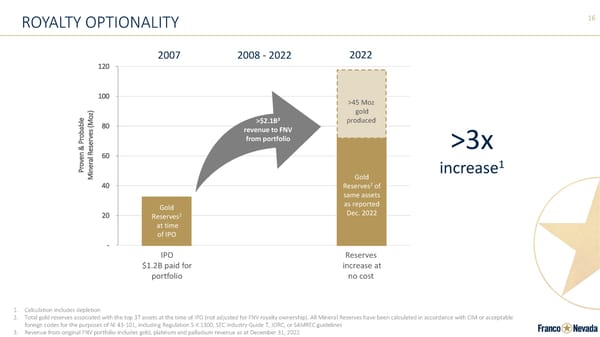

16 ROYALTY OPTIONALITY IPO $1.2B paid for portfolio Reserves increase at no cost 2007 2022 2008 - 2022 - 20 40 60 80 100 120 Proven & Probable Mineral Reserves (Moz) >45 Moz gold produced Gold Reserves 2 at time of IPO Gold Reserves 2 of same assets as reported Dec. 2022 >$2.1B 3 revenue to FNV from portfolio 1. Calculation includes depletion 2. Total gold reserves associated with the top 37 assets at the time of IPO (not adjusted for FNV royalty ownership). All Minera l R eserves have been calculated in accordance with CIM or acceptable foreign codes for the purposes of NI 43 - 101, including Regulation S - K 1300, SEC Industry Guide 7, JORC, or SAMREC guidelines 3. Revenue from original FNV portfolio includes gold, platinum and palladium revenue as at December 31, 2022 >3x increase 1

Corporate Presentation | Franco-Nevada Page 15 Page 17

Corporate Presentation | Franco-Nevada Page 15 Page 17