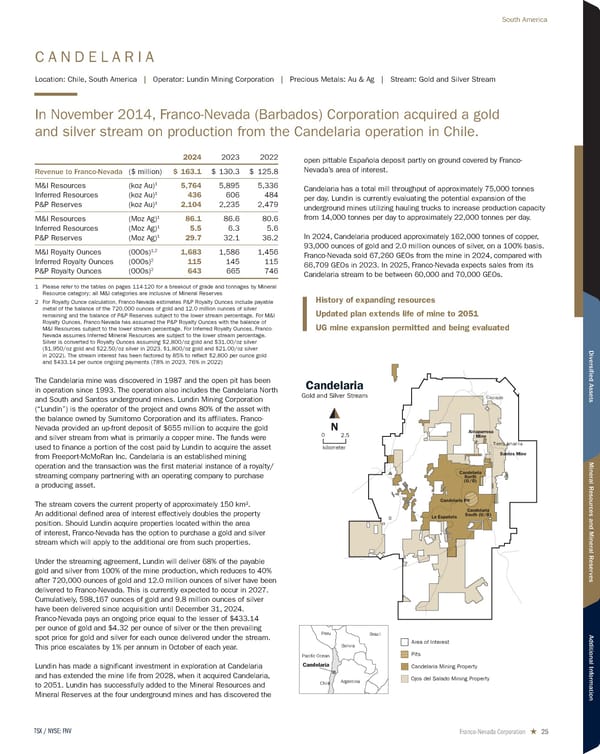

C A N D E L A R I A Location: Chile, South America | Operator: Lundin Mining Corporation | Precious Metals: Au & Ag | Stream: Gold and Silver Stream In November 2014, Franco-Nevada (Barbados) Corporation acquired a gold and silver stream on production from the Candelaria operation in Chile. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 163.1 $ 130.3 $ 125.8 M&I Resources (koz Au) 1 5,764 5,895 5,336 Inferred Resources (koz Au) 1 436 606 484 P&P Reserves (koz Au) 1 2,104 2,235 2,479 M&I Resources (Moz Ag) 1 86.1 86.6 80.6 Inferred Resources (Moz Ag) 1 5.5 6.3 5.6 P&P Reserves (Moz Ag) 1 29.7 32.1 36.2 M&I Royalty Ounces (000s) 1,2 1,683 1,586 1,456 Inferred Royalty Ounces (000s) 2 115 145 115 P&P Royalty Ounces (000s) 2 643 665 746 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates P&P Royalty Ounces include payable metal of the balance of the 720,000 ounces of gold and 12.0 million ounces of silver remaining and the balance of P&P Reserves subject to the lower stream percentage. For M&I Royalty Ounces, Franco-Nevada has assumed the P&P Royalty Ounces with the balance of M&I Resources subject to the lower stream percentage. For Inferred Royalty Ounces, Franco- Nevada assumes Inferred Mineral Resources are subject to the lower stream percentage. Silver is converted to Royalty Ounces assuming $2,800/oz gold and $31.00/oz silver ($1,950/oz gold and $22.50/oz silver in 2023, $1,800/oz gold and $21.00/oz silver in 2022). The stream interest has been factored by 85% to reflect $2,800 per ounce gold and $433.14 per ounce ongoing payments (78% in 2023, 76% in 2022) The Candelaria mine was discovered in 1987 and the open pit has been in operation since 1993. The operation also includes the Candelaria North and South and Santos underground mines. Lundin Mining Corporation (“Lundin”) is the operator of the project and owns 80% of the asset with the balance owned by Sumitomo Corporation and its affiliates. Franco- Nevada provided an up-front deposit of $655 million to acquire the gold and silver stream from what is primarily a copper mine. The funds were used to finance a portion of the cost paid by Lundin to acquire the asset from Freeport-McMoRan Inc. Candelaria is an established mining operation and the transaction was the first material instance of a royalty/ streaming company partnering with an operating company to purchase a producing asset. The stream covers the current property of approximately 150 km 2 . An additional defined area of interest effectively doubles the property position. Should Lundin acquire properties located within the area of interest, Franco-Nevada has the option to purchase a gold and silver stream which will apply to the additional ore from such properties. Under the streaming agreement, Lundin will deliver 68% of the payable gold and silver from 100% of the mine production, which reduces to 40% after 720,000 ounces of gold and 12.0 million ounces of silver have been delivered to Franco-Nevada. This is currently expected to occur in 2027. Cumulatively, 598,167 ounces of gold and 9.8 million ounces of silver have been delivered since acquisition until December 31, 2024. Franco-Nevada pays an ongoing price equal to the lesser of $433.14 per ounce of gold and $4.32 per ounce of silver or the then prevailing spot price for gold and silver for each ounce delivered under the stream. This price escalates by 1% per annum in October of each year. Lundin has made a significant investment in exploration at Candelaria and has extended the mine life from 2028, when it acquired Candelaria, to 2051. Lundin has successfully added to the Mineral Resources and Mineral Reserves at the four underground mines and has discovered the open pittable Española deposit partly on ground covered by Franco- Nevada’s area of interest. Candelaria has a total mill throughput of approximately 75,000 tonnes per day. Lundin is currently evaluating the potential expansion of the underground mines utilizing hauling trucks to increase production capacity from 14,000 tonnes per day to approximately 22,000 tonnes per day. In 2024, Candelaria produced approximately 162,000 tonnes of copper, 93,000 ounces of gold and 2.0 million ounces of silver, on a 100% basis. Franco-Nevada sold 67,260 GEOs from the mine in 2024, compared with 66,709 GEOs in 2023. In 2025, Franco-Nevada expects sales from its Candelaria stream to be between 60,000 and 70,000 GEOs. Tierra Amarilla Santos Mine Copiapo Candelaria North (U/G) Alcaparrosa Mine Candelaria Pit Candelaria South (U/G) La Española kilometer 0 2.5 N Candelaria Gold and Silver Stream Pacific Ocean Argentina Bolivia Peru Brazil Chile Candelaria Ojos del Salado Mining Property Candelaria Mining Property Area of Interest Pits History of expanding resources Updated plan extends life of mine to 2051 UG mine expansion permitted and being evaluated Franco-Nevada Corporation ★ 25 TSX / NYSE: FNV South America

2025 Asset Handbook Page 24 Page 26

2025 Asset Handbook Page 24 Page 26