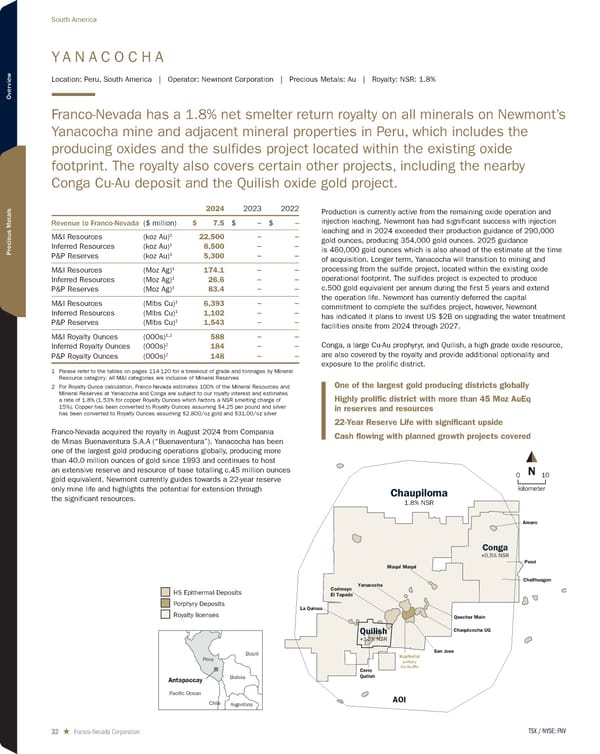

Y A N A C O C H A Location: Peru, South America | Operator: Newmont Corporation | Precious Metals: Au | Royalty: NSR: 1.8% Franco-Nevada has a 1.8% net smelter return royalty on all minerals on Newmont’s Yanacocha mine and adjacent mineral properties in Peru, which includes the producing oxides and the sulfides project located within the existing oxide footprint. The royalty also covers certain other projects, including the nearby Conga Cu-Au deposit and the Quilish oxide gold project. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 7.5 $ − $ – M&I Resources (koz Au) 1 22,500 − − Inferred Resources (koz Au) 1 8,500 − − P&P Reserves (koz Au) 1 5,300 − − M&I Resources (Moz Ag) 1 174.1 − − Inferred Resources (Moz Ag) 1 26.6 − − P&P Reserves (Moz Ag) 1 83.4 − − M&I Resources (Mlbs Cu) 1 6,393 − − Inferred Resources (Mlbs Cu) 1 1,102 − − P&P Reserves (Mlbs Cu) 1 1,543 − − M&I Royalty Ounces (000s) 1,2 588 − − Inferred Royalty Ounces (000s) 2 184 − − P&P Royalty Ounces (000s) 2 148 − − 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves at Yanacocha and Conga are subject to our royalty interest and estimates a rate of 1.8% (1.53% for copper Royalty Ounces which factors a NSR smelting charge of 15%). Copper has been converted to Royalty Ounces assuming $4.25 per pound and silver has been converted to Royalty Ounces assuming $2,800/oz gold and $31.00/oz silver Franco-Nevada acquired the royalty in August 2024 from Compania de Minas Buenaventura S.A.A (“Buenaventura”). Yanacocha has been one of the largest gold producing operations globally, producing more than 40.0 million ounces of gold since 1993 and continues to host an extensive reserve and resource of base totalling c.45 million ounces gold equivalent. Newmont currently guides towards a 22-year reserve only mine life and highlights the potential for extension through the significant resources. Production is currently active from the remaining oxide operation and injection leaching. Newmont has had significant success with injection leaching and in 2024 exceeded their production guidance of 290,000 gold ounces, producing 354,000 gold ounces. 2025 guidance is 460,000 gold ounces which is also ahead of the estimate at the time of acquisition. Longer term, Yanacocha will transition to mining and processing from the sulfide project, located within the existing oxide operational footprint. The sulfides project is expected to produce c.500 gold equivalent per annum during the first 5 years and extend the operation life. Newmont has currently deferred the capital commitment to complete the sulfides project, however, Newmont has indicated it plans to invest US $2B on upgrading the water treatment facilities onsite from 2024 through 2027. Conga, a large Cu-Au prophyryr, and Quilish, a high grade oxide resource, are also covered by the royalty and provide additional optionality and exposure to the prolific district. Perol Amaro Challhuagon Quecher Main San Jose AOI Yanacocha La Quinua Corlmayo El Tapado Cerro Quilish Maqul Maqul Chaqulcocha UG Kupfertal porhyry Cu-Au-Mo Conga +0.5% NSR Quilish +1-2% NSR HS Epithermal Deposits Porphyry Deposits Royalty licenses kilometer 10 0 N Chaupiloma 1.8% NSR Pacific Ocean Argentina Bolivia Peru Brazil Chile Antapaccay One of the largest gold producing districts globally Highly prolific district with more than 45 Moz AuEq in reserves and resources 22-Year Reserve Life with significant upside Cash flowing with planned growth projects covered Quecher Main San Jose AOI Yanacocha La Quinua Corlmayo El Tapado Cerro Quilish Maqul Maqul Chaqulcocha UG Kupfertal porhyry Cu-Au-Mo Conga +0.5% NSR Quilish +1-2% NSR HS Epithermal Deposits Porphyry Deposits Royalty licenses ki 0 Chaupiloma 1.8% NSR Pacific Ocean Argentina Bolivia Peru Brazil Chile Antapaccay TSX / NYSE: FNV 32 ★ Franco-Nevada Corporation South America

2025 Asset Handbook Page 31 Page 33

2025 Asset Handbook Page 31 Page 33