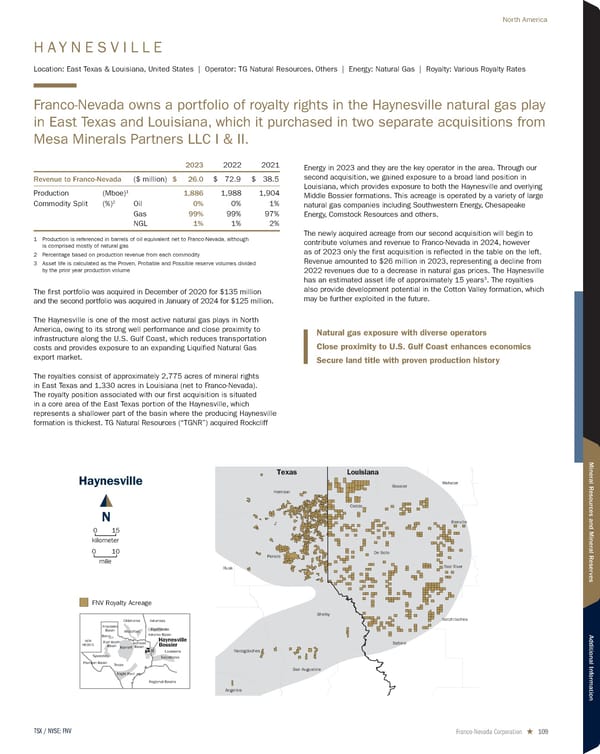

H A Y N E S V I L L E Location: East Texas & Louisiana, United States | Operator: TG Natural Resources, Others | Energy: Natural Gas | Royalty: Various Royalty Rates Franco-Nevada owns a portfolio of royalty rights in the Haynesville natural gas play in East Texas and Louisiana, which it purchased in two separate acquisitions from Mesa Minerals Partners LLC I & II. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 26.0 $ 72.9 $ 38.5 Production (Mboe) 1 1,886 1,988 1,904 Commodity Split (%) 2 Oil 0% 0% 1% Gas 99% 99% 97% NGL 1% 1% 2% 1 Production is referenced in barrels of oil equivalent net to Franco-Nevada, although is comprised mostly of natural gas 2 Percentage based on production revenue from each commodity 3 Asset life is calculated as the Proven, Probable and Possible reserve volumes divided by the prior year production volume The first portfolio was acquired in December of 2020 for $135 million and the second portfolio was acquired in January of 2024 for $125 million. The Haynesville is one of the most active natural gas plays in North America, owing to its strong well performance and close proximity to infrastructure along the U.S. Gulf Coast, which reduces transportation costs and provides exposure to an expanding Liquified Natural Gas export market. The royalties consist of approximately 2,775 acres of mineral rights in East Texas and 1,330 acres in Louisiana (net to Franco-Nevada). The royalty position associated with our first acquisition is situated in a core area of the East Texas portion of the Haynesville, which represents a shallower part of the basin where the producing Haynesville formation is thickest. TG Natural Resources (“TGNR”) acquired Rockcliff Energy in 2023 and they are the key operator in the area. Through our second acquisition, we gained exposure to a broad land position in Louisiana, which provides exposure to both the Haynesville and overlying Middle Bossier formations. This acreage is operated by a variety of large natural gas companies including Southwestern Energy, Chesapeake Energy, Comstock Resources and others. The newly acquired acreage from our second acquisition will begin to contribute volumes and revenue to Franco-Nevada in 2024, however as of 2023 only the first acquisition is reflected in the table on the left. Revenue amounted to $26 million in 2023, representing a decline from 2022 revenues due to a decrease in natural gas prices. The Haynesville has an estimated asset life of approximately 15 years 3 . The royalties also provide development potential in the Cotton Valley formation, which may be further exploited in the future. Natural gas exposure with diverse operators Close proximity to U.S. Gulf Coast enhances economics Secure land title with proven production history Haynesville N 15 0 mile 10 0 kilometer Texas Eagle Ford Barnett Haynesville Bossier NEW MEXICO Louisiana Oklahoma Arkansas Regional Basins Tuscaloosa Fayetteville Woodford Spraberry Bend Permian Basin Anadarko Basin Ardmore Basin Arkomo Basin Fort Worth Basin FNV Royalty Acreage Harrison Panola Shelby Rusk Nacogdoches San Augustine Angelina Sabine Natchitoches Red River De Soto Bienville Webster Bossier Caddo Texas Louisiana Franco-Nevada Corporation ★ 109 TSX / NYSE: FNV North America

2024 Asset Handbook Page 108 Page 110

2024 Asset Handbook Page 108 Page 110