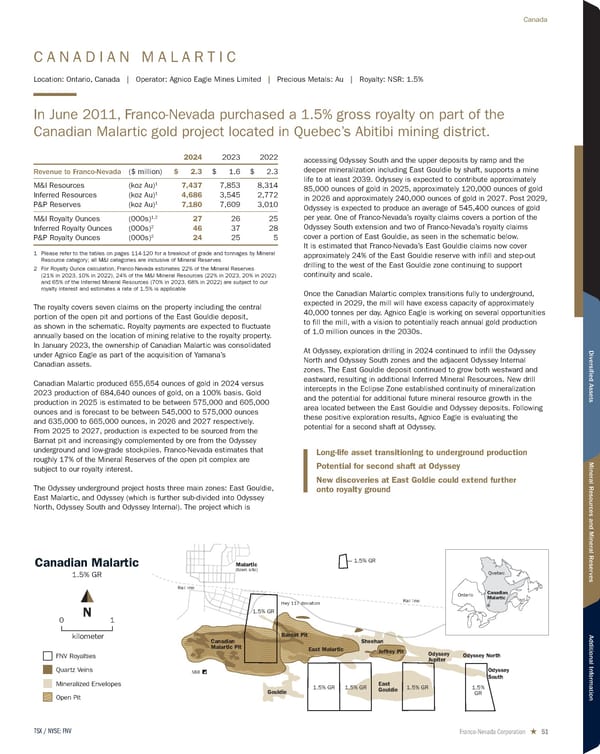

C A N A D I A N M A L A R T I C Location: Ontario, Canada | Operator: Agnico Eagle Mines Limited | Precious Metals: Au | Royalty: NSR: 1.5% In June 2011, Franco-Nevada purchased a 1.5% gross royalty on part of the Canadian Malartic gold project located in Quebec’s Abitibi mining district. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 2.3 $ 1.6 $ 2.3 M&I Resources (koz Au) 1 7,437 7,853 8,314 Inferred Resources (koz Au) 1 4,686 3,545 2,772 P&P Reserves (koz Au) 1 7,180 7,609 3,010 M&I Royalty Ounces (000s) 1,2 27 26 25 Inferred Royalty Ounces (000s) 2 46 37 28 P&P Royalty Ounces (000s) 2 24 25 5 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 22% of the Mineral Reserves (21% in 2023, 10% in 2022), 24% of the M&I Mineral Resources (22% in 2023, 20% in 2022) and 65% of the Inferred Mineral Resources (70% in 2023, 68% in 2022) are subject to our royalty interest and estimates a rate of 1.5% is applicable The royalty covers seven claims on the property including the central portion of the open pit and portions of the East Gouldie deposit, as shown in the schematic. Royalty payments are expected to fluctuate annually based on the location of mining relative to the royalty property. In January 2023, the ownership of Canadian Malartic was consolidated under Agnico Eagle as part of the acquisition of Yamana’s Canadian assets. Canadian Malartic produced 655,654 ounces of gold in 2024 versus 2023 production of 684,640 ounces of gold, on a 100% basis. Gold production in 2025 is estimated to be between 575,000 and 605,000 ounces and is forecast to be between 545,000 to 575,000 ounces and 635,000 to 665,000 ounces, in 2026 and 2027 respectively. From 2025 to 2027, production is expected to be sourced from the Barnat pit and increasingly complemented by ore from the Odyssey underground and low-grade stockpiles. Franco-Nevada estimates that roughly 17% of the Mineral Reserves of the open pit complex are subject to our royalty interest. The Odyssey underground project hosts three main zones: East Gouldie, East Malartic, and Odyssey (which is further sub-divided into Odyssey North, Odyssey South and Odyssey Internal). The project which is accessing Odyssey South and the upper deposits by ramp and the deeper mineralization including East Gouldie by shaft, supports a mine life to at least 2039. Odyssey is expected to contribute approximately 85,000 ounces of gold in 2025, approximately 120,000 ounces of gold in 2026 and approximately 240,000 ounces of gold in 2027. Post 2029, Odyssey is expected to produce an average of 545,400 ounces of gold per year. One of Franco-Nevada’s royalty claims covers a portion of the Odyssey South extension and two of Franco-Nevada’s royalty claims cover a portion of East Gouldie, as seen in the schematic below. It is estimated that Franco-Nevada’s East Gouldie claims now cover approximately 24% of the East Gouldie reserve with infill and step-out drilling to the west of the East Gouldie zone continuing to support continuity and scale. Once the Canadian Malartic complex transitions fully to underground, expected in 2029, the mill will have excess capacity of approximately 40,000 tonnes per day. Agnico Eagle is working on several opportunities to fill the mill, with a vision to potentially reach annual gold production of 1.0 million ounces in the 2030s. At Odyssey, exploration drilling in 2024 continued to infill the Odyssey North and Odyssey South zones and the adjacent Odyssey Internal zones. The East Gouldie deposit continued to grow both westward and eastward, resulting in additional Inferred Mineral Resources. New drill intercepts in the Eclipse Zone established continuity of mineralization and the potential for additional future mineral resource growth in the area located between the East Gouldie and Odyssey deposits. Following these positive exploration results, Agnico Eagle is evaluating the potential for a second shaft at Odyssey. Canadian Malartic 1.5% GR Mill Malartic (town site) Hwy 117 deviation Rail line Rail line East Gouldie Barnat Pit Canadian Malartic Pit East Malartic Jeffrey Pit Sheehan Odyssey Jupiter Odyssey South Odyssey North Gouldie FNV Royalties Quartz Veins Mineralized Envelopes Open Pit Quebec Ontario Canadian Malartic 1.5% GR 1.5% GR 1.5% GR 1.5% GR 1.5% GR 1.5% GR kilometer 1 0 N Long-life asset transitioning to underground production Potential for second shaft at Odyssey New discoveries at East Goldie could extend further onto royalty ground Franco-Nevada Corporation ★ 51 TSX / NYSE: FNV Canada

2025 Asset Handbook Page 50 Page 52

2025 Asset Handbook Page 50 Page 52