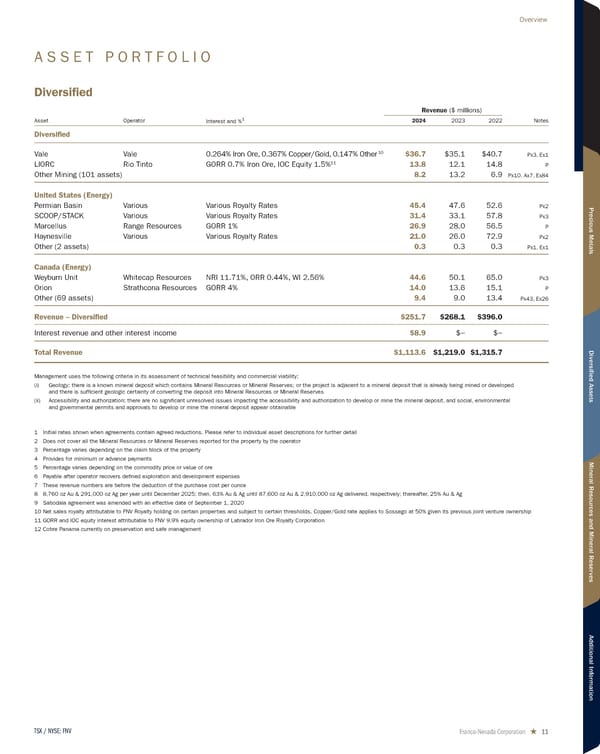

A S S E T P O R T F O L I O Diversified Revenue ($ millions) Asset Operator Interest and % 1 2024 2023 2022 Notes Diversified Vale Vale 0.264% Iron Ore, 0.367% Copper/Gold, 0.147% Other 10 $36.7 $35.1 $40.7 Px3, Ex1 LIORC Rio Tinto GORR 0.7% Iron Ore, IOC Equity 1.5% 11 13.8 12.1 14.8 P Other Mining (101 assets) 8.2 13.2 6.9 Px10, Ax7, Ex84 United States (Energy) Permian Basin Various Various Royalty Rates 45.4 47.6 52.6 Px2 SCOOP/STACK Various Various Royalty Rates 31.4 33.1 57.8 Px3 Marcellus Range Resources GORR 1% 26.9 28.0 56.5 P Haynesville Various Various Royalty Rates 21.0 26.0 72.9 Px2 Other (2 assets) 0.3 0.3 0.3 Px1, Ex1 Canada (Energy) Weyburn Unit Whitecap Resources NRI 11.71%, ORR 0.44%, WI 2.56% 44.6 50.1 65.0 Px3 Orion Strathcona Resources GORR 4% 14.0 13.6 15.1 P Other (69 assets) 9.4 9.0 13.4 Px43, Ex26 Revenue – Diversified $251.7 $268.1 $396.0 Interest revenue and other interest income $8.9 $− $− Total Revenue $1,113.6 $1,219.0 $1,315.7 Management uses the following criteria in its assessment of technical feasibility and commercial viability: (i) Geology: there is a known mineral deposit which contains Mineral Resources or Mineral Reserves; or the project is adjacent to a mineral deposit that is already being mined or developed and there is sufficient geologic certainty of converting the deposit into Mineral Resources or Mineral Reserves (ii) Accessibility and authorization: there are no significant unresolved issues impacting the accessibility and authorization to develop or mine the mineral deposit, and social, environmental and governmental permits and approvals to develop or mine the mineral deposit appear obtainable 1 Initial rates shown when agreements contain agreed reductions. Please refer to individual asset descriptions for further detail 2 Does not cover all the Mineral Resources or Mineral Reserves reported for the property by the operator 3 Percentage varies depending on the claim block of the property 4 Provides for minimum or advance payments 5 Percentage varies depending on the commodity price or value of ore 6 Payable after operator recovers defined exploration and development expenses 7 These revenue numbers are before the deduction of the purchase cost per ounce 8 8,760 oz Au & 291,000 oz Ag per year until December 2025; then, 63% Au & Ag until 87,600 oz Au & 2,910,000 oz Ag delivered, respectively; thereafter, 25% Au & Ag 9 Sabodala agreement was amended with an effective date of September 1, 2020 10 Net sales royalty attributable to FNV Royalty holding on certain properties and subject to certain thresholds. Copper/Gold rate applies to Sossego at 50% given its previous joint venture ownership 11 GORR and IOC equity interest attributable to FNV 9.9% equity ownership of Labrador Iron Ore Royalty Corporation 12 Cobre Panama currently on preservation and safe management Franco-Nevada Corporation ★ 11 TSX / NYSE: FNV Overview

2025 Asset Handbook Page 10 Page 12

2025 Asset Handbook Page 10 Page 12