2023 Asset Handbook

The 2023 Asset Handbook provides a comprehensive overview of Franco-Nevada's diversified global portfolio of 419 royalty, stream, and working interests across precious metals, energy, and other mining assets.

2023 Asset Handbook

This Asset Handbook has not been prepared in connection with the sale of securities and is not an offering memorandum and should not be relied upon as such. This Asset Handbook does not constitute an offer to sell or a solicitation for an offer to purchase any security in any jurisdiction. Information relating to projects, properties and their owners and operators presented in this Asset Handbook has been sourced from the public disclosure of the owners and operators of our assets available as at March 9, 2023 (except where stated otherwise). More current information may become available in our subsequent disclosure and on our website. This Asset Handbook contains information about many of our assets, including those that may not currently be material to us. Also, the description and depiction of our business and assets have been simplified for presentation purposes. Dollar references are in U.S. dollars unless otherwise noted. This Asset Handbook should be read with reference to the explanatory notes and cautionary statements contained in the Additional Information section found at the end of this Asset Handbook. Please also refer to the additional supporting information and explanatory notes found in our Annual Information Form (“AIF”), our annual Management’s Discussion & Analysis (“MD&A“), and our Annual Report on Form 40-F available at www.sedar.com and www.sec.gov, respectively, and on our website at www.franco-nevada.com. This Asset Handbook complements but does not form part of such documents. Overview Message to Stakeholders 1 Our History 2 Our Business Model 3 Funding Successful Mines 4 Diversified Portfolio With Low Risk 5 Long-Life Assets 5 Global Assets 6 Asset Portfolio 8 Asset Portfolio 9 Historical Performance 10 Track Record 12 Organic Growth Drivers 13 Royalty Optionality 14 Royalty Ounces 15 Precious Metals Royalty Ounces 16 Diversified Royalty Ounces 17 Royalty Ounces by Mineral Resource, Location and Type 18 Royalty Ounce Growth 18 Environmental, Social and Governance Highlights 19 Precious Metals Assets South America 26 Central America and Mexico 36 United States 40 Canada 53 Rest of World 72 Precious Metals Exploration Assets 83 Diversified Assets Iron Ore 89 Other Mining 93 Diversified (Mining) Exploration Assets 102 Energy Assets 104 Energy Exploration Assets 113 Mineral Resources and Mineral Reserves Gold Mineral Resources 116 Gold Mineral Reserves 117 Mineral Resources and Mineral Reserves 118 Additional Information Asset Counts, Acreage of Assets 122 Mine Life Index 123 Board of Directors 124 Executive Management 126 Corporate Organization 127 Non-GAAP Financial Measures 128 Technical and Third-Party Information 130 Forward Looking Information 131 Glossary 132 Corporate Information 134 Contents

1 Franco-Nevada Corporation TSX / NYSE: FNV Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Overview Dear Stakeholders David Harquail, Chair of the Board and Paul Brink, President & CEO at the Cobre Panama Mine, November 2022 We believe combining a lower-risk gold investment, a strong balance sheet and progressive dividends is the right mix to appeal to investors seeking to hedge market instability. Franco-Nevada achieved record revenues in 2022 driven by the sharp run-up in energy prices following the invasion of Ukraine. Our business continued to deliver consistent performance and we generated record Adjusted EBITDA 1 and Adjusted Net Income 1 during the year. Exploration success on our properties continued to fuel our organic growth, with the expansion of the Detour Lake orebody being the most recent highlight. Our shareholders have realized a compound annual growth rate greater than 17% since our initial public offering in late 2007. Earlier this year we made our 16 th consecutive dividend increase and cumulative dividends now exceed US$1.9 billion. At the end of March, our market capitalization was US$28 billion, ranking Franco-Nevada among the largest gold companies in the world. Our shareholders rely on us to allocate capital to responsible mining operations, making ESG a critical part of our transaction due diligence. We also encourage our operators to adopt responsible operating principles and work with them to develop and fund programs to benefit their local communities. Our goal each year is to improve the transparency of our reporting on these initiatives. We are proud to have achieved a “Global 50 Top Rated” ESG score for 2023 from Sustainalytics which places us among a select group of all the companies that Sustainalytics ranks globally. We operate our business with a small team of 40 people and have kept overhead low while our revenue and asset base have grown substantially. Our success is a result of a highly capable team and the guidance of an experienced and engaged Board of Directors. They have a material stake in the business and think like owners. We are delighted by the growing diversity of our team and are confident of achieving our goal of at least 40% diverse representation at the Board and senior management level as a group by 2025. We are convinced of the long-term investment appeal of gold and believe the tapering off of reserve bank rate hikes combined with continued global tensions will be a strong tailwind for gold prices in 2023. Thank you for your ongoing trust and support. David Harquail Paul Brink Chair of the Board President & CEO April 12, 2023 Our diversified portfolio of cash-flow producing assets provides our shareholders exposure to production growth and exploration optionality from high quality mineral and energy deposits in many of the world’s most prospective resource trends. 1 Franco-Nevada Corporation TSX / NYSE: FNV 1 Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures with no standardized meaning under International Financial Reporting Standards (“IFRS”) and might not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-GAAP Financial Measures” section starting on page 128 of this Asset Handbook Overview

2 TSX / NYSE: FNV Franco-Nevada Corporation Overview 2 TSX / NYSE: FNV Franco-Nevada Corporation Our History Our Unique Approach We avoid having long-term debt, preferring to have capital to invest when others don’t. The commodity downturn of 2014-2016 forced even the largest global mining companies to repair their balance sheets. We invested US$1.8 billion in those years, creating precious metals streams at some of the world’s largest copper mines – Candelaria, Antamina and Antapaccay – and gaining exposure to longer duration assets than can typically be found in the gold industry. We have not forgotten our roots and continue to invest in smaller development-stage assets which over time have tremendous resource optionality. Our total mining asset count has grown from 190 at IPO to 419 today, including exploration assets on some of the world’s best gold belts. We have invested outside of precious metals when good opportunities have come to market, adding cash flow growth and exposure to the exploration upside on a broad range of world- class resources. In 2011, we acquired royalties on a suite of large copper development projects by acquiring Lumina Royalty. Following the oil price collapse in 2014, we added to our long held Canadian oil and gas royalty interests, investing in the major U.S. basins including the the Permian, SCOOP/ STACK, Marcellus, and Haynesville. Most recently, we added royalty exposure to high grade iron ore at Vale’s Northern and Southeastern systems in Brazil. We believe the depth of our portfolio gives us the latitude to patiently search for exposure to good geology. Our desire is to build the most diverse portfolio of royalties and streams exposed to precious metal prices, but also to exploration success across the world’s greatest mineral belts. Our prospects to put more capital to work in the capital intensive and cyclical resource sector have never been better. Creation of the Royalty Model Franco-Nevada Mining Corporation Limited The history of our business starts with our predecessor company, Franco- Nevada Mining Corporation Limited, founded by Seymour Schulich and Pierre Lassonde. Pierre bought Franco-Nevada’s first royalty in 1986 on the Goldstrike mine in the Carlin Trend. At the time, it was a small heap-leach mine operated by Western States Mining. Shortly thereafter, American Barrick (now Barrick Gold Corporation) purchased Goldstrike and did the deep level exploration that would ultimately reveal a 50 million ounce orebody that drove the success of both Barrick and Franco-Nevada. Pierre and Seymour, assisted by David Harquail, began acquiring royalties in the more prolific gold camps in the world including the Carlin and Getchell trends in Nevada, Timmins and Kirkland Lake camps in Ontario and the Kalgoorlie belt in Australia. They also expanded into PGMs including a royalty on Stillwater in Montana which, along with Goldstrike, stands out as one of their most successful royalty purchases. In the early 1990s as part of their prospect generation model, Franco - Nevada discovered the high-grade Ken Snyder deposit in Nevada. They determined that the deposit had a high enough silver credit to carry all operating costs, creating an effective 100% gold royalty and proceeded to construct the mine. In early 2001, Franco-Nevada sold the mine to Normandy Mining in exchange for 20% of Normandy and a royalty on the mine. Later in 2001, AngloGold made a bid for Normandy. Seeing the potential for a better alternative transaction, Seymour and Pierre struck a deal with Newmont to acquire both Franco-Nevada and Normandy. When the transaction closed in 2002, Franco-Nevada was valued at close to US$3 billion. The IPO Franco-Nevada Corporation (FNV) In 2007, Newmont made the decision to divest its portfolio of royalty assets. Pierre Lassonde, David Harquail and a small team led by management of the original Franco-Nevada, launched an initial public offering on the Toronto Stock Exchange and acquired the royalty portfolio from Newmont for US$1.2 billion. The offering remains the largest mining IPO completed in North America and was the birth of Franco-Nevada Corporation (FNV). The performance of the portfolio of royalties acquired from Newmont has more than justified the price of the IPO. In the past 15 years, the IPO portfolio has paid out over US$2.1 billion in revenue. At the same time, the reserve ounces associated with those same properties has tripled. Key contributors, including Detour Lake and Tasiast, have once again proven the power of the royalty business model and the exploration optionality of being exposed to great geology. Streaming – the New Engine of Growth At the end of 2008, in the depth of the financial crisis, we entered into our first gold streaming agreement with Coeur Mining to complete the construction of the Palmarejo mine in Mexico. Our largest stream transaction to date was a US$1 billion gold and silver streaming commitment to support Inmet’s construction of the giant Cobre Panama project in 2012. A few years later the commitment was expanded to US$1.35 billion with the development of Cobre Panama then in the hands of First Quantum. First Quantum demonstrated its industry-leading project development skill bringing the asset to production in 2019. Franco-Nevada Historical TSX Share Price (US$) (December 31, 2007 – March 31, 2023) – $50 $100 $150 $200 December 31, 2007 Franco-Nevada TSX Share Price (US$) March 31, 2023 Overview

3 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Our Business Model Business Model Advantages Streams Streams have become a mainstream source of capital to mining companies most often to fund the construction of new projects. In particular, streaming precious metals by-product from large copper projects provides a very attractive cost of capital to project developers. Streams are metal purchase agreements where the streamer purchases all or a portion of the gold, silver or other products from a mine in exchange for an upfront payment and an additional payment on each delivery. While streams have similar exploration and price optionality to royalties, they differ from royalties in many respects including the ongoing cash payment required to purchase the physical metal. Royalties Royalties are often 1-2% of the value of future production from a resource property and are typically created as exploration properties change hands. Often royalties are a percentage of the net value a mine operator receives for its product when it is processed at a smelter, hence the term “net smelter return” or “NSR” royalty. Other forms of royalties include profit-related royalties or “NPI” royalties but these are not a major part of Franco-Nevada’s portfolio. Royalty rights are often registered on the title of the property or mineral rights. Registered royalties have strong tenure and, in jurisdictions where recognized, will generally survive an operating company reorganization. As a gold-focused royalty and streaming company, we do not operate mines, develop projects or conduct exploration. Optionality Potential for exploration success on ~66,000 km 2 Free Cash Flow Business Not exposed to capital calls High Margin and Low Overhead Strong cash generation throughout the commodity cycle Focus on Growth Management not occupied with operational decisions Limited Cost Inflation Streams/NSRs not exposed to cost inflation Diversified Portfolio Non-operating business is more scalable We have a unique business that is exposed to both the tremendous resource upside potential, or “optionality” of royalties on gold mines, development projects and exploration properties and the low risk, long life cash flows of precious metals streams on large copper mines. Both royalties and streams provide exposure to commodity prices, increases in production and future discoveries on the property. Neither interest is subject to cash calls to fund exploration, development, capital, environmental or closure costs and so they are lower risk than an operating interest.

4 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Funding Successful Mines Project Development Emerging Projects M&A Debt Reduction Royalties and streams provide low-cost and flexible funding for the mining industry. It helps operators reduce the fixed burden of debt and avoid excessive equity dilution, particularly when financing new mine builds. We aim to be a stable and supportive partner through the cycle and to share in the exploration success of the projects that we help fund.

5 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Diversified Portfolio With Low Risk Long-Life Assets Commodity Assets M&I (inclusive) Royalty Ounce Mine Life (Years) Geography Operator Franco-Nevada has the largest and most diversified portfolio of cash flow producing assets. Franco-Nevada’s long resource and reserve life is due largely to its precious metals by-product streams on large copper assets. Gold 55% Silver 11% Gas 11% NGL 2% PGM 4% Iron Ore 4% Other Mining 1% Oil 12% Cobre Panama 17% Candelaria 10% Energy 25% Other 27% Antapaccay 7% Guadalupe 6% Antamina 5% Vale 3% Canada and United States 41% South America 27% Mexico and Central America 23% Rest of the World 9% First Quantum 17% Lundin 10% Vale 3% Other 48% Glencore 7% Coeur 6% Teck 5% Barrick 4% Please refer to page 123 for further information. 2022 Revenue 0 5 10 15 20 25 30 35 2022 2021 34 Years 32 Years

6 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Island Gold Sterling Robinson Fire Creek Bald Mountain Marigold EaglePicher Granite Creek (Pinson) Midas Goldstrike Gold Quarry South Arturo Hollister Nevada Cobre Panama Falcondo Castle Mountain Mesquite Courageous Lake Musselwhite Hemlo Greenstone Detour Lake Midale Weyburn Goldfields Monument Bay Edson Timmins West Sudbury Kirkland Lake Golden Highway Canadian Malartic Nevada Stibnite Gold Cariboo SCOOP Midland Orion Dublin Gulch (Eagle) Red Mountain Delaware STACK Franco-Nevada Head Office Franco-Nevada U.S. Office Kivivic 2 Marcellus Guadalupe-Palmarejo Brucejack CentroGold (Gurupi) Cerro Moro Taca Taca NuevaUnión (Relincho) San Jorge Antamina Salares Norte/ Rio Baker Valentine Gold Antapaccay Candelaria Calcatreu Stillwater Cascabel (Alpala) Red Lake (McFinley) Milpillas Haynesville Condestable Carol Lake Vale N. System Vale S.E. System Sossego Posse (Mara Rosa) Eskay Creek Copper World Project Franco-Nevada Barbados Office Caserones Tocantinzinho Magino Global Assets

7 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Our Portfolio 419 Total 113 Producing 45 Advanced 261 Exploration Precious Metals Diversified Precious Metals Diversified Millmerran Red October Henty Mt Keith Duketon Yandal (Bronzewing/Julius) King Vol Bowen Basin South Kalgoorlie (Mt Martin-Loc. 45) Flying Fox Australia Subika (Ahafo) Tasiast Sabodala Edikan MWS Perama Hill Kiziltepe Karma Sissingué Pandora Franco-Nevada Australia Office Agate Creek White Dam Séguéla Edna May Higginsville (Lake Cowan) Aphrodite Matilda (Wiluna) South Kalgoorlie (New Celebration/ Mt Marion Lithium) Cue Gold (Day Dawn) Asset count as of April 12, 2023 (not all assets shown on map including exploration assets) Warrawoona “ A diversified portfolio of 419 assets covering ~66,000 km 2 .”

8 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Asset Portfolio Precious Metals “NSR” Net Smelter Return Royalty “GORR” Gross Overriding Royalty “GR” Gross Royalty “ORR” Overriding Royalty “FH” Freehold or Lessor Royalty “NPI” Net Profits Interest “NRI” Net Royalty Interest “WI” Working Interest “P” “Producing” assets are those that have generated revenue from steady-state operations for Franco - Nevada or are expected to in the next year “A” “Advanced” assets are interests on projects which are not yet producing but where, in management’s view, the technical feasibility and commercial viability of extracting a mineral resource are demonstrable “E” “Exploration” assets represent interests on projects where technical feasibility and commercial viability of extracting a mineral resource are not demonstrable Management uses the following criteria in its assessment of technical feasibility and commercial viability: (i) Geology: there is a known mineral deposit which contains Mineral Resources or Mineral Reserves; or the project is adjacent to a mineral deposit that is already being mined or developed and there is sufficient geologic certainty of converting the deposit into Mineral Resources or Mineral Reserves (ii) Accessibility and authorization: there are no significant unresolved issues impacting the accessibility and authorization to develop or mine the mineral deposit, and social, environmental and governmental permits and approvals to develop or mine the mineral deposit appear obtainable Revenue ($ millions) Asset Operator Interest and % (Gold unless otherwise noted) 2022 2021 2020 Notes Precious Metals South America Candelaria Lundin Mining Stream 68% Gold & Silver $125.8 $116.5 $106.8 6, P Antapaccay Glencore Stream (indexed) Gold & Silver 95.2 111.6 118.5 6, P Antamina Teck Resources Stream 22.5% Silver 68.4 94.1 57.0 6, P Condestable Southern Peaks Mining Stream Gold & Silver, Fixed through 2025 then % 7 22.4 22.5 — 6, P Other (21 assets) 6.3 6.2 4.9 Px1, Ax8, Ex12 Central America & Mexico Cobre Panama First Quantum Stream (indexed) Gold & Silver 223.3 235.0 135.4 6, P Guadalupe-Palmarejo Coeur Mining Stream 50% 74.2 83.4 79.0 1, 3, 6, P Other (1 asset) — — 0.5 Ex1 United States Stillwater Sibanye-Stillwater NSR 5% PGM 36.8 57.8 50.9 1, P Goldstrike Nevada Gold Mines NSR 2-4%, NPI 2.4-6% 19.2 25.3 20.7 1, 2, P Gold Quarry Nevada Gold Mines NSR 7.29% 4.9 7.5 10.7 1, 3, P Marigold SSR Mining NSR 1.75-5%, GR 0.5-4% 7.5 8.5 7.1 1, 2, 3, 4, P Bald Mountain Kinross Gold NSR/GR 0.875-5% 8.4 11.2 11.2 1, 2, 3, 4, P Other (36 assets) 9.5 12.5 12.2 Px5, Ax6, Ex25 Canada Detour Lake Agnico Eagle Mines NSR 2% 26.3 25.3 20.4 P Sudbury KGHM International Stream 50% PGM & Gold 21.4 17.4 40.1 1, 6, Px2 Hemlo Barrick Gold NSR 3%, NPI 50% 28.2 27.6 69.9 1, 5, P Brucejack Newcrest Mining NSR 1.2% 5.8 7.0 7.2 1, P Kirkland Lake Agnico Eagle Mines NSR 1.5-5.5%, NPI 20% 5.5 5.8 5.4 2, 3, P Other (75 assets) 10.4 10.3 12.3 Px5, Ax14, Ex56 Rest of World MWS Harmony Gold Mining Stream 25% 39.2 41.3 41.8 6, P Sabodala Endeavour Mining Stream 6%, Fixed to 105,750 oz 8 16.8 16.7 21.6 3, 6, P Tasiast Kinross Gold NSR 2% 18.3 6.7 14.3 P Subika (Ahafo) Newmont NSR 2% 18.0 11.6 10.4 1, P Karma Néré Mining Stream 4.875% 3.3 9.9 28.9 6, P Duketon Regis Resources NSR 2% 10.7 11.1 9.6 1, P Other (74 assets) 13.9 12.9 14.0 Px10, Ax10, Ex54 Revenue – Precious Metals $919.7 $995.7 $910.8 Notes:

9 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Asset Portfolio Diversified 1 Does not cover all the Mineral Resources or Mineral Reserves reported for the property by the operator 2 Percentage varies depending on the claim block of the property 3 Provides for minimum or advance payments 4 Percentage varies depending on the commodity price or value of ore 5 Payable after operator recovers defined exploration and development expenses 6 These revenue numbers are before the deduction of the purchase cost per ounce 7 8,760 oz Au & 291,000 oz Ag per year until December 2025; then, 63% Au & Ag until 87,600 oz Au & 2,910,000 oz Ag delivered, respectively; thereafter, 25% Au & Ag 8 Sabodala agreement was amended with an effective date of September 1, 2020 9 Net sales royalty attributable to FNV Royalty holding on certain properties and subject to certain thresholds. Copper/Gold rate applies to Sossego at 50% given its previous joint venture ownership 10 GORR and IOC equity interest attributable to FNV 9.9% equity ownership of Labrador Iron Ore Royalty Corporation Revenue ($ millions) Asset Operator Interest and % 2022 2021 2020 Notes Diversified Vale Vale 0.264% Iron Ore, 0.367% Copper/Gold, 0.147% Other 9 $40.7 $59.4 $ — Px3, Ex1 LIORC Rio Tinto GORR 0.7% Iron Ore, IOC Equity 1.5% 10 14.8 30.2 14.7 P Other Mining (102 assets) 6.9 5.2 3.1 Px10, Ax7, Ex85 United States (Energy) Marcellus Range Resources GORR 1% 56.5 36.1 20.4 P Haynesville Various Various Royalty Rates 72.9 38.5 4.2 P SCOOP/STACK Various Various Royalty Rates 57.8 36.4 21.6 Px3 Permian Basin Various Various Royalty Rates 52.6 35.0 18.5 Px2 Other (2 assets) 0.3 0.2 0.1 Px1, Ex1 Canada (Energy) Weyburn Unit Whitecap Resources NRI 11.71%, ORR 0.44%, WI 2.56% 65.0 43.8 16.0 Px3 Orion Strathcona Resources GORR 4% 15.1 10.8 5.9 P Other (69 assets) 13.4 8.7 5.0 Px43, Ex26 Revenue – Diversified $396.0 $304.3 $109.5 Total Revenue (Precious Metals + Diversified) $1,315.7 $1,300.0 $1,020.3

10 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview (in millions, except GEOs, Total Shareholders’ Equity, Market Capitalization, and per share amounts) 2022 3 2021 3 2020 3 2019 3 2018 3 2017 3 GEOs 1 sold (000s) 730.0 728.2 573.3 598.4 516.6 537.7 Revenue $ 1,315.7 $ 1,300.0 $ 1,020.2 $ 844.1 $ 653.2 $ 675.0 Operating Income $ 820.7 $ 860.7 $ 336.5 $ 410.2 $ 188.8 $ 235.4 Net Income (Loss) $ 700.6 $ 733.7 $ 326.2 $ 344.1 $ 139.0 $ 194.7 Basic Earnings (Loss) per share $ 3.66 $ 3.84 $ 1.71 $ 1.83 $ 0.75 $ 1.06 Adjusted Net Income 2 $ 697.6 $ 673.6 $ 516.3 $ 341.5 $ 217.0 $ 198.3 Adjusted Net Income 2 per share $ 3.64 $ 3.52 $ 2.71 $ 1.82 $ 1.17 $ 1.08 Adjusted EBITDA 2 $ 1,106.9 $ 1,092.3 $ 839.6 $ 673.4 $ 519.6 $ 516.1 Adjusted EBITDA 2 per share $ 5.78 $ 5.72 $ 4.41 $ 3.59 $ 2.79 $ 2.82 Dividends and DRIP Paid $ 245.8 $ 221.4 $ 197.2 $ 187.0 $ 177.8 $ 167.9 Dividends Paid per share $ 1.28 $ 1.16 $ 1.03 $ 0.99 $ 0.95 $ 0.91 Working Capital 4 $ 1,332.9 $ 708.2 $ 610.5 $ 225.3 $ 153.5 $ 593.8 Debt $ Nil $ Nil $ Nil $ 80.0 $ 207.6 $ Nil Total Shareholders’ Equity $ 6.4B $ 6.0B $ 5.4B $ 5.1B $ 4.6B $ 4.7B Market Capitalization 5 $ 26.1B $ 26.5B $ 23.9B $ 19.6B $ 13.1B $ 14.9B Historical Performance 2022 – 2008 1 Starting in Q4 2021, revenue from Franco-Nevada’s Energy assets are included in the calculation of Gold Equivalent Ounces (“GEOs”). GEOs for comparative periods have been recalculated to conform with the current presentation. GEOs include Franco-Nevada’s attributable share of production from our Mining and Energy assets, after applicable recovery and payability factors. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces, before the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking into account the NPI economics. Silver, platinum, palladium, iron ore, oil, gas and other commodities are converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used in the computation of GEOs earned from a particular asset varies depending on the royalty or stream agreement, which may make reference to the market price realized by the operator, or the average price for the month, quarter, or year in which the commodity was produced or sold. 2 Adjusted Net Income, Adjusted Net Income per share, Adjusted EBITDA, and Adjusted EBITDA per share are non-GAAP financial measures with no standardized meaning under International Financial Reporting Standards (“IFRS”) and might not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-GAAP Financial Measures” section starting on page 128 of this Asset Handbook. 3 Fiscal years 2010 through 2022 were prepared in accordance with IFRS. Fiscal years 2008 and 2009 were prepared in accordance with Canadian GAAP. Comparative information has been adjusted to conform to current presentation. 4 The Company defines Working Capital as current assets less current liabilities. 5 As at December 31. Gold Equivalent Ounces Sold 1 (000s) Revenue (US$ millions) Adjusted EBITDA 2 (US$ millions) – 100 200 300 400 500 600 700 800 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08 – 300 600 900 1,200 $1,500 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08 – 200 400 600 800 1,000 $1,200 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08

11 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals 2016 3 2015 3 2014 3 2013 3 2012 3 2011 3 2010 3 2009 3 2008 3 488.5 384.5 351.6 290.4 254.7 260.6 185.4 158.2 167.8 $ 610.2 $ 443.6 $ 442.4 $ 400.9 $ 427.0 $ 411.2 $ 227.2 $ 199.7 $ 151.0 $ 155.4 $ 51.3 $ 155.8 $ 77.7 $ 146.7 $ 45.5 $ 87.3 $ 87.4 $ 38.1 $ 122.2 $ 24.6 $ 106.7 $ 11.7 $ 102.6 $ (6.8) $ 62.7 $ 80.9 $ 40.3 $ 0.70 $ 0.16 $ 0.71 $ 0.08 $ 0.72 $ (0.05) $ 0.55 $ 0.76 $ 0.41 $ 164.4 $ 88.9 $ 137.5 $ 138.3 $ 171.0 $ 136.0 $ 52.1 $ 32.0 $ 43.7 $ 0.94 $ 0.57 $ 0.91 $ 0.94 $ 1.19 $ 1.08 $ 0.46 $ 0.30 $ 0.48 $ 489.1 $ 337.1 $ 356.0 $ 319.9 $ 347.5 $ 327.3 $ 180.0 $ 119.4 $ 127.2 $ 2.79 $ 2.37 $ 2.18 $ 2.43 $ 2.61 $ 1.58 $ 1.12 $ 1.30 $ 2.15 $ 156.8 $ 129.0 $ 118.0 $ 104.4 $ 77.9 $ 49.2 $ 33.3 $ 28.2 $ 21.8 $ 0.87 $ 0.83 $ 0.78 $ 0.72 $ 0.54 $ 0.32 $ 0.29 C$ 0.28 C$ 0.24 $ 323.6 $ 253.9 $ 677.8 $ 861.2 $ 822.4 $ 851.1 $ 572.7 $ 530.7 $ 239.1 $ Nil $ 457.3 $ Nil $ Nil $ Nil $ Nil $ Nil $ Nil $ Nil $ 4.1B $ 3.2B $ 3.4B $ 3.0B $ 3.1B $ 2.8B $ 2.0B $ 1.9B $ 1.4B $ 10.7B $ 7.2B $ 7.7B $ 6.0B $ 8.3B $ 5.3B $ 3.8B $ 3.2B $ 1.7B Market Capitalization 5 (US$ billions) G&A as % of Market Capitalization Adjusted Net Income Per Share 2 (US$ per share) – 5 10 15 20 25 $30 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08 – 0.2 0.4 0.6 0.8 1.0% 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08 – 0.5 1.0 1.5 2.0 2.5 3.0 3.5 $4.0 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08

12 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview -5% 0% 5% 10% 15% 20% NASDAQ S&P 500 Gold Bullion ETF Barclays US Aggregate Bond Franco-Nevada (FNV) US$ basis GDX (index of mostly gold miners) Track Record CAGR Since FNV Inception 1, 2, 3 1-Year 2-Year 5-Year Since FNV Total Return Total Return Total Return Inception 1 Franco-Nevada (US$) 2 (7.7%) 8.8% 17.5% 17.4% NASDAQ (13.3%) (3.2%) 12.6% 11.8% S&P 500 (7.8%) 3.3% 11.2% 9.2% Gold Bullion ETF 3 1.4% 7.0% 7.8% 5.7% Barclays US Aggregate Bond 4 (4.8%) (4.5%) 0.9% 2.8% GDX (index of mostly gold miners) (14.2%) 1.5% 9.1% (1.0%) Note: Total return assumes reinvestment of dividends over designated period Source: TD Securities; Bloomberg 1 Compounded annual total returns from December 20, 2007 to March 31, 2023 2 Since FNV inception returns in US$ are calculated assuming an initial cost of US$15.21 (based on an IPO price of C$15.20 and CAD/USD of 1.0009 on December 20, 2007). All other index returns are in US$ 3 SPDR Gold Trust 4 Bloomberg Barclays US Aggregate Bond Index “ Since its IPO in 2007, Franco-Nevada has outperformed all the relevant benchmarks.” 1 FNV Inception - December 20, 2007 2 Compounded annual total returns to March 31, 2023 3 Source: TD Securities; Bloomberg

13 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals 2023 2024 2025 2026 2027 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Magino Ontario Séguéla Côte d'Ivoire Salares Norte Chile Yandal/Bronzewing Australia Greenstone Ontario Posse (Mara Rosa) Brazil Tocantinzinho Brazil Valentine Gold Newfoundland Eskay Creek British Columbia Stibnite Gold Idaho Copper World Project Arizona 1 2023 Guidance and 2027 Outlook as published on March 15, 2023 in Franco-Nevada’s 2022 Annual Report. Assuming: $1,800/oz Au, $21/oz Ag, $900/oz Pt, $1,500/oz Pd, $120/tonne Fe 62% CFR China, $80/bbl WTI oil and $3.00/mcf Henry Hub natural gas 2 Expansion periods are based on operators’ indicated period of ramp-up 3 Indicated start periods are based on operators’ guidance and FNV best estimates Organic Growth Drivers The ongoing Cobre Panama expansion is expected to be the largest growth driver through the period. That growth is expected to be complemented by a combination of mine expansions and a number of new mines commencing production. Over the last 15 years, Franco-Nevada's GEOs have grown over four times both through organic expansions and acquisitions. We have a strong pipeline of opportunities to add further growth through acquisitions. 2023 2024 2025 2026 2027 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Cobre Panama Panama Subika Ghana Tasiast Mauritania Vale Brazil Detour Lake Ontario Kirkland Gold Ontario Island Gold Ontario Stillwater Montana Our guidance 1 is for total GEO sales of 640,000 to 700,000 GEOs in 2023 growing to 760,000 to 820,000 GEOs by 2027 through organic growth alone. Expansions 2 New Mines Estimated Start 3

14 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview 1 Calculation includes depletion 2 Total ounces associated with top 37 assets at IPO. Total ounces are not the same as Franco-Nevada Royalty Ounces. All Mineral Reserves have been calculated in accordance with CIM or acceptable foreign codes for the purposes of NI 43-101, including S-K 1300, SEC Industry Guide 7, JORC, or SAMREC guidelines 3 Revenue from original FNV portfolio includes gold, platinum and palladium revenue as at December 31, 2022 Royalty Optionality In particular, we have royalties on the next generation copper assets: Cascabel (Alpala) in Ecuador, Copper World Project in Arizona, Taca Taca in Argentina, and NuevaUnión and Vizcachitas both in Chile. We also have royalties that cover much of the Ring of Fire in Northern Ontario which hosts some of the world’s largest chromite resources, along with nickel, copper and gold deposits. Another asset with large scale potential is the Crawford nickel deposit that is being delineated in Ontario. We profile all these assets in this Asset Handbook, although the profiles are not exhaustive. In addition to the profiled assets, we have another 253 exploration assets which are listed on pages 83-85 and pages 102-103. There is no doubt there will be more discoveries in the coming years from the ~66,000 km 2 that our portfolio covers across the best mineral trends in the world. The optionality value of the portfolio is difficult to measure. The example below, however, gives an indication of how this optionality has played out historically. Numerous exploration and development stage assets are expected to drive long-term growth. 0 20 40 60 80 100 120 2022 2008 – 2022 2007 Gold Reserves 2 at time of IPO Proven and Probable Mineral Reserves (Moz) >45 Moz gold produced $1.2 billion paid for portfolio at IPO Gold Reserves 2 of same assets as reported December 2022 Reserves increase at no cost >$2.1 billion 3 revenue to Franco-Nevada from portfolio >3.5x increase 1

15 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Royalty Ounces 4. An asset producing silver, PGM or base/bulk metal: The number of attributable silver, platinum or palladium ounces, and attributable base/bulk metals pounds/tonnes are converted into Royalty Ounces. This year’s pricing assumptions for conversion include: $1,800 per ounce gold, $21.00 per ounce silver, $900 per ounce platinum, $1,500 per ounce palladium, $4.00 per pound copper, $11.00 per pound nickel, $1.22 per pound ferrochrome and $120/t Fe 62% CFR China for our calculations. For copper, nickel, ferrochrome and iron ore Royalty Ounce calculations, we do reflect deductions for processing and refining as they are more material compared to a typical gold NSR asset. In the Assets section of this Asset Handbook, we provide details for each asset that include summary figures for the Mineral Resources (M&I Resources inclusive of P&P Reserves), Mineral Reserves (P&P Reserves) and Inferred Mineral Resources (Inferred Resources). We also provide the related M&I Royalty Ounces, P&P Royalty Ounces and Inferred Royalty Ounces for each of those assets and the key guidance and assumptions that were required to derive those Royalty Ounces. Readers are cautioned that the Royalty Ounces are prepared by the management of Franco-Nevada and have not been reviewed or endorsed by the operators of the projects. Why We Measure “Royalty Ounces” Franco-Nevada’s mining properties that have reported Mineral Resources and Mineral Reserves are tabulated in the Mineral Resources and Mineral Reserves appendix of this Asset Handbook. Unless otherwise noted in the Royalty Ounce calculation for each asset, the figures are tabulated based on the publicly disclosed reports of each operator for each property on a 100% basis. However, the tabulation does not provide a specific measure for Franco-Nevada’s interest in such Mineral Resources and Mineral Reserves for the following reasons: • Royalty and stream interests have different economics than an operator has for its stated Mineral Resources and Mineral Reserves. In addition, the economics differ between NSR, NPI and stream interests • Some assets do not cover the entire property associated with the operator’s publicly reported figures To account for the above, we calculate “Royalty Ounces” to estimate the value attributable to Franco-Nevada due to our economic interest in the Mineral Resources and Mineral Reserves of our portfolio. The value of a Royalty Ounce is normalized to that of a gold NSR ounce. How We Estimate “Royalty Ounces” A traditional NSR royalty on a gold mining property provides Franco- Nevada with a simple percentage of the revenue or gold in-kind produced from that property. For example, if we have a 2% NSR royalty on a property, we calculate 2% of the stated Mineral Resources and Mineral Reserves as our “Royalty Ounces”. Note we do not make adjustments for recoveries and refining fees for gold NSRs as they are typically minor. When calculating Royalty Ounces for a property our objective is that they should be comparable to an attributable gold NSR Royalty Ounce. To achieve comparable Royalty Ounce figures, we make adjustments in the following circumstances: 1. The royalty or stream does not cover all the Mineral Resources or Mineral Reserves on a property: We provide our best estimate of the percentage of Mineral Resources and Mineral Reserves that are attributable to our interest. 2. A stream interest with an associated ongoing cost per ounce: The number of attributable stream ounces are factored to make them economically equivalent to a NSR ounce. For example as illustrated on this page, at an $1,800 per ounce gold price and a $400 cost per ounce, the stream ounces are factored by 77.8%. The factor depends on cost per ounce or the percentage margin written in the agreement. 3. A NPI royalty: A NPI is subject to the operating and capital costs specific to each asset. We generate our own internal mine life projections for each asset to determine a reasonable estimate of the economic equivalent of a gold NSR Royalty Ounce using an $1,800 gold price assumption. Developed NSR Stream NPI or WI 1 One ounce sold at $ 1,800 $ 1,800 $ 1,800 Applicable cost $ – $ 400 1 $ 1,222 1 Margin for calculation $ 1,800 $ 1,400 $ 578 NSR, Stream or NPI % 4% 4% 4% Revenue per ounce to FNV $ 72 $ 56 $ 23 Value relative to an NSR 1.0x 0.78x 0.32x 1 Franco-Nevada’s streams have various ongoing costs. In some cases, it is $400 per ounce plus a 1% annual increment, in other cases it is 20% of the spot price of gold. For each stream, Franco-Nevada indicates the detail for ongoing costs. 2 For applicable costs for a developed NPI or WI, Franco-Nevada is, for illustrative purposes, assuming Barrick Gold Corporation’s (“Barrick”) 2022 all-in sustaining cash cost measure, as Barrick is the operator of two assets at which Franco-Nevada has NPI interests. Example Economics of a Royalty (NSR or NPI) versus a Stream The example below compares the relative value per ounce to Franco- Nevada of an NSR, a stream or an NPI or WI. Assume for one ounce of gold, a sales price of $1,800, a “stream cost” 1 of $400 per ounce and that the “all-in sustaining cost” 2 of the mine is $1,222 per ounce.

16 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Precious Metals Royalty Ounces 1, 2 Asset Asset Type P&P (000s) M&I 4 (000s) Inf (000s) South America Candelaria Stream 746 1,456 115 Antapaccay Stream 397 786 36 Antamina Stream 153 528 531 Condestable Stream 97 164 87 Tocantinzinho Stream 204 210 5 Cerro Moro NSR 14 17 6 Salares Norte NSR 39 45 2 Cascabel (Alpala) 3 NSR 233 724 91 Posse (Mara Rosa) NSR 9 12 – CentroGold (Gurupi) NSR 11 17 6 Calcatreu NSR – 17 9 San Jorge NSR – 91 4 Central America and Mexico Cobre Panama Stream 4,532 4,758 750 Guadalupe-Palmarejo Stream 241 535 102 United States Stillwater NSR 879 1,316 1,497 Carlin Trend NSR/NPI 171 324 94 Marigold NSR 86 126 6 Bald Mountain NSR 22 101 11 Mesquite NSR 9 34 17 Castle Mountain NSR 110 149 38 Fire Creek/Midas NSR – 2 84 Hollister NSR – 2 8 Stibnite Gold NSR 82 107 27 Mountain View NSR – – 5 Canada Detour Lake NSR 414 773 23 Sudbury Stream 24 24 – Hemlo NSR/NPI 65 137 22 Brucejack NSR 47 86 37 Kirkland Lake NSR/NPI 29 63 58 Dublin Gulch (Eagle) NSR 24 43 5 Musselwhite NPI 31 39 7 Timmins West NSR 12 15 1 Canadian Malartic NSR 5 25 28 Magino NSR 49 80 11 Island Gold NSR 8 9 19 Greenstone NSR 166 210 92 Valentine Gold NSR 40 59 17 Golden Highway – Holt Complex NSR – 131 86 Golden Highway – Hislop NSR – 7 4 Golden Highway – Aquarius NSR – 22 – Eskay Creek NSR 56 78 3 Spences Bridge (Shovelnose) NSR – 16 5 Red Lake (McFinley) NSR 1 5 3 Courageous Lake NSR 66 82 40 Goldfields NSR – 20 4 Monument Bay NSR – 44 53 Red Mountain NSR 5 8 1 Fenelon-Martiniere NSR – 37 30 Marathon (Sally) NSR – 7 3 1 For information regarding the calculation of each Royalty Ounce, please refer to the individual asset sections. We have assumed $1,800/oz Au, $21/oz Ag, $900/oz Pt, $1,500/oz Pd, $4.00/lb copper, $11.00/lb nickel, $1.22/lb ferrochrome and $120/t Fe 62% CFR China for our calculations 2 Metallurgical deductions have not been made to the Mineral Resources and Mineral Reserves shown in order to estimate metal produced 3 Copper Royalty Ounces assume NSR deductions of 15% (for Sossego please refer to the Vale asset section); Nickel Royalty Ounces and Ferrochrome Royalty Ounces assume NSR deductions of 30%. Please also refer to the individual Vale (Northern & Southeastern System) & LIORC asset sections for the deductions applied to the Iron Ore Royalty Ounces 4 M&I Royalty Ounces include P&P Royalty Ounces

17 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Asset Asset Type P&P (000s) M&I 4 (000s) Inf (000s) Rest of World MWS Stream 38 38 – Sabodala Stream 67 120 32 Tasiast NSR 115 145 29 Subika (Ahafo) NSR 76 78 14 Karma Stream 6 74 26 Duketon NSR 25 71 16 Edikan NSR 20 28 4 Matilda (Wiluna) NSR 51 128 71 South Kalgoorlie NSR 7 19 14 Kiziltepe NSR 2 3 2 Sissingué NSR – 1 – Pandora NPI 22 193 24 Yandal (Bronzewing) NSR 19 37 4 Aphrodite NSR 8 29 13 Rebecca NSR – 15 3 Séguéla NSR 13 19 12 Perama Hill NSR 25 27 16 Aği Daği NSR 23 44 6 Precious Metals Royalty Ounces 9,594 14,610 4,369 Diversified Royalty Ounces 1, 2 Mining 3 Vale (Northern and Southeastern System) Other 1,002 1,376 84 Sossego Other 4 4 – LIORC Other 185 332 139 NuevaUnión (Relincho) NSR 286 399 163 Taca Taca NSR 403 490 112 Caserones NSR 59 93 – Falcondo NPI 103 116 8 Copper World Project NSR – 412 83 Robinson NSR 6 20 1 Ring of Fire NSR – 203 58 Eagle's Nest NSR 20 22 16 Crawford NSR – 656 292 Mt Keith NSR/NPI 23 51 6 Diversified Royalty Ounces 2,092 4,176 961 Total Royalty Ounces 11,686 18,786 5,330 Refer to footnotes on page 16 Compared to a gold exchange traded product, an investment in Franco-Nevada provides the opportunity to acquire gold exposure at a discount, along with the benefits of a meaningful yield and gold exploration optionality. Assuming $2,000 per ounce gold price implies an undiscounted value of $23.4 billion for our attributable Mineral Reserve Royalty Ounces and $37.6 billion for our attributable M&I (inclusive) Mineral Resource Royalty Ounces. By contrast, our market capitalization at March 31, 2023 was $28.0 billion. We do not calculate Royalty Ounces for our energy assets, comprised principally of oil and gas assets. In 2022, these assets comprised 25% of Franco- Nevada’s overall revenue. Furthermore, we only estimate Royalty Ounces on our 84 most material mining projects. There are a further 253 advanced and exploration projects not included in the estimates that add considerable optionality for further ounces in the future. Our experience is that each year some of these projects will advance enough to be included as Royalty Ounces. The value of a Royalty Ounce takes into account the costs associated of an ounce. Costs that are not deducted are income tax expenses (10% of revenue in 2022) and general and administrative expenses (2.5% of revenue in 2022). $37.6 billion in undiscounted Value of M&I Mineral Resource Royalty Ounces

18 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Royalty Ounces by Mineral Resource, Location and Type Royalty Ounce Growth Royalty ounces represent cost-free ounces to Franco-Nevada. The following chart shows the Royalty Ounce growth over the last 10 years. 1 M&I Royalty Ounces include P&P Royalty Ounces Royalty Ounces by Mineral Resource Category M&I Royalty Ounces 1 by Location M&I Royalty Ounces 1 by Type P&P 49% M&I 29% Inferred 22% South America 34% Central America and Mexico 29% United States 14% Canada 17% Rest of World 6% NSR 42% Stream 46% NPI 3% Other 9% 0 5 10 15 20 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 Royalty Ounces (millions) P&P Royalty Ounces Exclusive M&I Royalty Ounces

19 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Environmental, Social and Governance Highlights Franco-Nevada’s 2022 environmental, social and governance (“ESG”) highlights are described in our 2023 ESG Report, which is available on our website, and are summarized below. Due diligence to invest in strong ESG performers Our principal ESG-related focuses when making investments are highlighted in our 2023 ESG Report, including health and safety, carbon footprints, water management and risk, tailings management and biodiversity. We have also assessed how the operators of our top revenue-generating assets have performed in each of these five categories. Furthered diverse representation and diversity initiatives We increased the diverse representation in our global workforce, with 43% of senior mangement and 60% of our overall team comprised of diverse persons. We have also expanded our Board diversity targets with the new goal of having, by 2025, at least one diverse director on grounds broader than gender diversity. The number of Franco-Nevada Diversity Scholarship awards were increased in 2022 and made several diversity-related donations and contributions, including in furtherance of our BlackNorth Initiative pledge and our support of The Prosperity Project. New climate action policy and net-zero goals and commitments We have adopted a Climate Action Policy, which sets out our goal to achieve net-zero GHG emissions by 2050 at our corporate workplaces and the measures we will take to further this goal, including measuring and disclosing our corporate GHG emissions, adopting science-based GHG emission reduction targets, and providing annual updates on our progress. We also commit to evaluate the decarbonization commitments, plans, targets and initiatives of operators and operations, including their alignment with net-zero, when making investment decisions and to engage with existing partners on their plans and progress toward net-zero. Increased community contributions and commitments Our community contributions funded increased year-over-year, including our renewed Enseña Peru funding and the Alto Huarca water project, among other initiatives. During the year, we made new commitments with G Mining Ventures and Argonaut Gold to partner in community initiatives near their operations where we invested in 2022. We continue to support mining industry groups and diversity initiatives. Focus on employee well-being and accommodations Maintaining a safe and supportive environment for our global workforce is a top priority for Franco-Nevada. Our 2023 ESG Report highlights the efforts made by our organization to promote the physical and mental well-being of our employees, including providing hybrid work arrangements, health benefits, wellness allowances, accommodations for cultural and religious beliefs, and the ability to disconnect when not working. Financed emissions are included in Scope 3 emissions We have measured and disclosed financed GHG emissions attributable to our royalty and stream interests. Financed GHG emissions were calculated in alignment with the Greenhouse Gas Protocol reporting standards and included as Scope 3, Category 15 (Investments) emissions. In our 2023 ESG Report, we include a primer for navigating the Greenhouse Gas Protocol standards, including what comprises Scope 1, 2 and 3 emissions. Sandip Rana, Chief Financial Officer (left) and Lloyd Hong, Chief Legal Officer (right) Enseña Peru initiative, Peru Continental Resources’ solar panels at West Blaine recycling facility, which Franco-Nevada is helping to finance

20 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Initiatives aligned with UN Sustainable Development Goals Initiatives across our business help advance a number of the Sustainable Development Goals (SDGs), which were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. Continued high rankings and recognition from ESG rating agencies We continue to receive recognition for our ESG efforts and rank highly with top ESG rating agencies, including 2022 ratings of “AA” by MSCI and “Prime” by ISS ESG. In 2022, we were also included as one of Corporate Knight’s Best 50 Corporate Citizens in Canada. We recently received a “Global 50 Top-Rated” ESG score for 2023 from Sustainalytics, which places us among a select group of all the companies that Sustainalytics ranks globally. Maintained carbon neutrality for corporate emissions Since 2020, we have maintained carbon neutrality for our office operations. We have accomplished this, and will continue to do so through the reduction of our corporate GHG emissions and the purchase of high quality carbon credits to offset emissions that cannot be eliminated. Alignment of ESG reporting with TCFD and SASB and first-alignment with the GRI standards Our ESG disclosure is aligned with leading reporting frameworks, including the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) frameworks. Our 2023 ESG Report also includes first-time reporting in line with the Global Reporting Initiative (GRI) standards. Commerce Court West, Toronto Environmental, Social and Governance Highlights (continued)

21 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Environmental, Social and Governance Highlights (continued) Frameworks and Standards Guiding Principles Ratings and Recognition Global 50 Top Rated by Sustainalytics in 2023 Responsible Gold Mining Principles United Nations Global Compact Sustainable Development Goals Task Force on Climate-related Financial Disclosures (TCFD) Sustainability Accounting Standards Board (SASB) Global Reporting Initiative (GRI) Best 50 Corporate Citizens in Canada in 2022 “B-“ CDP score in 2022 Rated “AA” by MSCI in 2022 Rated “Prime” by ISS ESG in 2022 The use by Franco-Nevada Corporation of any MSCI ESG Research LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of Franco-Nevada Corporation by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

22 TSX / NYSE: FNV Franco-Nevada Corporation Overview

Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Precious Metals Precious Metals

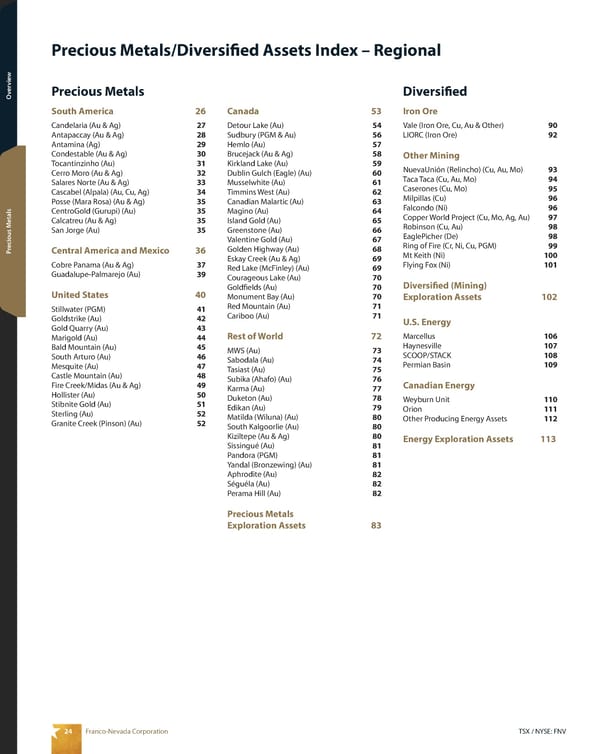

24 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Precious Metals Precious Metals/Diversified Assets Index – Regional South America 26 Candelaria (Au & Ag) 27 Antapaccay (Au & Ag) 28 Antamina (Ag) 29 Condestable (Au & Ag) 30 Tocantinzinho (Au) 31 Cerro Moro (Au & Ag) 32 Salares Norte (Au & Ag) 33 Cascabel (Alpala) (Au, Cu, Ag) 34 Posse (Mara Rosa) (Au & Ag) 35 CentroGold (Gurupi) (Au) 35 Calcatreu (Au & Ag) 35 San Jorge (Au) 35 Central America and Mexico 36 Cobre Panama (Au & Ag) 37 Guadalupe-Palmarejo (Au) 39 United States 40 Stillwater (PGM) 41 Goldstrike (Au) 42 Gold Quarry (Au) 43 Marigold (Au) 44 Bald Mountain (Au) 45 South Arturo (Au) 46 Mesquite (Au) 47 Castle Mountain (Au) 48 Fire Creek/Midas (Au & Ag) 49 Hollister (Au) 50 Stibnite Gold (Au) 51 Sterling (Au) 52 Granite Creek (Pinson) (Au) 52 Iron Ore Vale (Iron Ore, Cu, Au & Other) 90 LIORC (Iron Ore) 92 Other Mining NuevaUnión (Relincho) (Cu, Au, Mo) 93 Taca Taca (Cu, Au, Mo) 94 Caserones (Cu, Mo) 95 Milpillas (Cu) 96 Falcondo (Ni) 96 Copper World Project (Cu, Mo, Ag, Au) 97 Robinson (Cu, Au) 98 EaglePicher (De) 98 Ring of Fire (Cr, Ni, Cu, PGM) 99 Mt Keith (Ni) 100 Flying Fox (Ni) 101 Diversified (Mining) Exploration Assets 102 U.S. Energy Marcellus 106 Haynesville 107 SCOOP/STACK 108 Permian Basin 109 Canadian Energy Weyburn Unit 110 Orion 111 Other Producing Energy Assets 112 Energy Exploration Assets 113 Canada 53 Detour Lake (Au) 54 Sudbury (PGM & Au) 56 Hemlo (Au) 57 Brucejack (Au & Ag) 58 Kirkland Lake (Au) 59 Dublin Gulch (Eagle) (Au) 60 Musselwhite (Au) 61 Timmins West (Au) 62 Canadian Malartic (Au) 63 Magino (Au) 64 Island Gold (Au) 65 Greenstone (Au) 66 Valentine Gold (Au) 67 Golden Highway (Au) 68 Eskay Creek (Au & Ag) 69 Red Lake (McFinley) (Au) 69 Courageous Lake (Au) 70 Goldfields (Au) 70 Monument Bay (Au) 70 Red Mountain (Au) 71 Cariboo (Au) 71 Rest of World 72 MWS (Au) 73 Sabodala (Au) 74 Tasiast (Au) 75 Subika (Ahafo) (Au) 76 Karma (Au) 77 Duketon (Au) 78 Edikan (Au) 79 Matilda (Wiluna) (Au) 80 South Kalgoorlie (Au) 80 Kiziltepe (Au & Ag) 80 Sissingué (Au) 81 Pandora (PGM) 81 Yandal (Bronzewing) (Au) 81 Aphrodite (Au) 82 Séguéla (Au) 82 Perama Hill (Au) 82 Precious Metals Exploration Assets 83 Precious Metals Diversified 24 TSX / NYSE: FNV Franco-Nevada Corporation Precious Metals Precious Metals

25 Franco-Nevada Corporation TSX / NYSE: FNV Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals/Diversified Assets Index – Alphabetical Precious Metals Diversified Antamina (Ag) 29 Antapaccay (Au & Ag) 28 Aphrodite (Au) 82 Bald Mountain (Au) 45 Brucejack (Au & Ag) 58 Calcatreu (Au & Ag) 35 Canadian Malartic (Au) 63 Candelaria (Au & Ag) 27 Cariboo (Au) 71 Cascabel (Alpala) (Au, Cu, Ag) 34 Castle Mountain (Au) 48 CentroGold (Gurupi) (Au) 35 Cerro Moro (Au & Ag) 3 2 Cobre Panama (Au & Ag) 37 Condestable (Au & Ag) 30 Courageous Lake (Au) 70 Detour Lake (Au) 54 Dublin Gulch (Eagle) (Au) 60 Duketon (Au) 78 Edikan (Au) 79 Eskay Creek (Au & Ag) 69 Fire Creek/Midas (Au & Ag) 49 Gold Quarry (Au) 43 Golden Highway (Au) 68 Goldfields (Au) 70 Goldstrike (Au) 42 Granite Creek (Pinson) (Au) 52 Greenstone (Au) 66 Guadalupe-Palmarejo (Au) 39 Hemlo (Au) 57 Hollister (Au) 50 Island Gold (Au) 65 Karma (Au) 77 Kirkland Lake (Au) 59 Kiziltepe (Au & Ag) 80 Caserones (Cu, Mo) 95 Copper World Project (Cu, Mo, Ag, Au) 97 Diversified (Mining) Exploration Assets 102 EaglePicher (De) 98 Energy Exploration Assets 113 Falcondo (Ni) 96 Flying Fox (Ni) 101 Haynesville 107 LIORC (Iron Ore) 92 Marcellus 106 Milpillas (Cu) 96 Mt Keith (Ni) 100 NuevaUnión (Relincho) (Cu, Au, Mo) 93 Orion 111 Permian Basin 109 Ring of Fire (Cr, Ni, Cu, PGM) 99 Robinson (Cu, Au) 98 SCOOP/STACK 108 Taca Taca (Cu, Au, Mo) 94 Vale (Iron Ore, Cu, Au & Other) 90 Weyburn Unit 110 Magino (Au) 64 Marigold (Au) 44 Matilda (Wiluna) (Au) 80 Mesquite (Au) 47 Monument Bay (Au) 70 Musselwhite (Au) 61 MWS (Au) 73 Pandora (PGM) 81 Perama Hill (Au) 82 Posse (Mara Rosa) (Au & Ag) 35 Precious Metals Exploration Assets 83 Red Lake (McFinley) (Au) 69 Red Mountain (Au) 71 Sabodala (Au) 74 Salares Norte (Au & Ag) 33 San Jorge (Au) 35 Séguéla (Au) 82 Sissingué (Au) 81 South Arturo (Au) 46 South Kalgoorlie (Au) 80 Sterling (Au) 52 Stibnite Gold (Au) 51 Stillwater (PGM) 41 Subika (Ahafo) (Au) 76 Sudbury (PGM & Au) 56 Tasiast (Au) 75 Timmins West (Au) 62 Tocantinzinho (Au) 31 Valentine Gold (Au) 67 Yandal (Bronzewing) (Au) 81 The description and depiction of our assets in this Asset Handbook has been simplified for presentation purposes. More detailed and current information may be available in our previous and subsequent disclosure and on our website. Mineral Resources and Mineral Reserves information for 2021 and 2020 is provided for comparative purposes only. For a detailed breakdown of the 2021 and 2020 Mineral Resources and Mineral Reserves, please refer to our AIF for each of the years ended December 31, 2021 and December 31, 2020, respectively available on SEDAR at www.sedar.com.

26 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview Precious Metals CentroGold (Gurupi) Cerro Moro San Jorge Antamina Salares Norte/ Rio Baker Antapaccay Candelaria Calcatreu Condestable Cascabel (Alpala) Posse (Mara Rosa) Producing Advanced Tocantinzinho South America

27 Franco-Nevada Corporation TSX / NYSE: FNV South America Mineral Resources and Mineral Reserves Additional Information Diversified Assets Candelaria Location: Chile, South America Operator: Lundin Mining Corporation Precious Metals: Au & Ag Stream: Gold and Silver Stream N km 0 2.5 Candelaria Gold and Silver Stream Candelaria Mining Property Area of Interest Ojos del Salado Mining Property Tierra Amarilla Santos Mine Copiapo Candelaria North (U/G) Alcaparrosa Mine Candelaria Pit Candelaria South (U/G) La Espanola Pacific Ocean ARGENTINA BOLIVIA PERU BRAZIL CHILE Candelaria Mineral Resources and Mineral Reserves at the four underground mines and has discovered the Española open-pit deposit which is located partly on the stream concession and partly on ground covered by Franco- Nevada’s area of interest. Operations at the Alcaparrosa underground mine were suspended in connection with the sinkhole which occurred near the mine in July 2022. Candelaria has a total mill throughput of approximately 79 ktpd. In early 2022, Lundin completed a feasibility study update for throughput expansion of the underground mines from 15 ktpd to up to 30 ktpd and included underground crushing and conveying systems and a surface secondary crushing plant although a construction decision has not yet been made. In 2022, Candelaria produced approximately 152 kt of copper, 86 koz of gold and 1.6 Moz of silver, on a 100% basis. Franco-Nevada sold 69,854 GEOs from the mine in 2022, compared with 65,034 GEOs in 2021. In 2023, Franco-Nevada expects sales from its Candelaria stream to be between 60,000 and 70,000 GEOs. History of expanding resources Updated plan extends life of mine to 2046 UG mine expansion being evaluated 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 125.8 $ 116.5 $ 106.8 M&I Resource (koz Au) 1 5,336 5,600 5,600 Inferred Resource (koz Au) 1 484 500 300 P&P Reserves (koz Au) 1 2,479 2,700 2,800 M&I Resource (Moz Ag) 1 80.6 83.0 78.0 Inferred Resource (Moz Ag) 1 5.6 7.0 4.0 P&P Reserves (Moz Ag) 1 36.2 39.0 39.0 M&I Royalty Ounces (000s) 1, 2 1,456 1,586 1,629 Inferred Royalty Ounces (000s) 2 115 125 75 P&P Royalty Ounces (000s) 2 746 851 920 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates P&P Royalty Ounces include payable metal of the balance of the 720,000 ounces of gold and 12 million ounces of silver remaining and the balance of P&P Reserves subject to the lower stream percentage. For M&I Royalty Ounces, Franco- Nevada has assumed the P&P Royalty Ounces with the balance of M&I Resources subject to the lower stream percentage. For Inferred Royalty Ounces, Franco-Nevada assumes Inferred Mineral Resources are subject to the lower stream percentage. Silver is converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz silver ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz silver in 2020). The stream interest has been factored by 76% to reflect $1,800 per ounce gold and $424.60 per ounce ongoing payments (77% in 2021, 76% in 2020) In November 2014, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, acquired a gold and silver stream on production from the Candelaria operation in Chile. The Candelaria mine was discovered in 1987 and the open pit has been in operation since 1993. The operation also includes the Candelaria North and South, Santos and Alcaparrosa underground mines. Lundin Mining Corporation (“Lundin”) is the operator of the project and owns 80% of the asset with the balance owned by Sumitomo Corporation and its affiliates. Franco-Nevada provided an up-front deposit of $655 million to acquire the gold and silver stream from what is primarily a copper mine. The funds were used to finance a portion of the cost paid by Lundin to acquire the asset from Freeport-McMoRan Inc. Candelaria is an established mining operation and the transaction was the first material instance of a royalty/ streaming company partnering with an operating company to purchase a producing asset. The stream covers the current property of approximately 150 km 2 . An additional defined area of interest effectively doubles the property position. Should Lundin acquire properties located within the area of interest, Franco-Nevada has the option to purchase a gold and silver stream which will apply to the additional ore from such properties. Under the streaming agreement, Lundin will deliver 68% of the payable gold and silver from 100% of the mine production, which reduces to 40% after 720,000 ounces of gold and 12 million ounces of silver have been delivered to Franco-Nevada. This is currently expected to occur in 2027. Cumulatively, 484,914 ounces of gold and 7.8 million ounces of silver have been delivered since acquisition until December 31, 2022. Franco-Nevada pays an ongoing price equal to the lesser of $424.60 per ounce of gold and $4.24 per ounce of silver or the then prevailing spot price for gold and silver for each ounce delivered under the stream. This price escalates by 1% per annum in October of each year. Lundin has made a significant investment in exploration at Candelaria and has increased M&I Mineral Resources by 240% when considering depletion. The go forward mine life has been extended from 2028, when it acquired Candelaria, to 2046. Lundin has successfully added to the Candelaria, Chile

28 TSX / NYSE: FNV Franco-Nevada Corporation South America Overview Overview Precious Metals Pacific Ocean ARGENTINA BOLIVIA PERU BRAZIL COLOMBIA EQUADOR CHILE Antapaccay Antapaccay Location: Peru, South America Operator: Glencore plc Precious Metals: Au & Ag Stream: Gold and Silver Stream Antapaccay Gold and Silver Stream Not included Antapaccay Pit Coroccohuayco km 0 10 Antapaccay Concession Area Antapaccay Concession area covers ~997 km 2 * Tintaya Pit/ Tailings Storage Antapaccay Plant Tintaya Plant 8 km 7 km December 31, 2022. Thereafter, Franco-Nevada will receive 30% of the gold and silver shipped. Franco-Nevada will initially pay an on-going price of 20% of the spot price of gold and silver until 750,000 ounces of refined gold and 12.8 million ounces of refined silver have been delivered. Thereafter, the on-going price will increase to 30% of the spot price of gold and silver. The stream is referenced to the entire Antapaccay concession covering approximately 997 km 2 . Glencore is considering developing the Coroccohuayco deposit which is located within 10 km of the Antapaccay plant. The project has been rescoped as an open pit with mine planning currently at the PFS level. Coroccohuayco hosts M&I Mineral Resources of 643 million tonnes with a copper grade that is approximately 50% higher than the Antapaccay Mineral Reserves. In addition, there are a number of large-scale regional targets and prospects on the Antapaccay concessions. Antapaccay has a combined (Antapaccay + Tintaya plants) mill throughput capacity of 105 ktpd. In 2022, Antapaccay produced 151 kt of copper, 61 koz of gold and 1.2 Moz of silver. Franco-Nevada sold 53,023 GEOs from the mine in 2022, compared with 62,411 GEOs in 2021 and, in 2023, expects sales from its Antapaccay stream to be between 57,500 and 67,500 GEOs. Antapaccay has a planned mine life to 2034 which would be further extended by any development of Coroccohuayco. Gold and silver deliveries initially referenced to copper in concentrate shipped Potential for Coroccohuayco to extend mine life Land package of 997 km 2 offers a number of large - scale regional targets 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 95.2 $ 111.6 $ 118.5 M&I Resource (koz Au) 1 3,079 3,279 3,161 Inferred Resource (koz Au) 1 193 383 201 P&P Reserves (koz Au) 1 1,198 1,222 1,204 M&I Resource (Moz Ag) 1 70.2 70.6 65.4 Inferred Resource (Moz Ag) 1 3.4 6.2 2.5 P&P Reserves (Moz Ag) 1 19.3 17.6 17.2 M&I Royalty Ounces (000s) 1, 2 786 868 861 Inferred Royalty Ounces (000s) 2 36 72 34 P&P Royalty Ounces (000s) 2 397 440 469 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates P&P Royalty Ounces include payable metal of the remaining deliveries before the 630,000 ounces of gold and 10 million ounces of silver hurdle with the balance of Mineral Reserves subject to a 30% stream. For M&I Royalty Ounces, Franco- Nevada assumes the P&P Royalty Ounces with the balance of M&I Resources subject to the 30% stream. For Inferred Royalty Ounces, Franco-Nevada assumes Inferred Mineral Resources are subject to the 30% stream. Silver has been converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz silver ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz silver in 2020). The stream interest has been factored by different ongoing payments of 20% of the spot price of gold and silver on the first 750,000 ounces of gold and 12.8 million ounces of silver and 30% of the spot price thereafter In February 2016, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, acquired a precious metals stream on production from the Antapaccay mine for $500 million from Glencore plc (“Glencore”) and its subsidiaries. Antapaccay is located within the province of Espinar in Southern Peru. The property also hosts the historic Tintaya open-pit mine and related infrastructure which began operating in 1984. Glencore (Xstrata) invested in excess of $1.5 billion of initial capital to build and commission the Antapaccay open-pit mine and plant, which commenced operations in 2012. Under the streaming agreement, gold and silver deliveries are initially referenced to copper in concentrate shipped. Franco-Nevada will receive 300 ounces of gold and 4,700 ounces of silver for each 1,000 tonnes of copper in concentrate shipped, until 630,000 ounces of gold and 10 million ounces of silver have been delivered, which is currently expected to occur in 2028. Cumulatively, 395,440 ounces of gold and 6.2 million ounces of silver have been delivered since acquisition until Antapaccay, Peru

29 Franco-Nevada Corporation TSX / NYSE: FNV South America Mineral Resources and Mineral Reserves Additional Information Diversified Assets Antamina Location: Peru, South America Operator: Teck Resources Limited (owns 22.50%) Precious Metals: Ag Stream: Silver Stream South America Antamina Paramonga Pativilca Lima Barranca Huacho Huaral Chancay Pto. Supe Cutatambo Autopista Panamericana Norte Autopista Panamericana Norte Cajacay Chasquitambo Conococha Carretera Pativilca-Huarez Huarmey Punta Lobitos CMA Puerto Minero Aquia Chiquian Catac Pachacoto Recuay Huaraz Huallanca Huanzala Yanashall Machac Huari San Marcos Chavui De Huantar PARQUE NACIONAL HUASCARAN Subestacion Linea de Transmision Electrica CMA Pipeline Peru Pacific Ocean N km 0 100 Antamina Silver Stream copper operations globally. Antamina has a mill throughput capacity of approximately 145,000 tonnes per day. In 2022, on a 100% basis, Antamina produced 454,800 tonnes of copper, 433,000 tonnes of zinc and 14.7 million ounces of silver (silver calculated from Glencore’s 33.75% interest in Antamina) in concentrates. Silver sold for 2022 was 3.1 million ounces for Franco-Nevada’s attributable production under the stream, with 3.8 million ounces sold in 2021. Franco-Nevada expects attributable production in 2023 to be between 2.4 to 2.8 million silver ounces, temporarily lower than our long- term expected annual range of 2.8 million to 3.2 million silver ounces as silver grades are expected to be lower than average in 2023. The stream is based on recovered silver from Teck’s attributable 22.50% interest in the Antamina mine, subject to a fixed silver payability of 90%. Franco-Nevada pays 5% of the spot silver price for each ounce of silver delivered under the stream. The stream will reduce by one-third after 86 million ounces of silver have been delivered. A total of 24.9 million cumulative ounces of silver have been delivered to Franco-Nevada as of December 31, 2022. Inclusive of Mineral Reserves, the mine contains total Measured and Indicated Mineral Resources of approximately 889 million tonnes of ore (with a silver grade of 11.2 g/t) and an Inferred Mineral Resource of 1.24 billion tonnes of ore (with a silver grade of 11.5 g/t). Total Mineral Reserves are 282 million tonnes of ore (with a silver grade of 9.8 g/t), which are currently constrained by tailings disposal capacity. CMA is currently conducting engineering studies for additional tailings storage options and alternative mine plans that could result in significant mine life extensions. In 2022, CMA submitted a Modification of Environmental Impact Assessment to Peruvian regulators to extend its mine life from 2028 to 2036. The regulatory review process is progressing as scheduled, with approval anticipated in the second half of 2023. Beyond the known Mineral Resources and Mineral Reserves, Antamina hosts additional potential open-pit and bulk/selective underground targets. There is also regional exploration potential over a large, prospective land package greater than 1,000 km 2 . High grade copper/zinc orebody One of the lowest cost copper operations globally Large, high grade Inferred Mineral Resource 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 68.4 $ 94.1 $ 57.0 M&I Resource (Moz Ag) 1 321.2 324.9 342.5 Inferred Resource (Moz Ag) 1 460.2 447.7 460.7 P&P Reserves (Moz Ag) 1 88.3 107.0 118.3 M&I Royalty Ounces (000s) 1, 2 528 585 642 Inferred Royalty Ounces (000s) 2 531 560 599 P&P Royalty Ounces (000s) 2 153 201 231 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada assumes 22.5% of Teck’s interest in Antamina is subject to our stream interest and that the stream reduces by 33% once 86 million silver ounces have been delivered. Silver has been converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz in 2020). The stream interest has been factored by ongoing payments of 5% of the spot price of silver In October 2015, Franco-Nevada acquired a silver stream for $610 million on production from the Antamina mine in Peru from Teck Resources Limited (“Teck”). Teck has a 22.50% interest in Compañía Minera Antamina S.A. (“CMA”), the Antamina joint venture company, along with partners BHP Billiton Plc (33.75%), Glencore (33.75%) and Mitsubishi Corporation (10.00%). Antamina commenced operations in 2001 and is one of the lowest cost Antamina, Peru

30 TSX / NYSE: FNV Franco-Nevada Corporation South America Overview Overview Precious Metals Condestable Location: Peru, South America Operator: Southern Peaks Mining LP Precious Metals: Au & Ag Stream: Gold and Silver Stream Santia Antofagasta Arequipa Cusco Mina Justa Cerro Pelado Sant Teresa de Colm’o Punt Mantoverde El Espino Panulcillo IOCG Deposit Lima N 0 250 km Condestable Candelaria Cretaceous IOCG Belt IOCG Mine (FNV Stream) Pacific Ocean Chil Peru Condestable UG Surface Facilities Raul UG Vinchos UG Pacific Ocean N 0 5 km Condestable Gold and Silver Stream Condestable Mining Property 102 km to Lima Pan American Hwy Antofagasta Arequipa Cusco Mina Justa Cerro Pelado Santo Domingo Teresa de Colm’o Punta del Cobre Mantoverde IOCG Deposit Lima La Paz Salta N 0 250 km Condestable Candelaria Cretaceous IOCG Belt IOCG Mine (FNV Stream) Pacific Ocean Bolivia Argentina Chile Peru Condestable UG Surface Facilities Raul UG Vinchos UG Pacific Ocean N 0 5 km Condestable Gold and Silver Stream 102 km to Lima Pan American The Condestable mine is located approximately 90 km south of Lima, Peru, and is owned and operated by a majority-owned subsidiary of Southern Peaks Mining LP (“SPM”), a private company. The Condestable mine has operated for over 50 years with a proven history of resource conversion. For the first five years of the streaming agreement, commencing on January 1, 2021 and ending December 31, 2025, Franco-Nevada will receive 8,760 ounces of gold and 291,000 ounces of silver annually until a total of 43,800 ounces of gold and 1,455,000 ounces of silver have been delivered (the “Fixed Deliveries”). Thereafter, Franco-Nevada will receive 63% of the gold and silver contained in concentrate until a cumulative total of 87,600 ounces of gold and 2,910,000 ounces of silver have been delivered (the “Variable Phase 1 Deliveries”). The stream then reduces to 25% over the remaining life of mine (the “Variable Phase 2 Deliveries”). Franco-Nevada will pay 20% of the spot price for gold and silver for each ounce delivered under the stream (the “Ongoing Payment”). The stream has an effective date of January 1, 2021. For a period of four years from closing, subject to certain restrictions, a subsidiary of SPM may, at its option, make a one-time special delivery comprising the number of ounces of refined gold equal to $118.8 million at the then current spot price subject to the Ongoing Payment, to achieve the early payment of the Fixed Deliveries and Variable Phase 1 Deliveries. The Variable Phase 2 Deliveries would commence immediately thereafter. The stream is referenced to the entire Condestable concessions covering approximately 450 km 2 with excellent near mine exploration upside. SPM is currently ramping up processing capacity at the Condestable mine from 7,000 tpd to 8,400 tpd and is advancing a feasibility study on additional plant capacity expansion to 10,000 tpd. Proven operation with excellent potential for expansions and mine life extension Large, prospective land package of approximately 450 km 2 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 22.4 $ 22.5 $ – M&I Resource (koz Au) 1 688 701 711 Inferred Resource (koz Au) 1 479 480 481 P&P Reserves (koz Au) 1 163 170 n/a M&I Resource (Moz Ag) 1 17.4 17.6 17.9 Inferred Resource (Moz Ag) 1 12.2 12.3 12.3 P&P Reserves (Moz Ag) 1 5.2 5.2 n/a M&I Royalty Ounces (000s) 1, 2 164 180 188 Inferred Royalty Ounces (000s) 2 87 89 92 P&P Royalty Ounces (000s) 2 97 n/a n/a 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates fixed deliveries for M&I Royalty Ounces of 8,760 ounces of gold and 291,000 ounces of silver per year until December 2025; then, 63% of gold and silver until 87,600 ounces of gold and 2,910,000 ounces of silver are delivered, respectively; thereafter, 25% of gold and silver ounces are subject to the stream. For Inferred Royalty Ounces, Franco-Nevada assumes 25% of gold and silver from Inferred Mineral Resources (25% in 2021) are subject to the stream. Silver has been converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz in 2020). The stream interest has been factored by ongoing payments of 20% of the spot price of gold and silver On March 8, 2021, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, acquired a precious metals stream on production from the Condestable mine in Peru, for an up-front deposit of $165 million. Condestable, Peru

31 Franco-Nevada Corporation TSX / NYSE: FNV South America Mineral Resources and Mineral Reserves Additional Information Diversified Assets Tocantinzinho Location: Brazil, South America Operator: G Mining Ventures Corp. Precious Metals: Au Stream: Gold Stream 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ – $ – $ – M&I Resource (koz Au) 1 2,102 – – Inferred Resource (koz Au) 1 50 – – P&P Reserves (koz Au) 1 2,042 – – M&I Royalty Ounces (000s) 1, 2 210 – – Inferred Royalty Ounces (000s) 2 5 – – P&P Royalty Ounces (000s) 2 204 – – 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves. 2 For Royalty Ounce calculation, Franco-Nevada estimates it will receive 12.5% of gold produced which reduces to 7.5% after 300,000 ounces of gold have been delivered. The stream interest has been factored by 80% to reflect an ongoing payment price of 20% of the spot price for each ounce of gold delivered ($1,800 per ounce gold for 2022) On July 18, 2022, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, announced a $352.5 million funding package with G Mining Ventures Corp. on the Tocantinzinho gold project in Brazil. Tocantinzinho is located in the Tapajos region of Pará State, Brazil, 200 km south-southwest of the city of Itaituba, and is owned and operated by G Mining Ventures Corp. (“G Mining Ventures”). The construction funding package included a $250 million gold stream, $75 million secured term loan and $27.5 million of G Mining Ventures’ common shares. Under the streaming agreement, Franco-Nevada will receive 12.5% of gold produced which reduces to 7.5% after 300,000 ounces of gold have been delivered. Franco-Nevada pays an ongoing price of 20% of the spot gold price for each ounce of gold delivered. The $75 million, six-year term loan is available for a period of 3.5 years, drawable quarterly at G Mining Ventures’ option following full funding of the stream with an interest rate of 3-Month Term Secured Overnight Financing Rate (“3-Month SOFR”) +5.75% per annum, reducing to 3-Month SOFR+4.75% after completion tests have been achieved at the project. Tocantinzinho is a conventional open pit mining and milling operation. On February 9, 2022 G Mining Ventures announced a positive feasibility study on Tocantinzinho constructing a 12.6 ktpd mill and producing 1.8 Moz of gold over 10.5 years, resulting in an average annual gold production profile of approximately 175 koz with an all-in-sustaining cost of $681/oz and initial capital cost of $458 million. The project has commenced construction with first production expected in the second half of 2024. Based on expected mine performance, full year contributions to Franco-Nevada from the project are expected to average approximately 24,500 GEOs per year over the first five years of full production. Experienced team with track record of successful project delivery Project financing in place Large, prospective land package of approximately 996 km 2 N 0 10 Tocantinzinho Gold Stream Tocantinzinho km Mining Licenses Exploration Licenses Licenses under application Tocantinzinho, Brazil