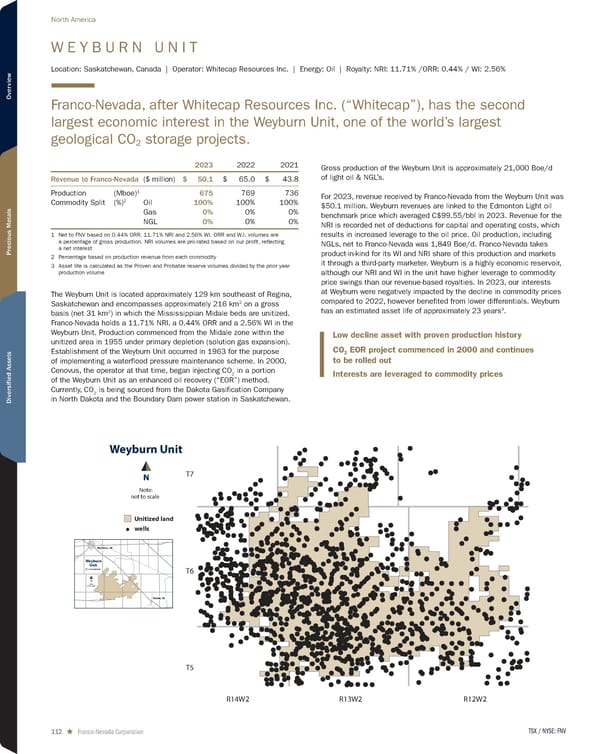

W E Y B U R N U N I T Location: Saskatchewan, Canada | Operator: Whitecap Resources Inc. | Energy: Oil | Royalty: NRI: 11.71% /ORR: 0.44% / WI: 2.56% Franco-Nevada, after Whitecap Resources Inc. (“Whitecap”), has the second largest economic interest in the Weyburn Unit, one of the world’s largest geological CO 2 storage projects. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 50.1 $ 65.0 $ 43.8 Production (Mboe) 1 675 769 736 Commodity Split (%) 2 Oil 100% 100% 100% Gas 0% 0% 0% NGL 0% 0% 0% 1 Net to FNV based on 0.44% ORR, 11.71% NRI and 2.56% WI. ORR and W.I. volumes are a percentage of gross production. NRI volumes are pro-rated based on our profit, reflecting a net interest 2 Percentage based on production revenue from each commodity 3 Asset life is calculated as the Proven and Probable reserve volumes divided by the prior year production volume The Weyburn Unit is located approximately 129 km southeast of Regina, Saskatchewan and encompasses approximately 216 km 2 on a gross basis (net 31 km 2) in which the Mississippian Midale beds are unitized. Franco-Nevada holds a 11.71% NRI, a 0.44% ORR and a 2.56% WI in the Weyburn Unit. Production commenced from the Midale zone within the unitized area in 1955 under primary depletion (solution gas expansion). Establishment of the Weyburn Unit occurred in 1963 for the purpose of implementing a waterflood pressure maintenance scheme. In 2000, Cenovus, the operator at that time, began injecting CO 2 in a portion of the Weyburn Unit as an enhanced oil recovery (“EOR”) method. Currently, CO 2 is being sourced from the Dakota Gasification Company in North Dakota and the Boundary Dam power station in Saskatchewan. Gross production of the Weyburn Unit is approximately 21,000 Boe/d of light oil & NGL’s. For 2023, revenue received by Franco-Nevada from the Weyburn Unit was $50.1 million. Weyburn revenues are linked to the Edmonton Light oil benchmark price which averaged C$99.55/bbl in 2023. Revenue for the NRI is recorded net of deductions for capital and operating costs, which results in increased leverage to the oil price. Oil production, including NGLs, net to Franco-Nevada was 1,849 Boe/d. Franco-Nevada takes product-in-kind for its WI and NRI share of this production and markets it through a third-party marketer. Weyburn is a highly economic reservoir, although our NRI and WI in the unit have higher leverage to commodity price swings than our revenue-based royalties. In 2023, our interests at Weyburn were negatively impacted by the decline in commodity prices compared to 2022, however benefited from lower differentials. Weyburn has an estimated asset life of approximately 23 years 3. Low decline asset with proven production history CO 2 EOR project commenced in 2000 and continues to be rolled out Interests are leveraged to commodity prices Weyburn Unit wells Unitized land Note: not to scale T7 T6 T5 R13W2 R12W2 R14W2 N Weyburn Unit Note: not to scale R15W2 R14W2 R13W2 R12W2 R11W2 R10W2 R9W2 R8W2 R15W2 R14W2 R13W2 R12W2 R11W2 R10W2 R9W2 R8W2 T9 T8 T7 T6 T5 T4 T3 T9 T8 T7 T6 T5 T4 T3 Weyburn, SK Unitized land Midale, SK N TSX / NYSE: FNV 112 ★ Franco-Nevada Corporation North America

2024 Asset Handbook Page 111 Page 113

2024 Asset Handbook Page 111 Page 113