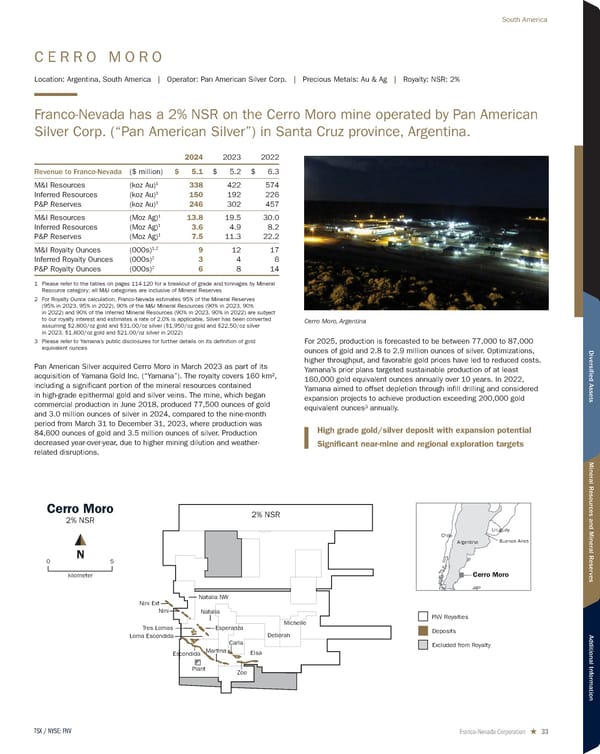

C E R R O M O R O Location: Argentina, South America | Operator: Pan American Silver Corp. | Precious Metals: Au & Ag | Royalty: NSR: 2% Franco-Nevada has a 2% NSR on the Cerro Moro mine operated by Pan American Silver Corp. (“Pan American Silver”) in Santa Cruz province, Argentina. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 5.1 $ 5.2 $ 6.3 M&I Resources (koz Au) 1 338 422 574 Inferred Resources (koz Au) 1 150 192 226 P&P Reserves (koz Au) 1 246 302 457 M&I Resources (Moz Ag) 1 13.8 19.5 30.0 Inferred Resources (Moz Ag) 1 3.6 4.9 8.2 P&P Reserves (Moz Ag) 1 7.5 11.3 22.2 M&I Royalty Ounces (000s) 1,2 9 12 17 Inferred Royalty Ounces (000s) 2 3 4 6 P&P Royalty Ounces (000s) 2 6 8 14 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 95% of the Mineral Reserves (95% in 2023, 95% in 2022), 90% of the M&I Mineral Resources (90% in 2023, 90% in 2022) and 90% of the Inferred Mineral Resources (90% in 2023, 90% in 2022) are subject to our royalty interest and estimates a rate of 2.0% is applicable. Silver has been converted assuming $2,800/oz gold and $31.00/oz silver ($1,950/oz gold and $22.50/oz silver in 2023, $1,800/oz gold and $21.00/oz silver in 2022) 3 Please refer to Yamana’s public disclosures for further details on its definition of gold equivalent ounces Pan American Silver acquired Cerro Moro in March 2023 as part of its acquisition of Yamana Gold Inc. (“Yamana”). The royalty covers 160 km 2 , including a significant portion of the mineral resources contained in high-grade epithermal gold and silver veins. The mine, which began commercial production in June 2018, produced 77,500 ounces of gold and 3.0 million ounces of silver in 2024, compared to the nine-month period from March 31 to December 31, 2023, where production was 84,600 ounces of gold and 3.5 million ounces of silver. Production decreased year-over-year, due to higher mining dilution and weather- related disruptions. For 2025, production is forecasted to be between 77,000 to 87,000 ounces of gold and 2.8 to 2.9 million ounces of silver. Optimizations, higher throughput, and favorable gold prices have led to reduced costs. Yamana’s prior plans targeted sustainable production of at least 160,000 gold equivalent ounces annually over 10 years. In 2022, Yamana aimed to offset depletion through infill drilling and considered expansion projects to achieve production exceeding 200,000 gold equivalent ounces³ annually. kilometer 5 0 Cerro Moro 2% NSR Carla Michelle Zoe Deborah Martina Tres Lomas Esperanza Loma Escondida Escondida Nini Nini Ext Natalia Natalia NW Plant Buenos Aires Cerro Moro Chile Argentina Uruguay Elsa 2% NSR FNV Royalties Excluded from Royalty Deposits N Cerro Moro, Argentina High grade gold/silver deposit with expansion potential Significant near-mine and regional exploration targets Franco-Nevada Corporation ★ 33 TSX / NYSE: FNV South America

2025 Asset Handbook Page 32 Page 34

2025 Asset Handbook Page 32 Page 34