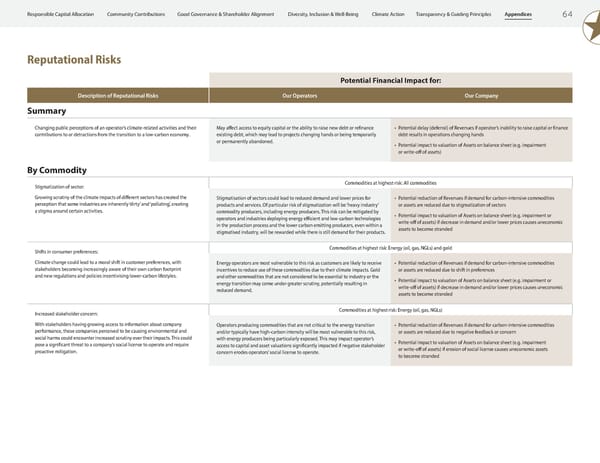

6 4 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Reputational Risks Potential Financial Impact for: Description of Reputational Risks Our Operators Our Company Summary Changing public perceptions of an operator’s climate-related activities and their contributions to or detractions from the transition to a low-carbon economy. May affect access to equity capital or the ability to raise new debt or refinance existing debt, which may lead to projects changing hands or being temporarily or permanently abandoned. • Potential delay (deferral) of Revenues if operator’s inability to raise capital or finance debt results in operations changing hands • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) By Commodity Stigmatization of sector: Growing scrutiny of the climate impacts of different sectors has created the perception that some industries are inherently ‘dirty’ and ‘polluting’, creating a stigma around certain activities. Commodities at highest risk: All commodities Stigmatisation of sectors could lead to reduced demand and lower prices for products and services. Of particular risk of stigmatization will be ‘heavy industry’ commodity producers, including energy producers. This risk can be mitigated by operators and industries deploying energy efficient and low-carbon technologies in the production process and the lower carbon emitting producers, even within a stigmatised industry, will be rewarded while there is still demand for their products. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to stigmatization of sectors • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if decrease in demand and/or lower prices causes uneconomic assets to become stranded Shifts in consumer preferences: Climate change could lead to a moral shift in customer preferences, with stakeholders becoming increasingly aware of their own carbon footprint and new regulations and policies incentivising lower-carbon lifestyles. Commodities at highest risk: Energy (oil, gas, NGLs) and gold Energy operators are most vulnerable to this risk as customers are likely to receive incentives to reduce use of these commodities due to their climate impacts. Gold and other commodities that are not considered to be essential to industry or the energy transition may come under greater scrutiny, potentially resulting in reduced demand. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to shift in preferences • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if decrease in demand and/or lower prices causes uneconomic assets to become stranded Increased stakeholder concern: With stakeholders having growing access to information about company performance, those companies perceived to be causing environmental and social harms could encounter increased scrutiny over their impacts. This could pose a significant threat to a company’s social license to operate and require proactive mitigation. Commodities at highest risk: Energy (oil, gas, NGLs) Operators producing commodities that are not critical to the energy transition and/or typically have high-carbon intensity will be most vulnerable to this risk, with energy producers being particularly exposed. This may impact operator’s access to capital and asset valuations significantly impacted if negative stakeholder concern erodes operators’ social license to operate. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to negative feedback or concern • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if erosion of social license causes uneconomic assets to become stranded

ESG Report 2023 Page 65 Page 67

ESG Report 2023 Page 65 Page 67