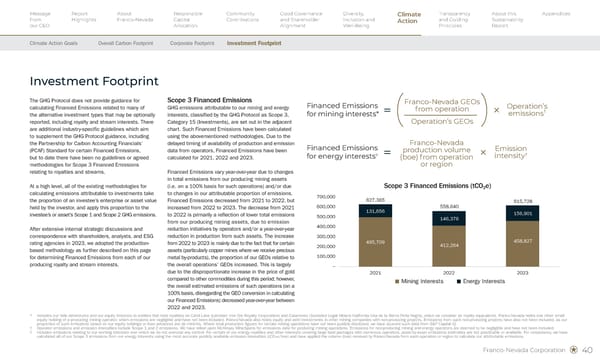

Franco-Nevada Corporation 40 Investment Footprint The GHG Protocol does not provide guidance for calculating Financed Emissions related to many of the alternative investment types that may be optionally reported, including royalty and stream interests. There are additional industry-specific guidelines which aim to supplement the GHG Protocol guidance, including the Partnership for Carbon Accounting Financials’ (PCAF) Standard for certain Financed Emissions, but to date there have been no guidelines or agreed methodologies for Scope 3 Financed Emissions relating to royalties and streams. At a high level, all of the existing methodologies for calculating emissions attributable to investments take the proportion of an investee’s enterprise or asset value held by the investor, and apply this proportion to the investee’s or asset’s Scope 1 and Scope 2 GHG emissions. After extensive internal strategic discussions and correspondence with shareholders, analysts, and ESG rating agencies in 2023, we adopted the production- based methodology as further described on this page for determining Financed Emissions from each of our producing royalty and stream interests. Scope 3 Financed Emissions GHG emissions attributable to our mining and energy interests, classified by the GHG Protocol as Scope 3, Category 15 (Investments), are set out in the adjacent chart. Such Financed Emissions have been calculated using the abovementioned methodologies. Due to the delayed timing of availability of production and emission data from operators, Financed Emissions have been calculated for 2021, 2022 and 2023. Financed Emissions vary year-over-year due to changes in total emissions from our producing mining assets (i.e. on a 100% basis for such operations) and/or due to changes in our attributable proportion of emissions. Financed Emissions decreased from 2021 to 2022, but increased from 2022 to 2023. The decrease from 2021 to 2022 is primarily a reflection of lower total emissions from our producing mining assets, due to emission reduction initiatives by operators and/or a year-over-year reduction in production from such assets. The increase from 2022 to 2023 is mainly due to the fact that for certain assets (particularly copper mines where we receive precious metal by-products), the proportion of our GEOs relative to the overall operations’ GEOs increased. This is largely due to the disproportionate increase in the price of gold compared to other commodities during this period; however, the overall estimated emissions of such operations (on a 100% basis, disregarding the GEO conversion in calculating our Financed Emissions) decreased year-over-year between 2022 and 2023. Financed Emissions for mining interests* Financed Emissions for energy interests◊ * Includes our Vale debentures and our equity interests in entities that hold royalties on Carol Lake (Labrador Iron Ore Royalty Corporation) and Caserones (Socieded Legal Minera California Una de la Sierra Peña Negra), which we consider as royalty equivalents. Franco-Nevada holds one other small equity holding of a producing mining operator, which emissions are negligible and have not been included. Franco-Nevada also holds equity and debt investments in other mining companies with non-producing projects. Emissions from such non-producing projects have also not been included, as our proportion of such emissions based on our equity holdings or loan advances are de minimis. Where total production figures for certain mining operations have not been publicly disclosed, we have sourced such data from S&P Capital IQ. † Operator emissions and emission intensities include Scope 1 and 2 emissions. We have relied upon McKinsey MineSpans for emissions data for producing mining operations. Emissions for non-producing mining and energy operators are deemed to be negligible and have not been included. ◊ Includes emissions relating to our working interests over which we do not exercise any control. For certain of our energy royalties and other interests covering large land packages with numerous operators, asset-by-asset emissions estimates are not practicable or available. For consistency, we have calculated all of our Scope 3 emissions from our energy interests using the most accurate publicly available emission intensities (tCO2e/boe) and have applied the volume (boe) received by Franco-Nevada from each operation or region to calculate our attributable emissions. – 100,000 200,000 300,000 400,000 500,000 600,000 700,000 2023 2022 2021 627,365 131,656 495,709 558,640 146,376 412,264 615,728 156,901 458,827 Mining Interests Energy Interests Scope 3 Financed Emissions (tCO2e) Operation’s emissions † Emission intensity† Operation’s GEOs Franco-Nevada GEOs from operation Franco-Nevada production volume (boe) from operation or region Message from our CEO Report Highlights About Franco-Nevada Responsible Capital Allocation Community Contributions Good Governance and Shareholder Alignment Diversity, Inclusion and Well-Being Transparency and Guiding Principles About this Sustainability Report Appendices Climate Action Goals Overall Carbon Footprint Corporate Footprint Climate Action Investment Footprint

Sustainability Report 2025 Page 41 Page 43

Sustainability Report 2025 Page 41 Page 43