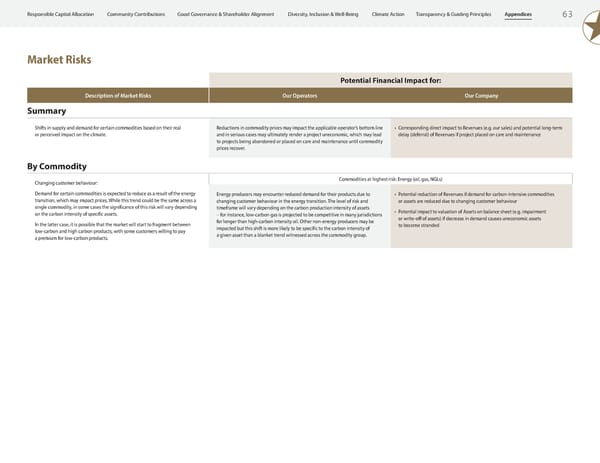

6 3 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Market Risks Potential Financial Impact for: Description of Market Risks Our Operators Our Company Summary Shifts in supply and demand for certain commodities based on their real or perceived impact on the climate. Reductions in commodity prices may impact the applicable operator’s bottom line and in serious cases may ultimately render a project uneconomic, which may lead to projects being abandoned or placed on care and maintenance until commodity prices recover. • Corresponding direct impact to Revenues (e.g. our sales) and potential long-term delay (deferral) of Revenues if project placed on care and maintenance By Commodity Changing customer behaviour: Demand for certain commodities is expected to reduce as a result of the energy transition, which may impact prices. While this trend could be the same across a single commodity, in some cases the significance of this risk will vary depending on the carbon intensity of specific assets. In the latter case, it is possible that the market will start to fragment between low-carbon and high carbon products, with some customers willing to pay a premium for low-carbon products. Commodities at highest risk: Energy (oil, gas, NGLs) Energy producers may encounter reduced demand for their products due to changing customer behaviour in the energy transition. The level of risk and timeframe will vary depending on the carbon production intensity of assets – for instance, low-carbon gas is projected to be competitive in many jurisdictions for longer than high-carbon intensity oil. Other non-energy producers may be impacted but this shift is more likely to be specific to the carbon intensity of a given asset than a blanket trend witnessed across the commodity group. • Potential reduction of Revenues if demand for carbon-intensive commodities or assets are reduced due to changing customer behaviour • Potential impact to valuation of Assets on balance sheet (e.g. impairment or write-off of assets) if decrease in demand causes uneconomic assets to become stranded

ESG Report 2023 Page 64 Page 66

ESG Report 2023 Page 64 Page 66