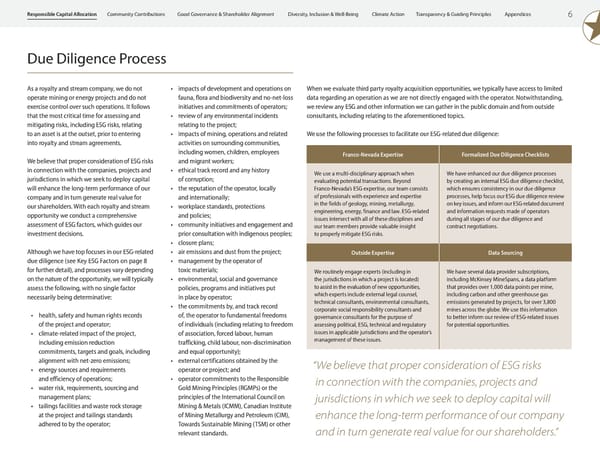

6 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Due Diligence Process As a royalty and stream company, we do not operate mining or energy projects and do not exercise control over such operations. It follows that the most critical time for assessing and mitigating risks, including ESG risks, relating to an asset is at the outset, prior to entering into royalty and stream agreements. We believe that proper consideration of ESG risks in connection with the companies, projects and jurisdictions in which we seek to deploy capital will enhance the long-term performance of our company and in turn generate real value for our shareholders. With each royalty and stream opportunity we conduct a comprehensive assessment of ESG factors, which guides our investment decisions. Although we have top focuses in our ESG-related due diligence (see Key ESG Factors on page 8 for further detail), and processes vary depending on the nature of the opportunity, we will typically assess the following, with no single factor necessarily being determinative: • health, safety and human rights records of the project and operator; • climate-related impact of the project, including emission reduction commitments, targets and goals, including alignment with net-zero emissions; • energy sources and requirements and efficiency of operations; • water risk, requirements, sourcing and management plans; • tailings facilities and waste rock storage at the project and tailings standards adhered to by the operator; • impacts of development and operations on fauna, flora and biodiversity and no-net-loss initiatives and commitments of operators; • review of any environmental incidents relating to the project; • impacts of mining, operations and related activities on surrounding communities, including women, children, employees and migrant workers; • ethical track record and any history of corruption; • the reputation of the operator, locally and internationally; • workplace standards, protections and policies; • community initiatives and engagement and prior consultation with indigenous peoples; • closure plans; • air emissions and dust from the project; • management by the operator of toxic materials; • environmental, social and governance policies, programs and initiatives put in place by operator; • the commitments by, and track record of, the operator to fundamental freedoms of individuals (including relating to freedom of association, forced labour, human trafficking, child labour, non-discrimination and equal opportunity); • external certifications obtained by the operator or project; and • operator commitments to the Responsible Gold Mining Principles (RGMPs) or the principles of the International Council on Mining & Metals (ICMM), Canadian Institute of Mining Metallurgy and Petroleum (CIM), Towards Sustainable Mining (TSM) or other relevant standards. Franco-Nevada Expertise Formalized Due Diligence Checklists We use a multi-disciplinary approach when evaluating potential transactions. Beyond Franco-Nevada’s ESG expertise, our team consists of professionals with experience and expertise in the fields of geology, mining, metallurgy, engineering, energy, finance and law. ESG-related issues intersect with all of these disciplines and our team members provide valuable insight to properly mitigate ESG risks. We have enhanced our due diligence processes by creating an internal ESG due diligence checklist, which ensures consistency in our due diligence processes, help focus our ESG due diligence review on key issues, and inform our ESG-related document and information requests made of operators during all stages of our due diligence and contract negotiations. Outside Expertise Data Sourcing We routinely engage experts (including in the jurisdictions in which a project is located) to assist in the evaluation of new opportunities, which experts include external legal counsel, technical consultants, environmental consultants, corporate social responsibility consultants and governance consultants for the purpose of assessing political, ESG, technical and regulatory issues in applicable jurisdictions and the operator’s management of these issues. We have several data provider subscriptions, including McKinsey MineSpans, a data platform that provides over 1,000 data points per mine, including carbon and other greenhouse gas emissions generated by projects, for over 3,800 mines across the globe. We use this information to better inform our review of ESG-related issues for potential opportunities. “We believe that proper consideration of ESG risks in connection with the companies, projects and jurisdictions in which we seek to deploy capital will enhance the long-term performance of our company and in turn generate real value for our shareholders.” When we evaluate third party royalty acquisition opportunities, we typically have access to limited data regarding an operation as we are not directly engaged with the operator. Notwithstanding, we review any ESG and other information we can gather in the public domain and from outside consultants, including relating to the aforementioned topics. We use the following processes to facilitate our ESG-related due diligence:

ESG Report 2023 Page 7 Page 9

ESG Report 2023 Page 7 Page 9