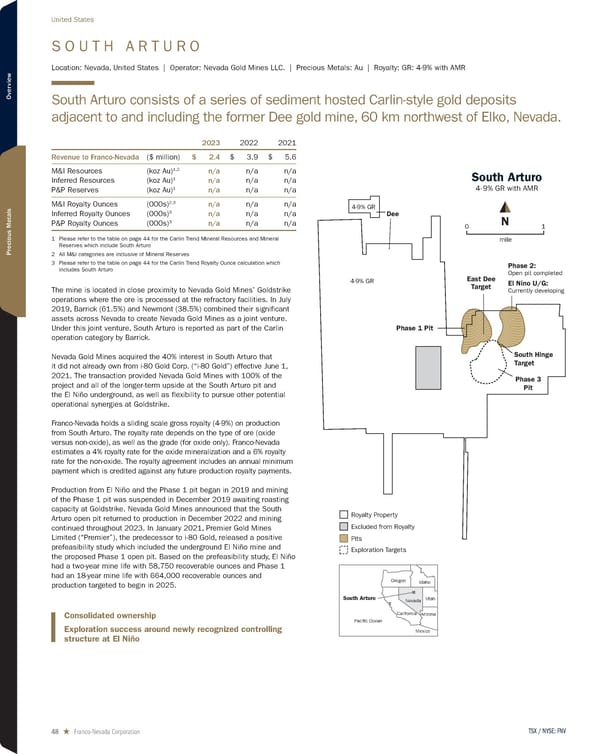

S O U T H A R T U R O Location: Nevada, United States | Operator: Nevada Gold Mines LLC. | Precious Metals: Au | Royalty: GR: 4-9% with AMR South Arturo consists of a series of sediment hosted Carlin-style gold deposits adjacent to and including the former Dee gold mine, 60 km northwest of Elko, Nevada. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 2.4 $ 3.9 $ 5.6 M&I Resources (koz Au) 1,2 n/a n/a n/a Inferred Resources (koz Au) 1 n/a n/a n/a P&P Reserves (koz Au) 1 n/a n/a n/a M&I Royalty Ounces (000s) 2,3 n/a n/a n/a Inferred Royalty Ounces (000s) 3 n/a n/a n/a P&P Royalty Ounces (000s) 3 n/a n/a n/a 1 Please refer to the table on page 44 for the Carlin Trend Mineral Resources and Mineral Reserves which include South Arturo 2 All M&I categories are inclusive of Mineral Reserves 3 Please refer to the table on page 44 for the Carlin Trend Royalty Ounce calculation which includes South Arturo The mine is located in close proximity to Nevada Gold Mines’ Goldstrike operations where the ore is processed at the refractory facilities. In July 2019, Barrick (61.5%) and Newmont (38.5%) combined their significant assets across Nevada to create Nevada Gold Mines as a joint venture. Under this joint venture, South Arturo is reported as part of the Carlin operation category by Barrick. Nevada Gold Mines acquired the 40% interest in South Arturo that it did not already own from i-80 Gold Corp. (“i-80 Gold”) effective June 1, 2021. The transaction provided Nevada Gold Mines with 100% of the project and all of the longer-term upside at the South Arturo pit and the El Niño underground, as well as flexibility to pursue other potential operational synergies at Goldstrike. Franco-Nevada holds a sliding scale gross royalty (4-9%) on production from South Arturo. The royalty rate depends on the type of ore (oxide versus non-oxide), as well as the grade (for oxide only). Franco-Nevada estimates a 4% royalty rate for the oxide mineralization and a 6% royalty rate for the non-oxide. The royalty agreement includes an annual minimum payment which is credited against any future production royalty payments. Production from El Niño and the Phase 1 pit began in 2019 and mining of the Phase 1 pit was suspended in December 2019 awaiting roasting capacity at Goldstrike. Nevada Gold Mines announced that the South Arturo open pit returned to production in December 2022 and mining continued throughout 2023. In January 2021, Premier Gold Mines Limited (“Premier”), the predecessor to i-80 Gold, released a positive prefeasibility study which included the underground El Niño mine and the proposed Phase 1 open pit. Based on the prefeasibility study, El Niño had a two-year mine life with 58,750 recoverable ounces and Phase 1 had an 18-year mine life with 664,000 recoverable ounces and production targeted to begin in 2025. Consolidated ownership Exploration success around newly recognized controlling structure at El Niño South Arturo Pacific Ocean Oregon Idaho Utah Nevada California Arizona Mexico South Arturo 4-9% GR with AMR Royalty Property Pits Excluded from Royalty Exploration Targets Dee Phase 1 Pit Phase 3 Pit Phase 2: Open pit completed El Nino U/G: Currently developing East Dee Target South Hinge Target 4-9% GR 4-9% GR mile 1 0 N TSX / NYSE: FNV 48 ★ Franco-Nevada Corporation United States

2024 Asset Handbook Page 47 Page 49

2024 Asset Handbook Page 47 Page 49