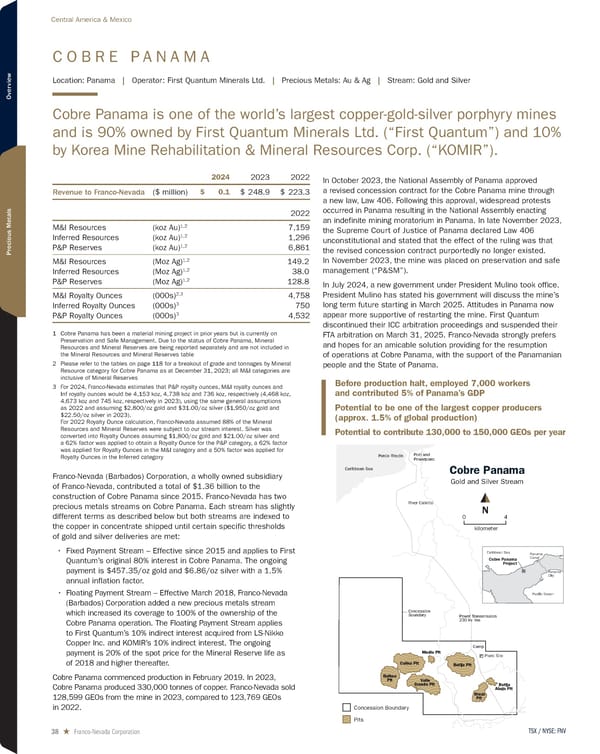

C O B R E P A N A M A Location: Panama | Operator: First Quantum Minerals Ltd. | Precious Metals: Au & Ag | Stream: Gold and Silver Cobre Panama is one of the world’s largest copper-gold-silver porphyry mines and is 90% owned by First Quantum Minerals Ltd. (“First Quantum”) and 10% by Korea Mine Rehabilitation & Mineral Resources Corp. (“KOMIR”). 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 0.1 $ 248.9 $ 223.3 2022 M&I Resources (koz Au) 1,2 7,159 Inferred Resources (koz Au) 1,2 1,296 P&P Reserves (koz Au) 1,2 6,861 M&I Resources (Moz Ag) 1,2 149.2 Inferred Resources (Moz Ag) 1,2 38.0 P&P Reserves (Moz Ag) 1,2 128.8 M&I Royalty Ounces (000s) 2,3 4,758 Inferred Royalty Ounces (000s) 3 750 P&P Royalty Ounces (000s) 3 4,532 1 Cobre Panama has been a material mining project in prior years but is currently on Preservation and Safe Management. Due to the status of Cobre Panama, Mineral Resources and Mineral Reserves are being reported separately and are not included in the Mineral Resources and Mineral Reserves table 2 Please refer to the tables on page 118 for a breakout of grade and tonnages by Mineral Resource category for Cobre Panama as at December 31, 2023; all M&I categories are inclusive of Mineral Reserves 3 For 2024, Franco-Nevada estimates that P&P royalty ounces, M&I royalty ounces and Inf royalty ounces would be 4,153 koz, 4,738 koz and 736 koz, respectively (4,468 koz, 4,673 koz and 745 koz, respectively in 2023), using the same general assumptions as 2022 and assuming $2,800/oz gold and $31.00/oz silver ($1,950/oz gold and $22.50/oz silver in 2023). For 2022 Royalty Ounce calculation, Franco-Nevada assumed 88% of the Mineral Resources and Mineral Reserves were subject to our stream interest. Silver was converted into Royalty Ounces assuming $1,800/oz gold and $21.00/oz silver and a 62% factor was applied to obtain a Royalty Ounce for the P&P category, a 62% factor was applied for Royalty Ounces in the M&I category and a 50% factor was applied for Royalty Ounces in the Inferred category Franco-Nevada (Barbados) Corporation, a wholly owned subsidiary of Franco-Nevada, contributed a total of $1.36 billion to the construction of Cobre Panama since 2015. Franco-Nevada has two precious metals streams on Cobre Panama. Each stream has slightly different terms as described below but both streams are indexed to the copper in concentrate shipped until certain specific thresholds of gold and silver deliveries are met: • Fixed Payment Stream – Effective since 2015 and applies to First Quantum’s original 80% interest in Cobre Panama. The ongoing payment is $457.35/oz gold and $6.86/oz silver with a 1.5% annual inflation factor. • Floating Payment Stream – Effective March 2018, Franco-Nevada (Barbados) Corporation added a new precious metals stream which increased its coverage to 100% of the ownership of the Cobre Panama operation. The Floating Payment Stream applies to First Quantum’s 10% indirect interest acquired from LS-Nikko Copper Inc. and KOMIR’s 10% indirect interest. The ongoing payment is 20% of the spot price for the Mineral Reserve life as of 2018 and higher thereafter. Cobre Panama commenced production in February 2019. In 2023, Cobre Panama produced 330,000 tonnes of copper. Franco-Nevada sold 128,599 GEOs from the mine in 2023, compared to 123,769 GEOs in 2022. In October 2023, the National Assembly of Panama approved a revised concession contract for the Cobre Panama mine through a new law, Law 406. Following this approval, widespread protests occurred in Panama resulting in the National Assembly enacting an indefinite mining moratorium in Panama. In late November 2023, the Supreme Court of Justice of Panama declared Law 406 unconstitutional and stated that the effect of the ruling was that the revised concession contract purportedly no longer existed. In November 2023, the mine was placed on preservation and safe management (“P&SM”). In July 2024, a new government under President Mulino took office. President Mulino has stated his government will discuss the mine’s long term future starting in March 2025. Attitudes in Panama now appear more supportive of restarting the mine. First Quantum discontinued their ICC arbitration proceedings and suspended their FTA arbitration on March 31, 2025. Franco-Nevada strongly prefers and hopes for an amicable solution providing for the resumption of operations at Cobre Panama, with the support of the Panamanian people and the State of Panama. Before production halt, employed 7,000 workers and contributed 5% of Panama’s GDP Potential to be one of the largest copper producers (approx. 1.5% of global production) Potential to contribute 130,000 to 150,000 GEOs per year Cobre Panama Gold and Silver Stream kilometer 4 0 N Concession Boundary Pits Camp Caribbean Sea Punta Rincón River Caimito Plant Site Concession Boundary Power Transmission 230 kv line Port and Powerplant Balboa Pit Colina Pit Valle Grande Pit Botija Pit Brazo Pit Medio Pit Botija Abajo Pit Cobre Panama Project Panama Canal Caribbean Sea Co Gol Concession Boundary Pits Caribbean Sea Punta Rincón River Caimito Concession Boundary P 2 Port and Powerplant Balboa Pit Colina Pit Valle Grande Pit Boti Medio Pit Cobre Panama Project Panama City Panama Canal Pacific Ocean Caribbean Sea TSX / NYSE: FNV 38 ★ Franco-Nevada Corporation Central America & Mexico

2025 Asset Handbook Page 37 Page 39

2025 Asset Handbook Page 37 Page 39