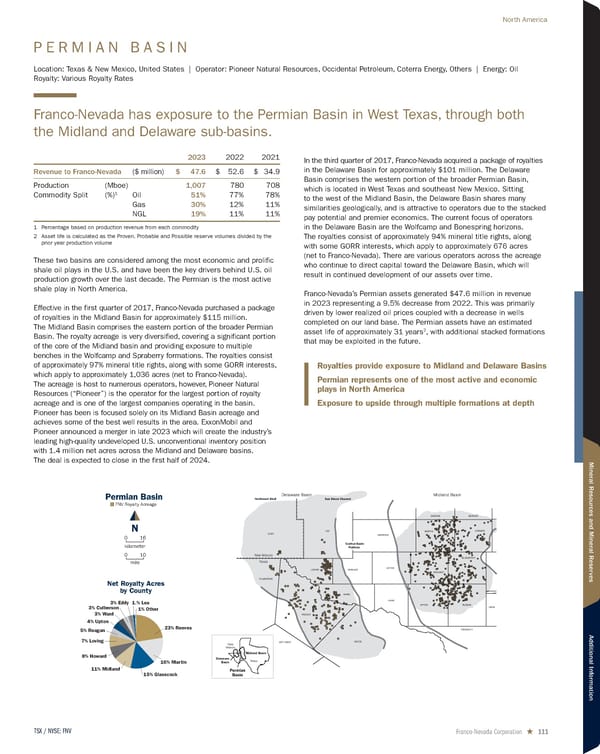

P E R M I A N B A S I N Location: Texas & New Mexico, United States | Operator: Pioneer Natural Resources, Occidental Petroleum, Coterra Energy, Others | Energy: Oil Royalty: Various Royalty Rates Franco-Nevada has exposure to the Permian Basin in West Texas, through both the Midland and Delaware sub-basins. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 47.6 $ 52.6 $ 34.9 Production (Mboe) 1,007 780 708 Commodity Split (%) 1 Oil 51% 77% 78% Gas 30% 12% 11% NGL 19% 11% 11% 1 Percentage based on production revenue from each commodity 2 Asset life is calculated as the Proven, Probable and Possible reserve volumes divided by the prior year production volume These two basins are considered among the most economic and prolific shale oil plays in the U.S. and have been the key drivers behind U.S. oil production growth over the last decade. The Permian is the most active shale play in North America. Effective in the first quarter of 2017, Franco-Nevada purchased a package of royalties in the Midland Basin for approximately $115 million. The Midland Basin comprises the eastern portion of the broader Permian Basin. The royalty acreage is very diversified, covering a significant portion of the core of the Midland basin and providing exposure to multiple benches in the Wolfcamp and Spraberry formations. The royalties consist of approximately 97% mineral title rights, along with some GORR interests, which apply to approximately 1,036 acres (net to Franco-Nevada). The acreage is host to numerous operators, however, Pioneer Natural Resources (“Pioneer”) is the operator for the largest portion of royalty acreage and is one of the largest companies operating in the basin. Pioneer has been is focused solely on its Midland Basin acreage and achieves some of the best well results in the area. ExxonMobil and Pioneer announced a merger in late 2023 which will create the industry’s leading high-quality undeveloped U.S. unconventional inventory position with 1.4 million net acres across the Midland and Delaware basins. The deal is expected to close in the first half of 2024. In the third quarter of 2017, Franco-Nevada acquired a package of royalties in the Delaware Basin for approximately $101 million. The Delaware Basin comprises the western portion of the broader Permian Basin, which is located in West Texas and southeast New Mexico. Sitting to the west of the Midland Basin, the Delaware Basin shares many similarities geologically, and is attractive to operators due to the stacked pay potential and premier economics. The current focus of operators in the Delaware Basin are the Wolfcamp and Bonespring horizons. The royalties consist of approximately 94% mineral title rights, along with some GORR interests, which apply to approximately 676 acres (net to Franco-Nevada). There are various operators across the acreage who continue to direct capital toward the Delaware Basin, which will result in continued development of our assets over time. Franco-Nevada’s Permian assets generated $47.6 million in revenue in 2023 representing a 9.5% decrease from 2022. This was primarily driven by lower realized oil prices coupled with a decrease in wells completed on our land base. The Permian assets have an estimated asset life of approximately 31 years 2 , with additional stacked formations that may be exploited in the future. REAGAN GLASSCOCK MIDLAND ECTOR UPTON CRANE HOWARD MARTIN ANDREWS BORDEN DAWSON CROCKETT IRION Midland Basin WINKLER PECOS REEVES WARD CULBERSON LOVING LEA EDDY JEFF DAVIS New Mexico Texas San Simon Channel Northwest Shelf Central Basin Platform Delaware Basin Net Royalty Acres by County 23% Reeves 16% Martin 15% Glasscock 11% Midland 8% Howard 7% Loving 5% Reagan 4% Upton 3% Ward 3% Culberson 3% Eddy 1.% Lea 1% Other Permian Basin FNV Royalty Acreage Texas Midland Basin Delaware Basin New Mexico Permian Basin N 16 mile 10 0 0 kilometer Royalties provide exposure to Midland and Delaware Basins Permian represents one of the most active and economic plays in North America Exposure to upside through multiple formations at depth Franco-Nevada Corporation ★ 111 TSX / NYSE: FNV North America

2024 Asset Handbook Page 110 Page 112

2024 Asset Handbook Page 110 Page 112