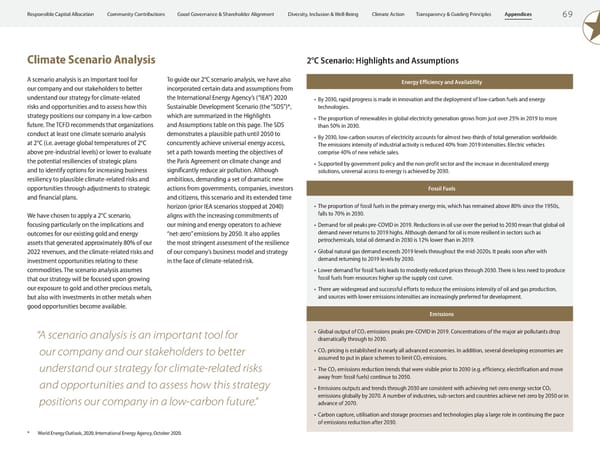

6 9 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation A scenario analysis is an important tool for our company and our stakeholders to better understand our strategy for climate-related risks and opportunities and to assess how this strategy positions our company in a low-carbon future. The TCFD recommends that organizations conduct at least one climate scenario analysis at 2°C (i.e. average global temperatures of 2°C above pre-industrial levels) or lower to evaluate the potential resiliencies of strategic plans and to identify options for increasing business resiliency to plausible climate-related risks and opportunities through adjustments to strategic and financial plans. We have chosen to apply a 2°C scenario, focusing particularly on the implications and outcomes for our existing gold and energy assets that generated approximately 80% of our 2022 revenues, and the climate-related risks and investment opportunities relating to these commodities. The scenario analysis assumes that our strategy will be focused upon growing our exposure to gold and other precious metals, but also with investments in other metals when good opportunities become available. To guide our 2°C scenario analysis, we have also incorporated certain data and assumptions from the International Energy Agency’s (“IEA”) 2020 Sustainable Development Scenario (the “SDS”)*, which are summarized in the Highlights and Assumptions table on this page. The SDS demonstrates a plausible path until 2050 to concurrently achieve universal energy access, set a path towards meeting the objectives of the Paris Agreement on climate change and significantly reduce air pollution. Although ambitious, demanding a set of dramatic new actions from governments, companies, investors and citizens, this scenario and its extended time horizon (prior IEA scenarios stopped at 2040) aligns with the increasing commitments of our mining and energy operators to achieve “net-zero” emissions by 2050. It also applies the most stringent assessment of the resilience of our company’s business model and strategy in the face of climate-related risk. * World Energy Outlook, 2020, International Energy Agency, October 2020. Climate Scenario Analysis 2°C Scenario: Highlights and Assumptions Energy Efficiency and Availability • By 2030, rapid progress is made in innovation and the deployment of low-carbon fuels and energy technologies. • The proportion of renewables in global electricity generation grows from just over 25% in 2019 to more than 50% in 2030. • By 2030, low-carbon sources of electricity accounts for almost two-thirds of total generation worldwide. The emissions intensity of industrial activity is reduced 40% from 2019 intensities. Electric vehicles comprise 40% of new vehicle sales. • Supported by government policy and the non-profit sector and the increase in decentralized energy solutions, universal access to energy is achieved by 2030. Fossil Fuels • The proportion of fossil fuels in the primary energy mix, which has remained above 80% since the 1950s, falls to 70% in 2030. • Demand for oil peaks pre-COVID in 2019. Reductions in oil use over the period to 2030 mean that global oil demand never returns to 2019 highs. Although demand for oil is more resilient in sectors such as petrochemicals, total oil demand in 2030 is 12% lower than in 2019. • Global natural gas demand exceeds 2019 levels throughout the mid-2020s. It peaks soon after with demand returning to 2019 levels by 2030. • Lower demand for fossil fuels leads to modestly reduced prices through 2030. There is less need to produce fossil fuels from resources higher up the supply cost curve. • There are widespread and successful efforts to reduce the emissions intensity of oil and gas production, and sources with lower emissions intensities are increasingly preferred for development. Emissions • Global output of CO 2 emissions peaks pre-COVID in 2019. Concentrations of the major air pollutants drop dramatically through to 2030. • CO 2 pricing is established in nearly all advanced economies. In addition, several developing economies are assumed to put in place schemes to limit CO 2 emissions. • The CO 2 emissions reduction trends that were visible prior to 2030 (e.g. efficiency, electrification and move away from fossil fuels) continue to 2050. • Emissions outputs and trends through 2030 are consistent with achieving net-zero energy sector CO 2 emissions globally by 2070. A number of industries, sub-sectors and countries achieve net-zero by 2050 or in advance of 2070. • Carbon capture, utilisation and storage processes and technologies play a large role in continuing the pace of emissions reduction after 2030. “A scenario analysis is an important tool for our company and our stakeholders to better understand our strategy for climate-related risks and opportunities and to assess how this strategy positions our company in a low-carbon future.”

ESG Report 2023 Page 70 Page 72

ESG Report 2023 Page 70 Page 72