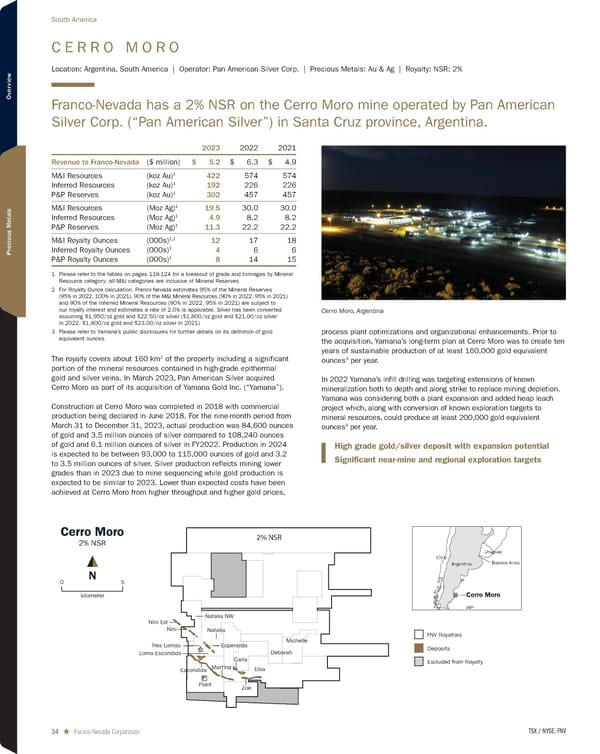

C E R R O M O R O Location: Argentina, South America | Operator: Pan American Silver Corp. | Precious Metals: Au & Ag | Royalty: NSR: 2% Franco-Nevada has a 2% NSR on the Cerro Moro mine operated by Pan American Silver Corp. (“Pan American Silver”) in Santa Cruz province, Argentina. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 5.2 $ 6.3 $ 4.9 M&I Resources (koz Au) 1 422 574 574 Inferred Resources (koz Au) 1 192 226 226 P&P Reserves (koz Au) 1 302 457 457 M&I Resources (Moz Ag) 1 19.5 30.0 30.0 Inferred Resources (Moz Ag) 1 4.9 8.2 8.2 P&P Reserves (Moz Ag) 1 11.3 22.2 22.2 M&I Royalty Ounces (000s) 1,2 12 17 18 Inferred Royalty Ounces (000s) 1 4 6 6 P&P Royalty Ounces (000s) 1 8 14 15 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 95% of the Mineral Reserves (95% in 2022, 100% in 2021), 90% of the M&I Mineral Resources (90% in 2022, 95% in 2021) and 90% of the Inferred Mineral Resources (90% in 2022, 95% in 2021) are subject to our royalty interest and estimates a rate of 2.0% is applicable. Silver has been converted assuming $1,950/oz gold and $22.50/oz silver ($1,800/oz gold and $21.00/oz silver in 2022, $1,800/oz gold and $23.00/oz silver in 2021) 3 Please refer to Yamana’s public disclosures for further details on its definition of gold equivalent ounces The royalty covers about 160 km 2 of the property including a significant portion of the mineral resources contained in high-grade epithermal gold and silver veins. In March 2023, Pan American Silver acquired Cerro Moro as part of its acquisition of Yamana Gold Inc. (“Yamana”). Construction at Cerro Moro was completed in 2018 with commercial production being declared in June 2018. For the nine-month period from March 31 to December 31, 2023, actual production was 84,600 ounces of gold and 3.5 million ounces of silver compared to 108,240 ounces of gold and 6.1 million ounces of silver in FY2022. Production in 2024 is expected to be between 93,000 to 115,000 ounces of gold and 3.2 to 3.5 million ounces of silver. Silver production reflects mining lower grades than in 2023 due to mine sequencing while gold production is expected to be similar to 2023. Lower than expected costs have been achieved at Cerro Moro from higher throughput and higher gold prices, process plant optimizations and organizational enhancements. Prior to the acquisition, Yamana’s long-term plan at Cerro Moro was to create ten years of sustainable production of at least 160,000 gold equivalent ounces 3 per year. In 2022 Yamana’s infill drilling was targeting extensions of known mineralization both to depth and along strike to replace mining depletion. Yamana was considering both a plant expansion and added heap leach project which, along with conversion of known exploration targets to mineral resources, could produce at least 200,000 gold equivalent ounces 3 per year. High grade gold/silver deposit with expansion potential Significant near-mine and regional exploration targets kilometer 5 0 Cerro Moro 2% NSR Carla Michelle Zoe Deborah Martina Tres Lomas Esperanza Loma Escondida Escondida Nini Nini Ext Natalia Natalia NW Plant Buenos Aires Cerro Moro Chile Argentina Uruguay Elsa 2% NSR FNV Royalties Excluded from Royalty Deposits N Cerro Moro, Argentina TSX / NYSE: FNV 34 ★ Franco-Nevada Corporation South America

2024 Asset Handbook Page 33 Page 35

2024 Asset Handbook Page 33 Page 35