Carbon Footprint

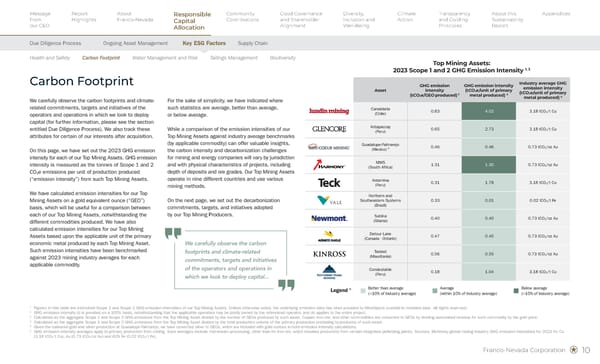

Franco-Nevada Corporation 10 1 Figures in this table are estimated Scope 1 and Scope 2 GHG emission intensities of our Top Mining Assets. Unless otherwise noted, the underlying emission data has been provided by MineSpans (outside-in modeled data - all rights reserved). 2 GHG emission intensity (i) is provided on a 100% basis, notwithstanding that the applicable operation may be jointly owned by the referenced operator, and (ii) applies to the entire project. 3 Calculated as the aggregate Scope 1 and Scope 2 GHG emissions from the Top Mining Asset divided by the number of GEOs produced by such asset. Copper, iron ore, and other commodities are converted to GEOs by dividing associated revenue for such commodity by the gold price. 4 Calculated as the aggregate Scope 1 and Scope 2 GHG emissions from the Top Mining Asset divided by the total production volume of the primary production (excluding by-products) of such asset. 5 Given the balanced gold and silver production at Guadalupe-Palmarejo, we have converted silver to GEOs, which are included with gold ounces in both emission intensity calculations. 6 GHG emission intensity averages apply to primary production from mining. Such averages exclude mid-stream processing, other than for iron ore, which includes production from certain integrated pelletizing plants. Sources: McKinsey global mining industry GHG emission intensities for 2023 for Cu (3.18 tCO2/t Cu), Au (0.73 tCO2/oz Au) and 62% Fe (0.02 tCO2/t Fe). Legend 6 Better than average (10% of industry average) We carefully observe the carbon footprints and climate- related commitments, targets and initiatives of the operators and operations in which we look to deploy capital (for further information, please see the section entitled Due Diligence Process). We also track these attributes for certain of our interests after acquisition. On this page, we have set out the 2023 GHG emission intensity for each of our Top Mining Assets. GHG emission intensity is measured as the tonnes of Scope 1 and 2 CO2e emissions per unit of production produced (“emission intensity”) from such Top Mining Assets. We have calculated emission intensities for our Top Mining Assets on a gold equivalent ounce (“GEO”) basis, which will be useful for a comparison between each of our Top Mining Assets, notwithstanding the different commodities produced. We have also calculated emission intensities for our Top Mining Assets based upon the applicable unit of the primary economic metal produced by each Top Mining Asset. Such emission intensities have been benchmarked against 2023 mining industry averages for each applicable commodity. For the sake of simplicity, we have indicated where such statistics are average, better than average, or below average. While a comparison of the emission intensities of our Top Mining Assets against industry average benchmarks (by applicable commodity) can offer valuable insights, the carbon intensity and decarbonization challenges for mining and energy companies will vary by jurisdiction and with physical characteristics of projects, including depth of deposits and ore grades. Our Top Mining Assets operate in nine different countries and use various mining methods. On the next page, we set out the decarbonization commitments, targets, and initiatives adopted by our Top Mining Producers. Carbon Footprint Top Mining Assets: 2023 Scope 1 and 2 GHG Emission Intensity 1, 2 Asset GHG emission intensity (tCO2e/GEO produced) 3 GHG emission intensity (tCO2e/unit of primary metal produced) 4 Industry average GHG emission intensity (tCO2e/unit of primary metal produced) 6 Candelaria (Chile) 0.83 4.02 3.18 tCO2/t Cu Antapaccay (Peru) 0.65 2.73 3.18 tCO2/t Cu Guadalupe-Palmarejo (Mexico) 5 0.46 0.46 0.73 tCO2/oz Au MWS (South Africa) 1.31 1.30 0.73 tCO2/oz Au Antamina (Peru) 0.31 1.78 3.18 tCO2/t Cu Northern and Southeastern Systems (Brazil) 0.33 0.01 0.02 tCO2/t Fe Subika (Ghana) 0.40 0.40 0.73 tCO2/oz Au Detour Lake (Canada - Ontario) 0.47 0.45 0.73 tCO2/oz Au Tasiast (Mauritania) 0.56 0.55 0.73 tCO2/oz Au Condestable (Peru) 0.18 1.04 3.18 tCO2/t Cu We carefully observe the carbon footprints and climate-related commitments, targets and initiatives of the operators and operations in which we look to deploy capital... Responsible Capital Allocation Due Diligence Process Ongoing Asset Management Key ESG Factors Supply Chain Message from our CEO Report Highlights About Franco-Nevada Community Contributions Good Governance and Shareholder Alignment Diversity, Inclusion and Well-Being Transparency and Guiding Principles Climate Action About this Sustainability Report Appendices Health and Safety Carbon Footprint Water Management and Risk Tailings Management Biodiversity

Sustainability Report 2025 Page 11 Page 13

Sustainability Report 2025 Page 11 Page 13