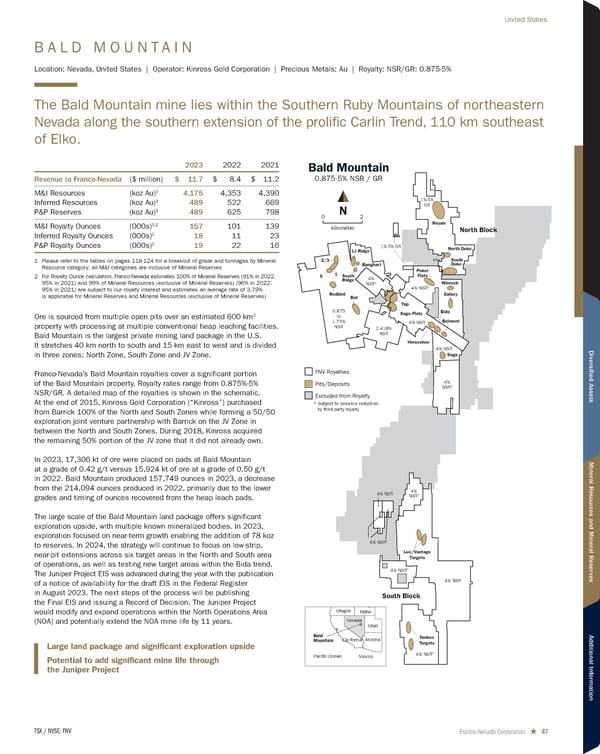

B A L D M O U N T A I N Location: Nevada, United States | Operator: Kinross Gold Corporation | Precious Metals: Au | Royalty: NSR/GR: 0.875-5% The Bald Mountain mine lies within the Southern Ruby Mountains of northeastern Nevada along the southern extension of the prolific Carlin Trend, 110 km southeast of Elko. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 11.7 $ 8.4 $ 11.2 M&I Resources (koz Au) 1 4,175 4,353 4,390 Inferred Resources (koz Au) 1 489 522 669 P&P Reserves (koz Au) 1 489 625 798 M&I Royalty Ounces (000s) 1,2 157 101 139 Inferred Royalty Ounces (000s) 2 18 11 23 P&P Royalty Ounces (000s) 2 19 22 16 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of Mineral Reserves (91% in 2022, 95% in 2021) and 99% of Mineral Resources (exclusive of Mineral Reserves) (96% in 2022, 95% in 2021) are subject to our royalty interest and estimates an average rate of 3.79% is applicable for Mineral Reserves and Mineral Resources (exclusive of Mineral Reserves) Ore is sourced from multiple open pits over an estimated 600 km 2 property with processing at multiple conventional heap leaching facilities. Bald Mountain is the largest private mining land package in the U.S. It stretches 40 km north to south and 15 km east to west and is divided in three zones: North Zone, South Zone and JV Zone. Franco-Nevada’s Bald Mountain royalties cover a significant portion of the Bald Mountain property. Royalty rates range from 0.875%-5% NSR/GR. A detailed map of the royalties is shown in the schematic. At the end of 2015, Kinross Gold Corporation (“Kinross”) purchased from Barrick 100% of the North and South Zones while forming a 50/50 exploration joint venture partnership with Barrick on the JV Zone in between the North and South Zones. During 2018, Kinross acquired the remaining 50% portion of the JV zone that it did not already own. In 2023, 17,306 kt of ore were placed on pads at Bald Mountain at a grade of 0.42 g/t versus 15,924 kt of ore at a grade of 0.50 g/t in 2022. Bald Mountain produced 157,749 ounces in 2023, a decrease from the 214,094 ounces produced in 2022, primarily due to the lower grades and timing of ounces recovered from the heap leach pads. The large scale of the Bald Mountain land package offers significant exploration upside, with multiple known mineralized bodies. In 2023, exploration focused on near-term growth enabling the addition of 78 koz to reserves. In 2024, the strategy will continue to focus on low-strip, near-pit extensions across six target areas in the North and South area of operations, as well as testing new target areas within the Bida trend. The Juniper Project EIS was advanced during the year with the publication of a notice of availability for the draft EIS in the Federal Register in August 2023. The next steps of the process will be publishing the Final EIS and issuing a Record of Decision. The Juniper Project would modify and expand operations within the North Operations Area (NOA) and potentially extend the NOA mine life by 11 years. Large land package and significant exploration upside Potential to add significant mine life through the Juniper Project FNV Royalties Excluded from Royalty Pits/Deposits * Subject to possible reduction by third-party royalty North Block South Block Galaxy Poker Flats Bida Saga Yankee Targets Lux/Vantage Targets Top Sage Flats Belmont Horseshoe 4% NSR 4% NSR 4% NSR 4% NSR 4% NSR * 4% NSR * 4% NSR * 4% NSR * 4% NSR * 4% NSR * 4% NSR * 0.875 to 1.75% NSR 2.418% NSR Royale 1%-5% GR Redbird 5 1 LJ Ridge Banghart South Ridge Rat North Duke South Duke 2/3 1%-5% GR Winrock Bald Mountain Oregon Idaho Utah Nevada California Arizona Mexico Pacific Ocean Bald Mountain 0.875-5% NSR / GR kilometer 2 0 N Franco-Nevada Corporation ★ 47 TSX / NYSE: FNV United States

2024 Asset Handbook Page 46 Page 48

2024 Asset Handbook Page 46 Page 48