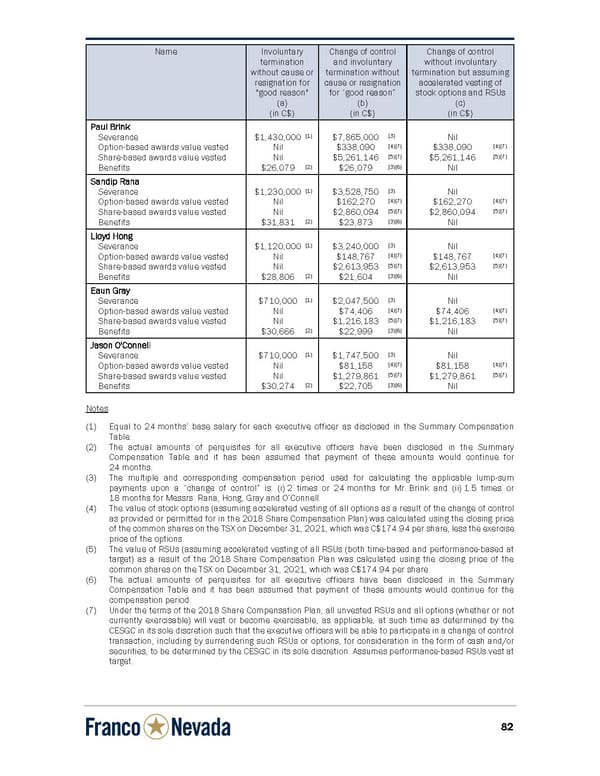

8 8 2 Name Involuntary Change of control Change of control termination and involuntary without involuntary without cause or termination without t ermination but assuming resignation for cause or resignation accelerated vesting of "good reason" for “good reason” stock options and RSUs (a) (b) (c) (in C$) (in C$) (in C$) P P a u l B r i n k Severance $1,430,000 (1) $7,865,000 (3) Nil Option-based awards value vested Nil $338,090 (4)(7) $338,090 (4)(7) Share-based awards value vested Nil $5,261,146 (5)(7) $5,261,146 (5)(7) Benefits $26,079 (2) $26,079 (3)(6) Nil S S a n d i p R a n a Severance $1,230,000 (1) $3,528,750 (3) Nil Option-based awards value vested Nil $162,270 (4)(7) $162,270 (4)(7) Share-based awards value vested Nil $2,860,094 (5)(7) $2,860,094 (5)(7) Benefits $31,831 (2) $23,873 (3)(6) Nil L L l o y d H o n g Severance $1,120,000 (1) $3,240,000 (3) Nil Option-based awards value vested Nil $148,767 (4)(7) $148,767 (4)(7) Share-based awards value vested Nil $2,613,953 (5)(7) $2,613,953 (5)(7) Benefits $28,806 (2) $21,604 (3)(6) Nil E E a u n G r a y Severance $710,000 (1) $2,047,500 (3) Nil Option-based awards value vested Nil $74,406 (4)(7) $74,406 (4)(7) Share-based awards value vested Nil $1,216,183 (5)(7) $1,216,183 (5)(7) Benefits $30,666 (2) $22,999 (3)(6) Nil J J a s o n O ' C o n n e l l Severance $710,000 (1) $1,747,500 (3) Nil Option-based awards value vested Nil $81,158 (4)(7) $81,158 (4)(7) Share-based awards value vested Nil $1,279,861 (5)(7) $1,279,861 (5)(7) Benefits $30,274 (2) $22,705 (3)(6) Nil Notes (1) Equal to 24 months’ base salary for each executive officer as disclosed in the Summary Compensation Table. (2) The actual amounts of perquisites for all executiv e officers have been disclosed in the Summary Compensation Table and it has been assumed that payment of these amounts would continue for 24 months. (3) The multiple and corresponding compensation period used for calculating the applicable lump-sum payments upon a “change of control” is: (i) 2 times or 24 months for Mr. Brink and (ii) 1.5 times or 18 months for Messrs. Rana, Hong, Gray and O’Connell. (4) The value of stock options (assuming accelerated vesting of all options as a result of the change of control as provided or permitted for in the 2018 Share Compensation Plan) was calculated using the closing price of the common shares on the TSX on December 31, 2021, which was C$174.94 per share, less the exercise price of the options. (5) The value of RSUs (assuming accelerated vesting of all RSUs (both time-based and performance-based at target) as a result of the 2018 Share Compensation Plan was calculated using the closing price of the common shares on the TSX on December 31, 2021, which was C$174.94 per share. (6) The actual amounts of perquisites for all executiv e officers have been disclosed in the Summary Compensation Table and it has been assumed that payment of these amounts would continue for the compensation period. (7) Under the terms of the 2018 Share Compensation Plan, all unvested RSUs and all options (whether or not currently exercisable) will vest or become exercisable, as applicable, at such time as determined by the CESGC in its sole discretion such that the executive officers will be able to participate in a change of control transaction, including by surrendering such RSUs or options, for consideration in the form of cash and/or securities, to be determined by the CESGC in its sole discretion. Assumes performance-based RSUs vest at target.

Circular Page 89 Page 91

Circular Page 89 Page 91