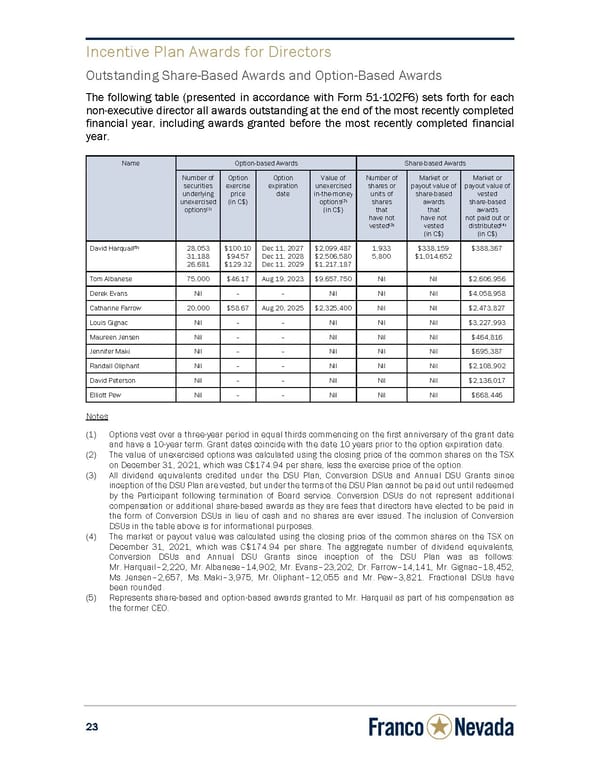

2 2 3 Incentive Plan Awar ds for Directors Outstanding Share-Based Awards and Option-Based Awards The following table (presented in accordance with Form 51-102F6) sets forth for each non-executive director all awards outstanding at the end of the most recently completed financial year, including awards granted before the most recently completed financial year. Name Option-based Awards Share-based Awards Number of Option Option Value of Number of Market or Market or securities exercise expiration unexercised shares or payout value o f payout value o f underlying price date in-the-mone y units of share-based vested unexercised (in C$) options (2) shares awards share-based options (1) (in C$) that that awards have not have not not paid out or vested (3) vested distributed (4) (in C$) (in C$) David Harquail (5) 28,053 $100.10 Dec 11, 2027 $2,099,487 1,933 $338,159 $388,367 31,188 $94.57 Dec 11, 2028 $2,506,580 5,800 $1,014,652 26,681 $129.32 Dec 11, 2029 $1,217,187 Tom Albanese 75,000 $46.17 Aug 19, 2023 $9,657,750 Nil Nil $2,606,956 Derek Evans Nil – – Nil Nil Nil $4,058,958 Catharine Farrow 20,000 $58.67 Aug 20, 2025 $2,325,400 Nil Nil $2,473,827 Louis Gignac Nil – – Nil Nil Nil $3,227,993 Maureen Jensen Nil – – Nil Nil Nil $464,816 Jennifer Maki Nil – – Nil Nil Nil $695,387 Randall Oliphant Nil – – Nil Nil Nil $2,108,902 David Peterson Nil – – Nil Nil Nil $2,136,017 Elliott Pew Nil – – Nil Nil Nil $668,446 Notes (1) Options vest over a three-year period in equal thirds commencing on the first anniversary of the grant date and have a 10-year term. Grant dates coincide with the date 10 years prior to the option expiration date. (2) The value of unexercised options was calculated using the closing price of the common shares on the TSX on December 31, 2021, which was C$174.94 per share, less the exercise price of the option. (3) All dividend equivalents credited under the DSU Plan, Conversion DSUs and Annual DSU Grants since inception of the DSU Plan are vested, but under the terms of the DSU Plan cannot be paid out until redeemed by the Participant following termination of Board service. Conversion DSUs do not represent additional compensation or additional share-based awards as they are fees that directors have elected to be paid in the form of Conversion DSUs in lieu of cash and no shares are ever issued. The inclusion of Conversion DSUs in the table above is for informational purposes. (4) The market or payout value was calculated using the closing price of the common shares on the TSX on December 31, 2021, which was C$174.94 per share. The aggregate number of dividend equivalents, Conversion DSUs and Annual DSU Grants since inception of the DSU Plan was as follows: Mr. Harquail – 2,220, Mr. Albanese – 14,902, Mr. Evans – 23,202, Dr. Farrow –14,141, Mr. Gignac – 18,452, Ms. Jensen – 2,657, Ms. Maki – 3,975, Mr. Oliphant – 12,055 and Mr. Pew – 3,821. Fractional DSUs have been rounded. (5) Represents share-based and option-based awards granted to Mr. Harquail as part of his compensation as the former CEO.

Circular Page 30 Page 32

Circular Page 30 Page 32