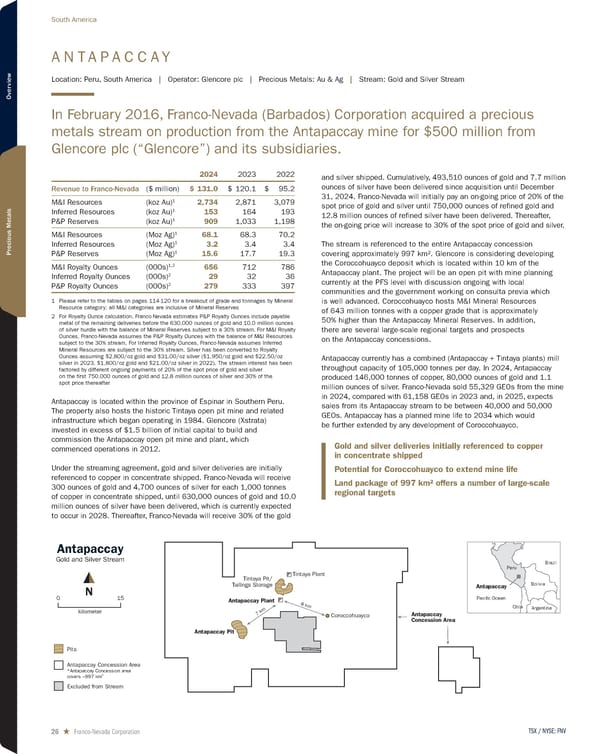

A N T A P A C C A Y Location: Peru, South America | Operator: Glencore plc | Precious Metals: Au & Ag | Stream: Gold and Silver Stream In February 2016, Franco-Nevada (Barbados) Corporation acquired a precious metals stream on production from the Antapaccay mine for $500 million from Glencore plc (“Glencore”) and its subsidiaries. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 131.0 $ 120.1 $ 95.2 M&I Resources (koz Au) 1 2,734 2,871 3,079 Inferred Resources (koz Au) 1 153 164 193 P&P Reserves (koz Au) 1 909 1,033 1,198 M&I Resources (Moz Ag) 1 68.1 68.3 70.2 Inferred Resources (Moz Ag) 1 3.2 3.4 3.4 P&P Reserves (Moz Ag) 1 15.6 17.7 19.3 M&I Royalty Ounces (000s) 1,2 656 712 786 Inferred Royalty Ounces (000s) 2 29 32 36 P&P Royalty Ounces (000s) 2 279 333 397 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates P&P Royalty Ounces include payable metal of the remaining deliveries before the 630,000 ounces of gold and 10.0 million ounces of silver hurdle with the balance of Mineral Reserves subject to a 30% stream. For M&I Royalty Ounces, Franco-Nevada assumes the P&P Royalty Ounces with the balance of M&I Resources subject to the 30% stream. For Inferred Royalty Ounces, Franco-Nevada assumes Inferred Mineral Resources are subject to the 30% stream. Silver has been converted to Royalty Ounces assuming $2,800/oz gold and $31.00/oz silver ($1,950/oz gold and $22.50/oz silver in 2023, $1,800/oz gold and $21.00/oz silver in 2022). The stream interest has been factored by different ongoing payments of 20% of the spot price of gold and silver on the first 750,000 ounces of gold and 12.8 million ounces of silver and 30% of the spot price thereafter Antapaccay is located within the province of Espinar in Southern Peru. The property also hosts the historic Tintaya open pit mine and related infrastructure which began operating in 1984. Glencore (Xstrata) invested in excess of $1.5 billion of initial capital to build and commission the Antapaccay open pit mine and plant, which commenced operations in 2012. Under the streaming agreement, gold and silver deliveries are initially referenced to copper in concentrate shipped. Franco-Nevada will receive 300 ounces of gold and 4,700 ounces of silver for each 1,000 tonnes of copper in concentrate shipped, until 630,000 ounces of gold and 10.0 million ounces of silver have been delivered, which is currently expected to occur in 2028. Thereafter, Franco-Nevada will receive 30% of the gold and silver shipped. Cumulatively, 493,510 ounces of gold and 7.7 million ounces of silver have been delivered since acquisition until December 31, 2024. Franco-Nevada will initially pay an on-going price of 20% of the spot price of gold and silver until 750,000 ounces of refined gold and 12.8 million ounces of refined silver have been delivered. Thereafter, the on-going price will increase to 30% of the spot price of gold and silver. The stream is referenced to the entire Antapaccay concession covering approximately 997 km 2 . Glencore is considering developing the Coroccohuayco deposit which is located within 10 km of the Antapaccay plant. The project will be an open pit with mine planning currently at the PFS level with discussion ongoing with local communities and the government working on consulta previa which is well advanced. Coroccohuayco hosts M&I Mineral Resources of 643 million tonnes with a copper grade that is approximately 50% higher than the Antapaccay Mineral Reserves. In addition, there are several large-scale regional targets and prospects on the Antapaccay concessions. Antapaccay currently has a combined (Antapaccay + Tintaya plants) mill throughput capacity of 105,000 tonnes per day. In 2024, Antapaccay produced 146,000 tonnes of copper, 80,000 ounces of gold and 1.1 million ounces of silver. Franco-Nevada sold 55,329 GEOs from the mine in 2024, compared with 61,158 GEOs in 2023 and, in 2025, expects sales from its Antapaccay stream to be between 40,000 and 50,000 GEOs. Antapaccay has a planned mine life to 2034 which would be further extended by any development of Coroccohuayco. kilometer 15 0 N Antapaccay Gold and Silver Stream Pacific Ocean Argentina Bolivia Peru Brazil Chile Antapaccay Antapaccay Pit Coroccohuayco Tintaya Pit/ Tailings Storage Antapaccay Plant Tintaya Plant 8 km 7 km Pits Antapaccay Concession Area *Antapaccay Concession area covers ~997 km 2 Excluded from Stream Antapaccay Concession Area Gold and silver deliveries initially referenced to copper in concentrate shipped Potential for Coroccohuayco to extend mine life Land package of 997 km² offers a number of large-scale regional targets TSX / NYSE: FNV 26 ★ Franco-Nevada Corporation South America

2025 Asset Handbook Page 25 Page 27

2025 Asset Handbook Page 25 Page 27