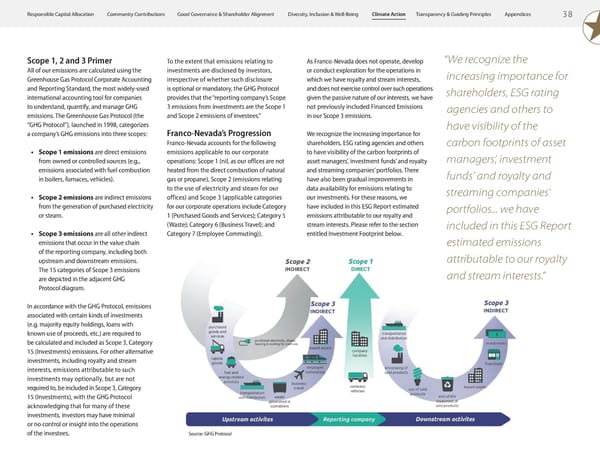

3 8 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Scope 1, 2 and 3 Primer All of our emissions are calculated using the Greenhouse Gas Protocol Corporate Accounting and Reporting Standard, the most widely-used international accounting tool for companies to understand, quantify, and manage GHG emissions. The Greenhouse Gas Protocol (the “GHG Protocol”), launched in 1998, categorizes a company’s GHG emissions into three scopes: • Scope 1 emissions are direct emissions from owned or controlled sources (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles). • Scope 2 emissions are indirect emissions from the generation of purchased electricity or steam. • Scope 3 emissions are all other indirect emissions that occur in the value chain of the reporting company, including both upstream and downstream emissions. The 15 categories of Scope 3 emissions are depicted in the adjacent GHG Protocol diagram. In accordance with the GHG Protocol, emissions associated with certain kinds of investments (e.g. majority equity holdings, loans with known use of proceeds, etc.) are required to be calculated and included as Scope 3, Category 15 (Investments) emissions. For other alternative investments, including royalty and stream interests, emissions attributable to such investments may optionally, but are not required to, be included in Scope 3, Category 15 (Investments), with the GHG Protocol acknowledging that for many of these investments, investors may have minimal or no control or insight into the operations of the investees. To the extent that emissions relating to investments are disclosed by investors, irrespective of whether such disclosure is optional or mandatory, the GHG Protocol provides that the “reporting company’s Scope 3 emissions from investments are the Scope 1 and Scope 2 emissions of investees.” Franco-Nevada’s Progression Franco-Nevada accounts for the following emissions applicable to our corporate operations: Scope 1 (nil, as our offices are not heated from the direct combustion of natural gas or propane), Scope 2 (emissions relating to the use of electricity and steam for our offices) and Scope 3 (applicable categories for our corporate operations include Category 1 (Purchased Goods and Services); Category 5 (Waste); Category 6 (Business Travel); and Category 7 (Employee Commuting)). As Franco-Nevada does not operate, develop or conduct exploration for the operations in which we have royalty and stream interests, and does not exercise control over such operations given the passive nature of our interests, we have not previously included Financed Emissions in our Scope 3 emissions. We recognize the increasing importance for shareholders, ESG rating agencies and others to have visibility of the carbon footprints of asset managers’, investment funds’ and royalty and streaming companies’ portfolios. There have also been gradual improvements in data availability for emissions relating to our investments. For these reasons, we have included in this ESG Report estimated emissions attributable to our royalty and stream interests. Please refer to the section entitled Investment Footprint below. Source: GHG Protocol “We recognize the increasing importance for shareholders, ESG rating agencies and others to have visibility of the carbon footprints of asset managers’, investment funds’ and royalty and streaming companies’ portfolios... we have included in this ESG Report estimated emissions attributable to our royalty and stream interests.”

ESG Report 2023 Page 39 Page 41

ESG Report 2023 Page 39 Page 41