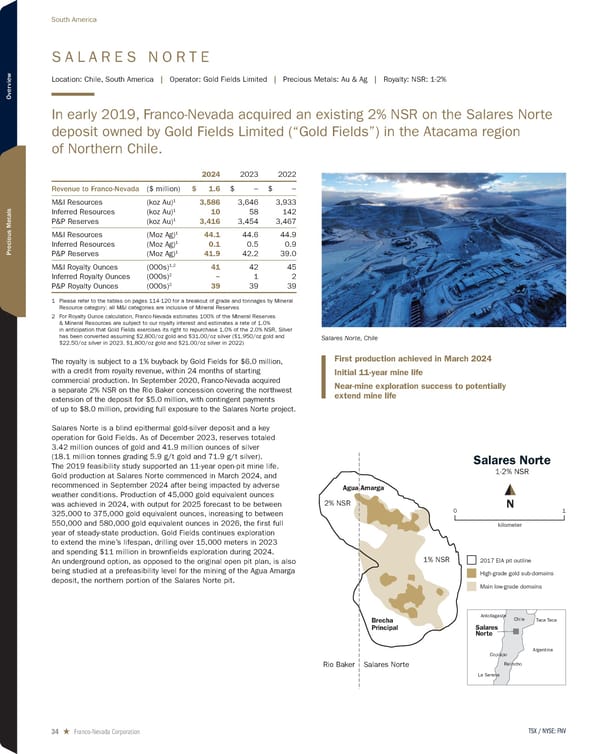

S A L A R E S N O R T E Location: Chile, South America | Operator: Gold Fields Limited | Precious Metals: Au & Ag | Royalty: NSR: 1-2% In early 2019, Franco-Nevada acquired an existing 2% NSR on the Salares Norte deposit owned by Gold Fields Limited (“Gold Fields”) in the Atacama region of Northern Chile. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 1.6 $ − $ − M&I Resources (koz Au) 1 3,586 3,646 3,933 Inferred Resources (koz Au) 1 10 58 142 P&P Reserves (koz Au) 1 3,416 3,454 3,467 M&I Resources (Moz Ag) 1 44.1 44.6 44.9 Inferred Resources (Moz Ag) 1 0.1 0.5 0.9 P&P Reserves (Moz Ag) 1 41.9 42.2 39.0 M&I Royalty Ounces (000s) 1,2 41 42 45 Inferred Royalty Ounces (000s) 2 − 1 2 P&P Royalty Ounces (000s) 2 39 39 39 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Reserves & Mineral Resources are subject to our royalty interest and estimates a rate of 1.0% in anticipation that Gold Fields exercises its right to repurchase 1.0% of the 2.0% NSR. Silver has been converted assuming $2,800/oz gold and $31.00/oz silver ($1,950/oz gold and $22.50/oz silver in 2023, $1,800/oz gold and $21.00/oz silver in 2022) The royalty is subject to a 1% buyback by Gold Fields for $6.0 million, with a credit from royalty revenue, within 24 months of starting commercial production. In September 2020, Franco-Nevada acquired a separate 2% NSR on the Rio Baker concession covering the northwest extension of the deposit for $5.0 million, with contingent payments of up to $8.0 million, providing full exposure to the Salares Norte project. Salares Norte is a blind epithermal gold-silver deposit and a key operation for Gold Fields. As of December 2023, reserves totaled 3.42 million ounces of gold and 41.9 million ounces of silver (18.1 million tonnes grading 5.9 g/t gold and 71.9 g/t silver). The 2019 feasibility study supported an 11-year open-pit mine life. Gold production at Salares Norte commenced in March 2024, and recommenced in September 2024 after being impacted by adverse weather conditions. Production of 45,000 gold equivalent ounces was achieved in 2024, with output for 2025 forecast to be between 325,000 to 375,000 gold equivalent ounces, increasing to between 550,000 and 580,000 gold equivalent ounces in 2026, the first full year of steady-state production. Gold Fields continues exploration to extend the mine’s lifespan, drilling over 15,000 meters in 2023 and spending $11 million in brownfields exploration during 2024. An underground option, as opposed to the original open pit plan, is also being studied at a prefeasibility level for the mining of the Agua Amarga deposit, the northern portion of the Salares Norte pit. Salares Norte, Chile High-grade gold sub-domains 2017 EIA pit outline Main low-grade domains Antofagasta La Serena Copiapo Relincho Chile Argentina BOLIVIA PERU San Jorge Taca Taca Salares Norte Brecha Principal Agua Amarga Salares Norte Rio Baker 1% NSR 2% NSR kilometer 1 0 Salares Norte 1-2% NSR N First production achieved in March 2024 Initial 11-year mine life Near-mine exploration success to potentially extend mine life TSX / NYSE: FNV 34 ★ Franco-Nevada Corporation South America

2025 Asset Handbook Page 33 Page 35

2025 Asset Handbook Page 33 Page 35