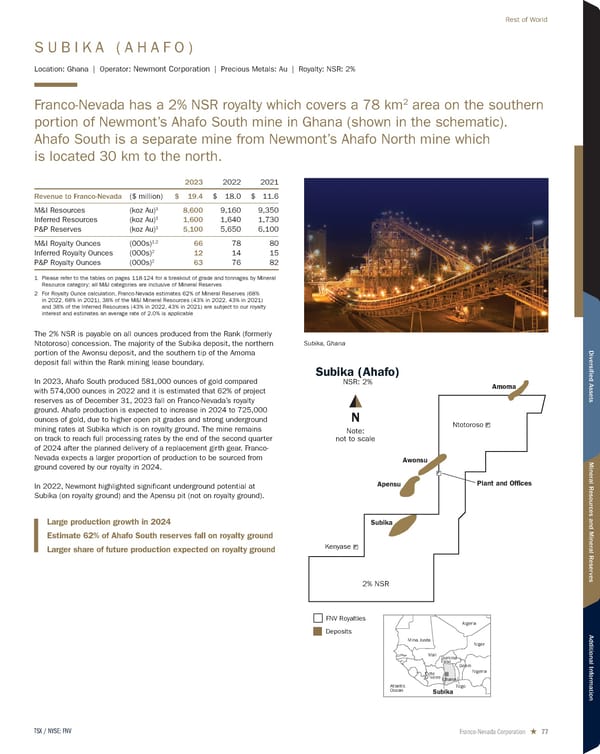

S U B I K A ( A H A F O ) Location: Ghana | Operator: Newmont Corporation | Precious Metals: Au | Royalty: NSR: 2% Franco-Nevada has a 2% NSR royalty which covers a 78 km 2 area on the southern portion of Newmont’s Ahafo South mine in Ghana (shown in the schematic). Ahafo South is a separate mine from Newmont’s Ahafo North mine which is located 30 km to the north. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 19.4 $ 18.0 $ 11.6 M&I Resources (koz Au) 1 8,600 9,160 9,350 Inferred Resources (koz Au) 1 1,600 1,640 1,730 P&P Reserves (koz Au) 1 5,100 5,650 6,100 M&I Royalty Ounces (000s) 1,2 66 78 80 Inferred Royalty Ounces (000s) 2 12 14 15 P&P Royalty Ounces (000s) 2 63 76 82 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 62% of Mineral Reserves (68% in 2022, 68% in 2021), 38% of the M&I Mineral Resources (43% in 2022, 43% in 2021) and 38% of the Inferred Resources (43% in 2022, 43% in 2021) are subject to our royalty interest and estimates an average rate of 2.0% is applicable The 2% NSR is payable on all ounces produced from the Rank (formerly Ntotoroso) concession. The majority of the Subika deposit, the northern portion of the Awonsu deposit, and the southern tip of the Amoma deposit fall within the Rank mining lease boundary. In 2023, Ahafo South produced 581,000 ounces of gold compared with 574,000 ounces in 2022 and it is estimated that 62% of project reserves as of December 31, 2023 fall on Franco-Nevada’s royalty ground. Ahafo production is expected to increase in 2024 to 725,000 ounces of gold, due to higher open pit grades and strong underground mining rates at Subika which is on royalty ground. The mine remains on track to reach full processing rates by the end of the second quarter of 2024 after the planned delivery of a replacement girth gear. Franco- Nevada expects a larger proportion of production to be sourced from ground covered by our royalty in 2024. In 2022, Newmont highlighted significant underground potential at Subika (on royalty ground) and the Apensu pit (not on royalty ground). Large production growth in 2024 Estimate 62% of Ahafo South reserves fall on royalty ground Larger share of future production expected on royalty ground Subika, Ghana Subika (Ahafo) NSR: 2% N Note: not to scale Mina Justa Atlantic Ocean Burkina Faso Cote D’ivoire Togo Benin Nigeria Niger Mali Algeria Subika Ghana 2% NSR Awonsu Apensu Subika Plant and Offices Ntotoroso Amoma Kenyase FNV Royalties Deposits Franco-Nevada Corporation ★ 77 TSX / NYSE: FNV Rest of World

2024 Asset Handbook Page 76 Page 78

2024 Asset Handbook Page 76 Page 78