ESG Report 2023

The 2023 ESG Report details Franco-Nevada’s environmental, social, and governance progress, highlighting its commitment to responsible capital allocation, diversity goals, and a net-zero target for corporate operations by 2050.

2023 ESG Report

Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Table of Contents Message from our CEO 1 Report Highlights 2 About Franco-Nevada 4 Responsible Capital Allocation 5 Due Diligence Process 6 Ongoing Asset Management 7 Key ESG Factors 8 • Health and Safety 9 • Carbon Footprint 10 • Water Management and Risk 12 • Tailings Management 13 • Biodiversity 14 Sustainable Investment Opportunities 16 Supply Chain 19 Community Contributions 20 Community Support 21 Industry and Other Support 22 Good Governance and Shareholder Alignment 23 Corporate Governance 24 Integrity and Compliance 25 Shareholder Alignment 26 Information Security 27 Diversity, Inclusion and Well-Being 28 Diversity and Inclusion 29 Employee Benefits and Well-Being 32 Health, Safety and Security 33 Human Rights, Non-Discrimination, Anti-Harassment and Equal Opportunity 34 Climate Action 35 Climate Action Commitments and Plans 36 Overall Carbon Footprint 37 Corporate Footprint 39 Investment Footprint 42 Transparency and Guiding Principles 43 TCFD, SASB, and GRI 44 UN Global Compact and SDGs 45 Responsible Gold Mining Principles 46 ESG Ratings and Recognition 48 About this ESG Report 49 Appendices 50 Appendix A: ESG Performance Table 51 Appendix B: Operators’ Emissions 53 Appendix C: TCFD Disclosure 57 Appendix D: SASB Disclosure 73 Appendix E: GRI Index 76 Appendix F: Sustainable Development Goals 80 Appendix G: KPMG: Independent Limited Assurance Report 82 Appendix H: Carbon Neutral Initiative 83

1 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation I am pleased to share our ESG Report, which describes the progress we and our partners have made on environmental, social and governance (“ESG”) issues and on our expanded commitments to sustainability. As a royalty and streaming company, we do not operate mines, develop projects or conduct exploration. Our ESG efforts fall into two categories: those relating to the operators, operations and local communities, where we deploy capital for acquisitions and those applicable to our corporate operations, including to our management, directors, and suppliers. Investment Focus Our shareholders expect us, and we are committed, to allocate capital to responsible operators that provide safe workplaces for their workforce, limit the environmental impacts of their projects and provide net benefits for their communities. We evaluate environmental and community impacts along with the technical aspects of operations during our due diligence for potential opportunities. We also seek to negotiate operator commitments to conduct operations in accordance with best operating and sustainability practices and to provide transparent reporting on their operations. Our principal ESG-related focuses when making acquisitions are as follows: • Health and safety track records, including evaluating each project’s safety performance statistics. • Carbon footprints and climate-related commitments, plans, targets and initiatives and, when available, an assessment of emissions-related metrics, such as carbon intensity. • Water risk, use and discharge and, to the extent applicable, a review of water consumption and water intensity performance indicators. • The design of planned or existing waste and tailings storage facilities and commitments from operators to implement and maintain international tailings standards. • The impact on biodiversity and ecosystems through project lifecycle, including preliminary assessments of impacts, life of project “no-net-loss” commitments, and rehabilitation and reclamation. You will see these project-specific priorities described in detail in this ESG Report, including disclosure relating to how the operators of our principal assets have performed in each category. Our second investment-oriented effort is partnering with our operators on initiatives to benefit the communities where our royalty and stream assets are located. In 2022, we increased our funding of community contributions and made several new commitments. Corporate Focus We are committed to responsible governance practices to ensure integrity in our dealings, compliance with our undertakings and alignment with our shareholders. Our Board and management team are substantial shareholders of the company, currently holding more than US$200 million in stock, and we treat shareholder funds as our own, with industry-leading low G&A, even relative to Gold ETF fees. We seek to maintain a safe and supportive environment for our team members and remove barriers and promote diversity and inclusion within our company, our communities, and in our industry. We actively seek out diverse candidates in our hiring processes and have adopted objective diversity targets for our Board of Directors and senior management. We also seek to promote diversity in the mining industry. We have made a number of donations in furtherance of our BlackNorth Initiative pledge and, in 2022, expanded the number of Franco-Nevada Diversity Scholarship awards. General Focus Climate action is an important priority for our company that relates to both our investments and our own corporate operations. We are committed to consider the decarbonization efforts and net-zero alignment of operators and operations when making investment decisions and to achieve net-zero emissions by 2050 with respect to our own corporate operations. Our climate-related plans and commitments have been formalized in our recently adopted Climate Action Policy, which is described in this ESG Report. We are also committed to providing transparency in all ESG matters relating to our business. In this ESG Report, we have measured, disclosed and attributed to our Scope 3 reporting, proportional greenhouse gas emissions from our royalty and stream interests. We have also provided disclosure aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and the Sustainability Accounting Standards Board (SASB) framework, and first-time disclosure aligned with the Global Reporting Initiative (GRI) standards. We continue to rank highly with leading ESG rating agencies, which is demonstrative of our ongoing dedication to fulfilling our investment and corporate commitments and to increasing transparency in our ESG disclosure. Thank you for your continued support of Franco-Nevada. We look forward to speaking with many of you over the coming months. Message from our CEO Paul Brink, President & CEO Paul Brink President & CEO

2 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Due diligence to invest in strong ESG performers Our principal ESG-related focuses when making investments are highlighted in this ESG Report, including health and safety, carbon footprint, water management and risk, tailings management and biodiversity. We have also assessed how the operators of our top revenue-generating assets have performed in each of these five categories. Read more à (page 8) Furthered diverse representation and diversity initiatives We increased the diverse representation in our global workforce, with 43% of senior management and 60% of our overall team comprised of diverse persons. We have also expanded our Board diversity targets with the new goal of having, by 2025, at least one diverse director on grounds broader than gender diversity. The number of Franco-Nevada Diversity Scholarship awards were increased in 2022 and we made several diversity-related donations and contributions, including in furtherance of our BlackNorth Initiative pledge and our support of The Prosperity Project. Read more à (page 29) New climate action policy and net-zero goals and commitments We have adopted a Climate Action Policy, which sets out our goal to achieve net-zero GHG emissions by 2050 at our corporate workplaces and the measures we will take to further this goal, including measuring and disclosing our corporate GHG emissions, adopting science- based GHG emission reduction targets, and providing annual updates on our progress. We also commit to evaluate the decarbonization commitments, plans, targets and initiatives of operators and operations, including their alignment with net-zero, when making investment decisions and to engage with existing partners on their plans and progress toward net-zero. Read more à (page 36) Increased community contributions and commitments Our community contributions funded increased year-over-year, including our renewed Enseña Peru funding and the Alto Huarca water project, among other initiatives. During the year, we made new commitments with G Mining Ventures and Argonaut Gold to partner in community initiatives near their operations where we invested in 2022. We continue to support mining industry groups and diversity initiatives. Read more à (page 21) Focus on employee well-being and accommodations Maintaining a safe and supportive environment for our global workforce is a top priority for Franco-Nevada. We have highlighted the efforts made by our organization to promote the physical and mental well-being of our employees, including providing hybrid work arrangements, health benefits, wellness allowances, accommodations for cultural and religious beliefs, and the ability to disconnect when not working. Read more à (page 32) Financed emissions are included in Scope 3 emissions We have measured and disclosed financed GHG emissions attributable to our royalty and stream interests. Financed GHG emissions were calculated in alignment with the Greenhouse Gas Protocol reporting standards and included as Scope 3, Category 15 (Investments) emissions. In this ESG Report, we include a primer for navigating the Greenhouse Gas Protocol standards, including what comprises Scope 1, 2 and 3 emissions. Read more à (page 42) Report Highlights Continental Resources’ solar panels at West Blaine recycling facility, which Franco-Nevada is helping to finance Lloyd Hong, Chief Legal Officer (left) and Sandip Rana, Chief Financial Officer (right)

3 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Initiatives aligned with UN Sustainable Development Goals Initiatives across our business help advance a number of the Sustainable Development Goals (SDGs), which were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. Read more à (page 45) Continued high rankings and recognition from ESG rating agencies We continue to receive recognition for our ESG efforts and rank highly with top ESG rating agencies, including 2022 ratings of “AA” by MSCI and “Prime” by ISS ESG. In 2022, we were also included as one of Corporate Knights Best 50 Corporate Citizens in Canada. We recently received a “Global 50 Top-Rated” ESG score for 2023 from Sustainalytics, which places us among a select group of all the companies that Sustainalytics ranks globally. Read more à (page 48) Maintained carbon neutrality for corporate emissions Since 2020, we have maintained carbon neutrality for our office operations. We have accomplished this, and will continue to do so through the reduction of our corporate GHG emissions and the purchase of high quality carbon credits to offset emissions that cannot be eliminated. Read more à (page 41) Alignment of ESG reporting with TCFD and SASB and first-time alignment with the GRI standards Our ESG disclosure is aligned with leading reporting frameworks, including the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) frameworks. This ESG Report also includes first-time reporting in line with the Global Reporting Initiative (GRI) standards. Read more à (page 44) Report Highlights (continued) Commerce Court West, Toronto “We are committed to providing transparency in all ESG matters relating to our business... We have provided disclosure aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and the Sustainability Accounting Standards Board (SASB) framework, and first-time disclosure aligned with the Global Reporting Initiative (GRI) standards.“

4 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation About Franco-Nevada We are the leading gold-focused royalty and stream company with the largest and most diversified portfolio of royalties and streams by commodity, geography, operator, revenue type and stage of project. We do not operate mines, develop projects or conduct exploration. Franco-Nevada has a free cash flow generating business with limited future capital commitments and management is focused on managing and growing its portfolio of royalties and streams. Our shares are listed on the Toronto and New York stock exchanges under the symbol FNV. An investment in our shares is expected to provide investors with yield and exposure to commodity price and exploration optionality while limiting exposure to cost inflation and other operating risks. Our tag-line is “Franco-Nevada is the gold investment that works” and we are committed to ensuring it does work, for our shareholders, our operating partners and our communities: • We believe that combining lower-risk gold investments with a strong balance sheet, progressively growing dividends and exposure to exploration optionality is the right mix to appeal to investors seeking to hedge market instability. Since our initial public offering over 15 years ago, we have increased our dividend annually and our share price has outperformed the gold price and all relevant gold equity benchmarks. • We build long-term alignment with our operating partners. This alignment and the natural flexibility of our royalties and streams is an effective source of capital for the cyclical resource sector. • We work to be a positive force in all our communities, promoting responsible mining, providing a safe and diverse workplace and contributing to build community support for the operations in which we invest. Our revenue is generated from various forms of agreements, ranging from net smelter return royalties, streams, net profits interests, net royalty interests, working interests and other types of arrangements. We recognize the cyclical nature of the industry and have a long-term investment outlook. We maintain a strong balance sheet to minimize financial risk and so that we can make investments during commodity cycle downturns. The focus of our business is to create exposure to gold and precious metal resource optionality. This principally involves investments in gold mines and providing funding to copper and other base metal mines to obtain exposure to by-product gold, silver and platinum group metals production. We also invest in other metals to expose our shareholders to additional resource optionality. Franco-Nevada Corporation Board of Directors at the Cobre Panama mine, Panama (2022) Franco-Nevada global workforce, Canada (2022) “Our tag-line is “Franco-Nevada is the gold investment that works” and we are committed to ensuring it does work, for our shareholders, our operating partners and our communities...”

Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions 5 Responsible Capital Allocation Contents Due Diligence Process 6 Ongoing Asset Management 7 Key ESG Factors 8 • Health and Safety 9 • Carbon Footprint 10 • Water Management and Risk 12 • Tailings Management 13 • Biodiversity 14 Sustainable Investment Opportunities 16 Supply Chain 19 Responsible Capital Allocation We are committed to allocating capital to responsible operators that provide safe workplaces for their workforce, limit the environmental impacts of their projects and provide net benefits for their communities. Employees at Condestable project, Peru

6 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Due Diligence Process As a royalty and stream company, we do not operate mining or energy projects and do not exercise control over such operations. It follows that the most critical time for assessing and mitigating risks, including ESG risks, relating to an asset is at the outset, prior to entering into royalty and stream agreements. We believe that proper consideration of ESG risks in connection with the companies, projects and jurisdictions in which we seek to deploy capital will enhance the long-term performance of our company and in turn generate real value for our shareholders. With each royalty and stream opportunity we conduct a comprehensive assessment of ESG factors, which guides our investment decisions. Although we have top focuses in our ESG-related due diligence (see Key ESG Factors on page 8 for further detail), and processes vary depending on the nature of the opportunity, we will typically assess the following, with no single factor necessarily being determinative: • health, safety and human rights records of the project and operator; • climate-related impact of the project, including emission reduction commitments, targets and goals, including alignment with net-zero emissions; • energy sources and requirements and efficiency of operations; • water risk, requirements, sourcing and management plans; • tailings facilities and waste rock storage at the project and tailings standards adhered to by the operator; • impacts of development and operations on fauna, flora and biodiversity and no-net-loss initiatives and commitments of operators; • review of any environmental incidents relating to the project; • impacts of mining, operations and related activities on surrounding communities, including women, children, employees and migrant workers; • ethical track record and any history of corruption; • the reputation of the operator, locally and internationally; • workplace standards, protections and policies; • community initiatives and engagement and prior consultation with indigenous peoples; • closure plans; • air emissions and dust from the project; • management by the operator of toxic materials; • environmental, social and governance policies, programs and initiatives put in place by operator; • the commitments by, and track record of, the operator to fundamental freedoms of individuals (including relating to freedom of association, forced labour, human trafficking, child labour, non-discrimination and equal opportunity); • external certifications obtained by the operator or project; and • operator commitments to the Responsible Gold Mining Principles (RGMPs) or the principles of the International Council on Mining & Metals (ICMM), Canadian Institute of Mining Metallurgy and Petroleum (CIM), Towards Sustainable Mining (TSM) or other relevant standards. Franco-Nevada Expertise Formalized Due Diligence Checklists We use a multi-disciplinary approach when evaluating potential transactions. Beyond Franco-Nevada’s ESG expertise, our team consists of professionals with experience and expertise in the fields of geology, mining, metallurgy, engineering, energy, finance and law. ESG-related issues intersect with all of these disciplines and our team members provide valuable insight to properly mitigate ESG risks. We have enhanced our due diligence processes by creating an internal ESG due diligence checklist, which ensures consistency in our due diligence processes, help focus our ESG due diligence review on key issues, and inform our ESG-related document and information requests made of operators during all stages of our due diligence and contract negotiations. Outside Expertise Data Sourcing We routinely engage experts (including in the jurisdictions in which a project is located) to assist in the evaluation of new opportunities, which experts include external legal counsel, technical consultants, environmental consultants, corporate social responsibility consultants and governance consultants for the purpose of assessing political, ESG, technical and regulatory issues in applicable jurisdictions and the operator’s management of these issues. We have several data provider subscriptions, including McKinsey MineSpans, a data platform that provides over 1,000 data points per mine, including carbon and other greenhouse gas emissions generated by projects, for over 3,800 mines across the globe. We use this information to better inform our review of ESG-related issues for potential opportunities. “We believe that proper consideration of ESG risks in connection with the companies, projects and jurisdictions in which we seek to deploy capital will enhance the long-term performance of our company and in turn generate real value for our shareholders.” When we evaluate third party royalty acquisition opportunities, we typically have access to limited data regarding an operation as we are not directly engaged with the operator. Notwithstanding, we review any ESG and other information we can gather in the public domain and from outside consultants, including relating to the aforementioned topics. We use the following processes to facilitate our ESG-related due diligence:

7 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Ongoing Asset Management Royalty and stream agreements differ in many respects, but typically include the following types of provisions: “...our royalty and streaming agreements typically contain certain operating covenants designed to ensure that operators are conducting operations in accordance with applicable law and responsible practices...” Our royalty and streaming agreements typically contain a series of reporting obligations including the delivery of monthly and annual reports, updated mine plans, forecasts and other documentation, which serve to keep us informed of operations. Operators are also typically required to notify us of any material adverse changes to a project or its operations. Upon a material adverse change occurring, we maintain regular communication and offer our guidance and expertise to the operators, where appropriate. These reporting obligations keep us informed of ESG-related issues when they arise. Given our business model, following our initial acquisition of royalties or streams, we are not involved in our operators’ development and operation of the applicable projects. However, our royalty and streaming agreements typically contain certain operating covenants designed to ensure that operators are conducting operations in accordance with applicable law and responsible practices, including ESG-related standards such as the RGMPs and ICMM, CIM or TSM mining principles. Streaming agreements afford us the ability to terminate and recover specific remedies upon a material breach of the contractual provisions providing us with the flexibility to exit unsuitable arrangements. In some instances, we have security arrangements in respect of our royalty and stream interests (including share pledges, account pledges, mortgages and corporate guarantees), which would enable us to exert influence in the event of bankruptcy, insolvency or other event of a default. Such arrangements provide additional protections to help address material ESG risks. Our royalty and streaming agreements may have restrictions that either (a) require our consent for the operator to transfer the project, or (b) otherwise establish the circumstances in which such transfer is permissible. Such constraints are intended to ensure we continue to be partnered with a quality operator over the life of the agreement and a responsible actor when it comes to ESG-related issues. We are usually entitled to audit the books and records of the operators on a periodic basis and may access and inspect the properties comprising the project. These rights provide us further insight into the operations and management by the operators. These provisions permit us to confirm compliance with the terms of the agreements, including with covenants to comply with international tailings standards, and with applicable laws, including environmental laws and ESG-related industry standards. Reporting Obligations: Operating Covenants: Security & Remedies: Transfer Restrictions: Audit & Inspection Rights: (Left to Right): Matt Begeman (VP, Business Development), Eaun Gray (SVP, Business Development), Chris Bell (VP, Geology) and Phil Wilson (VP, Technical)

8 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Cobre Panama, Panama Northern and Southeastern Systems, Brazil Mine Waste Solutions, South Africa Antapaccay, Peru Guadalupe-Palmarejo, Mexico Stillwater, Montana, U.S. Candelaria, Chile Detour Gold, Ontario, Canada Hemlo, Ontario, Canada Antamina, Peru Key ESG Factors In the preceding pages of this ESG Report, we described the many ESG-related factors that we evaluate when making acquisitions, some of which we continue to monitor with our existing assets. At Franco-Nevada, we prioritize the following five ESG-related factors relating to investments, which are described in further detail in the following sections: • Health and Safety: We are focused on the health and safety track records of the operators and operations where we look to deploy capital. • Carbon Footprint: We evaluate the carbon footprints and climate-related commitments, targets and initiatives of operators and operations. • Water Management and Risk: We are attentive to water-related issues and risks impacting all applicable aspects of the mining lifecycle. • Tailings Management: We review all aspects of a project’s planned or constructed waste and tailings storage facilities, including implementation of, and adherence to, international tailings standards. • Biodiversity: We review the impact on biodiversity and ecosystems throughout the lifecycle of a project. For each of these five key factors, we have included an assessment of how the top 10 revenue generating mining assets in our portfolio (the “Top Mining Assets”) and, where applicable, the operators of such assets (the “Top Mining Producers”), have performed. The Top Mining Assets highlight the diversification of our royalty and stream portfolio. They operate in eight countries, produce gold, silver, copper, zinc, PGM, iron ore, among other commodities, and contributed approximately 57% of our overall revenue in 2022. The Top Mining Assets are owned and operated by 10 different Top Mining Producers, with primary listings on five stock exchanges and having an aggregate market capitalization of approximately US$250 billion. “The Top Mining Assets highlight the diversification of our royalty and stream portfolio. They operate in eight countries, produce gold, silver, copper, zinc, PGM, iron ore, among other commodities, and contributed approximately 57% of our overall revenue in 2022.” Top Mining Assets

9 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Health and Safety Health and safety risks are inherent in many businesses and especially so with mining operations. Mine sites expose employees and contractors to potentially lethal risks that, in addition to causing bodily harm, can also impact the success and viability of a project. Franco-Nevada is particularly attentive to the health and safety track records of the operators and operations in which we look to deploy capital (for further information, please see the section entitled Due Diligence Process). When making acquisitions and thereafter, we track the following widely-adopted safety metrics for certain of our existing assets: • Total recordable injury frequency rate (“TRIFR”) refers to the frequency of recordable work-related injuries for every 200,000 hours worked. TRIFR is calculated by the number of lost time, restricted work and medical treatment cases x 200,000 then divided by the total hours worked. • Lost time injury frequency rate (“LTIFR”) is a limited subset of TRIFR and refers to the frequency of lost time cases for every 200,000 hours worked. LTIFR is calculated by the number of lost time cases x 200,000 then divided by the total hours worked. • Number of fatalities refers to the total number of fatalities. While we seek to review and track safety data for the particular assets where we have deployed capital, this data is not always publicly available. We have highlighted the TRIFR, LTIFR and number of fatalities for our Top Mining Producers in the adjacent table. This information is disclosed by operators on a consolidated basis for all of their operations and the safety figures provided do not solely relate to the projects in which Franco-Nevada has royalty or stream interests. The adjacent figures have been benchmarked against GlobalData six-year (2015-2020) mining industry averages from a group of 54 major global mining companies. For the sake of simplicity, we have colour coded where such statistics are average, better than average, or below average. We acknowledge that these metrics have certain limitations and can vary depending on the operational jurisdiction, mining method, workforce capability, and the standards and methodologies employed by operators for determining and recording lost time, restricted work, etc. Notwithstanding, they are valuable in providing a snapshot of the safety profiles of our Top Mining Producers, benchmarked against industry averages. 1 Figures are based on operators’ public disclosure and are consolidated at the group level (all operations); TRIFR and LTIFR are per 200,000 hours worked and have been adjusted where certain operators have disclosed on a one million hour basis; figures include both employees and contractors; unless noted, fatalities do not relate to projects in which Franco-Nevada has a royalty or stream interest; “NR” means not recorded by the operator. 2 Safety stats are based on Teck’s percentage of ownership, including where it has less than a 50% interest (e.g. 22.5% of Antamina). In 2021, there was one fatality at Antamina in Peru, where we have a stream interest. 3 In 2021, there were two fatalities at Sibanye-Stillwater’s Stillwater mine in Montana, where we have a royalty interest. 4 Beginning in 2021, such figures are consolidated with Kirkland Lake Gold (previous owner of Detour Gold in which we have royalty interests). LTIFR was calculated using public data, including total number of hours worked at all operations and number of lost time injury incidents. 5 There was one fatality in 2021 at Barrick’s Hemlo mine in Ontario, where we have a royalty interest. 6 Source: GlobalData six-year (2015-2020) industry averages for 54 global miners: TRIFR average: 0.79 per 200,000 hours; LTIFR average: 0.44 per 200,000 hours; Number of fatalities average: 4.95. Top Mining Producers: TRIFR, LTIFR and Fatalities 1 Total recordable injury frequency rate (TRIFR) Lost time injury frequency rate (LTIFR) Fatalities (#) 2019 2020 2021 2019 2020 2021 2019 2020 2021 0.31 0.32 0.33 0.05 0.06 0.07 0 0 1 0.66 0.55 0.54 0.40 0.26 0.39 0 1 0 0.58 0.54 0.48 0.20 0.19 0.17 17 8 4 0.85 0.74 0.67 0.30 0.25 0.17 0 0 0 2 0.82 0.73 0.64 0.34 0.29 0.27 1.2 0.4 1.2 0.69 0.40 0.28 0.11 0.14 0.08 242 4 2 NR NR NR 1.23 1.27 1.24 11 6 11 3 NR 1.34 1.42 1.05 1.11 1.20 6 9 20 4 0.99 1.02 0.78 NR 0.68 0.42 0 0 1 5 0.45 0.34 0.29 0.10 0.07 0.08 0 1 2 Legend 6 - Better than average (<10% of industry average) - Average (within 10% of industry average) - Below average (>10% of industry average)

1 0 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Carbon Footprint Pressures on mining and energy companies to decarbonize are likely to intensify in the future, which demands greater climate-related action and transparency. We carefully observe the carbon footprints and climate-related commitments, targets and initiatives of the operators and operations in which we look to deploy capital (for further information, please see the section entitled Due Diligence Process). We also track these attributes for certain of our interests after acquisition. On this page, we have set out the 2021 GHG emission intensity for each of our Top Mining Assets. GHG emission intensity is measured as the tonnes of Scope 1 and 2 CO 2 e emissions per unit of production produced (“emission intensity”) from such Top Mining Assets. We have calculated emission intensities for our Top Mining Assets on a gold equivalent ounce (“GEO”) basis, which will be useful for a comparison between each of our Top Mining Assets, notwithstanding the different commodities produced. We have also calculated emission intensities for our Top Mining Assets based upon the applicable unit of the primary economic metal produced by each Top Mining Asset. Such emission intensities have been benchmarked against 2021 mining industry averages for each applicable commodity. For the sake of simplicity, we have colour coded where such statistics are average, better than average, or below average. While a comparison of the emission intensities of our Top Mining Assets against industry average benchmarks (by applicable commodity) can offer valuable insights, the carbon intensity and decarbonization challenges for mining and energy companies will vary by jurisdiction and with physical characteristics of projects, including depth of deposits and ore grades. Our Top Mining Assets operate in eight different countries and use various mining methods. On the next page, we set out the decarbonization commitments, targets, plans and initiatives adopted by our Top Mining Producers. “...we carefully observe the carbon footprints and climate-related commitments, targets and initiatives of the operators and operations in which we look to deploy capital...” 1 Figures in this table are estimated Scope 1 and Scope 2 GHG emission intensities of our Top Mining Assets. Unless otherwise noted, the underlying emission data has been provided by MineSpans (outside-in modeled data - all rights reserved). 2 GHG emission intensity (i) is provided on a 100% basis, notwithstanding that the applicable operation may be jointly owned by the referenced operator, and (ii) applies to the entire project. 3 Calculated as the aggregate Scope 1 and Scope 2 GHG emissions from the Top Mining Asset divided by the number of GEOs produced by such asset. Copper, PGMs, iron ore, and other commodities are converted to GEOs by dividing associated revenue for such commodity by the gold price. 4 Calculated as the aggregate Scope 1 and Scope 2 GHG emissions from the Top Mining Asset divided by the total production volume of the primary production (excluding by-products) of such asset. 5 Given the balanced gold and silver production at Guadalupe-Palmarejo, we have converted silver to GEOs, which are included with gold ounces in both emission intensity calculations. 6 GHG emission intensity averages apply to primary production from mining. Such averages exclude mid-stream processing, other than iron ore which includes pelletizing if integrated with a mine. Sources: (1) McKinsey global mining industry GHG emission intensities for 2021: 0.76 tCO 2 /oz (gold), 3.46 tCO 2 /t (copper), 32.67 kgCO 2 /t Fe62% (iron ore); (2) International Platinum Group Metals Association 0.9 tCO 2 /oz (PGM). Top Mining Assets: 2021 Scope 1 & 2 GHG Emission Intensity 1, 2 Assets GHG emission intensity (tCO 2 e/GEO produced) 3 GHG emission intensity (tCO 2 e/unit of primary metal produced) 4 Cobre Panama (Panama) 1.58 tCO 2 e/GEO 8.41 tCO 2 e/t Cu Candelaria (Chile) 0.77 tCO 2 e/GEO 4.51 tCO 2 e/t Cu Antapaccay (Peru) 0.49 tCO 2 e/GEO 2.59 tCO 2 e/t Cu Guadalupe-Palmarejo (Mexico) 5 0.39 tCO 2 e/GEO 0.39 tCO 2 e/oz Au Antamina (Peru) 0.25 tCO 2 e/GEO 1.78 tCO 2 e/t Cu Northern and Southeastern Systems (Brazil) 0.25 tCO 2 e/GEO 0.01 tCO 2 e/t Fe62% MWS (South Africa) 2.60 tCO 2 e/GEO 2.60 tCO 2 e/oz Au Stillwater (USA - Montana) 0.22 tCO 2 e/GEO 0.27 tCO 2 e/oz PGM Detour Lake (Canada - Ontario) 0.37 tCO 2 e/GEO 0.37 tCO 2 e/oz Au Hemlo (Canada - Ontario) 0.17 tCO 2 e/GEO 0.17 tCO 2 e/oz Au Legend 6 - Better than average (<10% of industry average) - Average (within 10% of industry average) - Below average (>10% of industry average)

1 1 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Carbon Footprint (continued) Mining operators, contributing to more than two-thirds of our 2022 revenues, have proactively established targets to reduce carbon emissions, including planned or actualized emission reductions derived from reliance upon renewable energy, or have made commitments to achieve net-zero emissions by 2050 or sooner. Our Top Mining Producers have adopted commitments, targets, plans and initiatives, as highlighted on this page. We continue to look for opportunities to deploy capital to other best-in-class operators and, as a capital provider, potentially help facilitate their low-carbon transitions. Top Mining Producers: Decarbonization Commitments, Targets, Plans and Goals Net Zero Commitments Emission Reduction Targets Renewable Energy Transition Goals NA Reduce Scope 1 and 2 emissions by 30% by 2025 and 50% by 2030 Reduce GHG intensity of copper mining by 50% by 2030 Reduce 100,000 tCO 2 e per year by 2024 by powering Cobre Panama’s expansion with renewable energy NA Reduce Scope 1 and Scope 2 emissions by 35% by 2030, from 2019 baseline NA Achieve net-zero emissions by 2045 Reduce Scope 1, 2 and 3 emissions by 15% by 2026 and 50% by 2035, from 2019 baseline NA NA Reduce net emission intensity by 35% by 2024, from 2018-2019 baseline NA Achieve net-zero Scope 2 emissions by 2025 Achieve net-zero Scope 3 emissions by 2050 Achieve net-zero emissions by 2050 Reduce carbon intensity by 33% by 2030 NA Achieve net-zero Scope 1 and 2 emissions by 2050 Reduce Scope 1 and 2 emissions by 33% by 2030 Reduce Scope 3 net emissions by 15% by 2035 Use 100% renewable energy in Brazil by 2025 and globally by 2030 Achieve net-zero emissions by 2045 Reduce Scope 1 and 2 emissions by approximately 20% by 2025, from baseline Increase renewable energy consumption to 20% by 2025 Achieve carbon neutrality for Scope 1 and 2 emissions by 2040 Reduce Scope 1 and 2 carbon emissions by 27.3% by 2025, from 2010 baseline 20% renewable energy penetration by 2030 Achieve net-zero emissions by 2050 NA NA Achieve net-zero emissions by 2050 Reduce emissions by 15% by 2025 and 30% by 2030, each from 2018 baseline NA “Mining operators, contributing to more than two-thirds of our 2022 revenues, have proactively established targets to reduce carbon emissions... or have made commitments to achieve net-zero emissions by 2050 or sooner.”

1 2 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Water Management and Risk Sustainable water management is critical within the mining industry. In our due diligence assessments of new royalty and stream opportunities, Franco-Nevada pays particular attention to water-related issues and risks impacting all applicable aspects of the mining lifecycle, including: • management of water to access ore through dewatering; • water use for ore processing and recovery from mine tailings; • provision of potable water and sanitation facilities for employees and communities; • discharge of water back to the environment; • interaction with marine water resources through port facilities; and • utilization and desalination of marine water. Using World Resource Institute’s (WRI) Aqueduct tool, we have identified the overall water risk for the areas where each of our Top Mining Assets are located, which measures all water-related risks, including physical quantity, quality and regulatory and reputational risk. Water intensity is one measurement that can be used to monitor trends in water use efficiency at a project. Water intensity is particularly important in areas of water scarcity and/or where there are competing interests for water availability. In the case of the mining sector, the metric is commonly expressed as the amount of water used per unit of ore processed. On this page, we have set out the 2021 water intensities for each of our Top Mining Assets, measured as the cubic meters (m 3 ) of water used per kilotonne (kt) of ore milled. Water intensities for our Top Mining Assets have been benchmarked against McKinsey global mining industry average for 2021. For the sake of simplicity, we have colour coded where such statistics are average, better than average, or below average. Top Mining Assets: Overall Water Risk and Water Intensity 1,2 Asset Overall Water Risk 3 Water consumption intensity (m 3 /kt ore milled) Cobre Panama (Panama) Medium-High 12.0 Candelaria (Chile) High 16.1 Antapaccay (Peru) Medium-High 12.0 Guadalupe-Palmarejo (Mexico) Low-Medium 25.8 Antamina (Peru) Low-Medium 18.1 Northern and Southeastern Systems (Brazil) Low-Medium 17.5 MWS (South Africa) Low-Medium 16.1 Stillwater (USA - Montana) Low-Medium 6.8 Detour Lake (Canada - Ontario) Low 20.6 Hemlo (Canada - Ontario) Low 25.8 “...Franco-Nevada pays particular attention to water-related issues and risks impacting all applicable aspects of the mining lifecycle...” 1 Figures in this table are estimated water consumption intensities of our Top Mining Assets. Unless otherwise noted, such information has been provided by MineSpans (outside-in modeled data - all rights reserved). 2 Water consumption intensity (i) is provided on a 100% basis, notwithstanding that the applicable operation may be jointly owned by the referenced operator, and (ii) applies to the entire project. 3 Source: World Resource Institute’s (WRI) Aqueduct tool. Overall water risk measures all water-related risks, by aggregating all selected indicators from the following Aqueduct categories: Physical Quantity, Quality and Regulatory & Reputational Risk. 4 Source: McKinsey global mining industry average water consumption intensity for 2021: 17.1 m 3 /kt ore milled. Legend 4 - Better than average (<10% of industry average) - Average (within 10% of industry average) - Below average (>10% of industry average)

1 3 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Tailings Management With several major disasters occurring in the last decade, tailings dams have been under increased regulatory scrutiny and have triggered an international response. In 2019, the Church of England Pensions Board and the Council on Ethics of the Swedish National Pension Funds wrote to mining companies, requesting disclosure of details of their tailings storage facilities and identifying the lack of a global tailings management standard as one possible contributor to the recent disasters. The Global Industry Standard on Tailings Management (the “Global Standard”) was launched in August 2020, aimed towards the goal of zero harm. Nine of our 10 Top Mining Producers have since agreed to fully implement the Global Standard or have otherwise adopted the Towards Sustainable Mining (TSM) framework, with the remaining one Top Mining Producer (Harmony Gold) implementing certain aspects of the Global Standard. Further, comprehensive information relating to all our Top Mining Assets’ tailings dams have been made publicly available by our Top Mining Producers and is available on the Global Tailings Portal - see tailing.grida.no Responsible tailings management requires operators to consider the management and governance of tailings storage facilities throughout their lifecycle, from design to closure and post-closure. When deciding where to deploy capital, depending on the stage of development of an applicable project, Franco-Nevada reviews all aspects of a project’s planned or existing waste and tailings storage facilities. When negotiating new royalty or stream acquisitions, we endeavour to negotiate contractual arrangements such that the operator commits to implement the Global Standard or another equivalent international tailings standard in respect to their tailings storage facilities and to provide Franco-Nevada with ongoing reporting with respect to adherence to such standards. On this page, we have highlighted certain attributes of the tailings storage facilities for our Top Mining Assets. Top Mining Assets: Selected Tailings Dam Characteristics 1,2 Asset Number of active tailings dams Tailings dam type Classification system adopted Cobre Panama (Panama) 1 Downstream/ centreline hybrid (1) Canadian Dam Association Candelaria (Chile) 2 Downstream (2) SERNAGEOMIN DS 248/2007 and DGA Decreto 50 (2015), Chile Antapaccay (Peru) 1 Not defined Canadian Dam Association Guadalupe- Palmarejo (Mexico) 1 Downstream (1) Canadian Dam Association Antamina (Peru) 1 Downstream/ centreline hybrid (1) Canadian Dam Association Northern and Southeastern Systems (Brazil) 3 49 Downstream (14), single step (23), upstream (12) Ordinance 70.389/17 - ANM (Mining National Agency), Brasil MWS (South Africa) 1 Upstream (1) SANS 10286, South Africa Stillwater (USA - Montana) 3 Downstream (3) US Army Corp of Engineers Detour Lake (Canada - Ontario) 1 Centreline (1) Canadian Dam Association Hemlo (Canada - Ontario) 1 Upstream/ downstream hybrid (1) Canadian Dam Association 1 Tailings data sourced from Global Tailings Portal and Vale S.A. reporting. 2 Vale S.A. figures include tailings, sediment dams and other similar internal structures. 3 Tailings dams are on the entirety of the Northern and Southeastern Systems and not necessarily covered by Franco-Nevada’s effective royalty grounds. Includes dams undergoing decharacterization. “Nine of our 10 Top Mining Producers have since agreed to fully implement the Global Industry Standard on Tailings Management or have otherwise adopted the Towards Sustainable Mining (TSM) framework...”

1 4 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Operators’ and operational impacts on biodiversity are carefully regarded by Franco-Nevada when deciding where to deploy capital (for further information, please see the section entitled Due Diligence Process). A mining or energy company’s or project’s ecological profile can be difficult to navigate, with no two environments being the same, and operators’ plans and actions are traditionally not measurable or quantifiable using universal standards or metrics. Franco-Nevada reviews the impact on biodiversity and ecosystems throughout the lifecycle of a project, including preliminary strategic assessments of biodiversity impacts caused by project development, life of project “no-net- loss” commitments to offset unavoidable impacts on biodiversity through regional conservation activities, and plans for site rehabilitation and reclamation upon project closures. We track the environmental impacts of certain of our existing assets and we look to partner with operators to contribute to biodiversity-related initiatives in proximity to projects where we have royalty and stream interests. We have included on these pages the World Benchmarking Alliance: Nature Benchmark, Ecosystems and Biodiversity rankings for our Top Mining Producers in 2022. On the next page, we have also highlighted the performance and some of the biodiversity commitments and initiatives by our Top Mining Producers, including an in-depth look at two of our Top Mining Assets, Cobre Panama and Detour Lake, which information is derived from the 2022 sustainability reports of First Quantum and Agnico Eagle, respectively. Our Top Mining Producers: 7 of 10... have formalized commitments not to explore or mine in World Heritage Sites 7 of 10... have commitments to securing a net neutral or positive impact on biodiversity at their operations 6 of 10... have submitted responses to the Carbon Disclosure Project (CDP) forests questionnaire 6 of 10... reported no significant incidents or non-compliance relating to biodiversity in 2021 6 of 10... are WGC and/or ICMM members, which have biodiversity standards and commitments for members “...Franco-Nevada reviews the impact on biodiversity and ecosystems throughout the lifecycle of a project...” Biodiversity Our Top Mining Producers Ranked: World Benchmarking Alliance: Nature Benchmark, Ecosystems and Biodiversity ranking (2022)* Out of 97 global metals and mining companies Out of 389 global companies from all industries 1 4 8 25 17 51 25 81 26 82 39 132 54 198 NR NR NR NR NR NR * The World Benchmarking Alliance is a United Nations organization launched in 2018 to ensure that business impact is measured, in an effort to boost motivation and stimulate action for a sustainable future for everyone. The Ecosystems and biodiversity measurement area assesses the extent to which companies understand their impacts and dependencies on nature as well as how they tackle their main pressures on ecosystems and biodiversity. It is composed of sixteen indicators covering topics such as land and sea use change, direct exploitation and invasive alien species.

1 5 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Agnico Eagle: Detour Lake, Ontario The Detour Lake mine continues to expand its progressive reclamation program to include new areas of focus and research. In addition to the ongoing native plant revegetation research, tailings and test cover programs, and lichen and soil biological crust restoration projects, the team has included studies using mycorrhizal fungi to help improve tree seedling survival, as well as an expansion of the lichen transplant trials from greenhouse scale up to a field transplant trial. Efforts also continue to support the preservation of the Woodland Caribou by means of ongoing aerial surveys and telemetry collaring programs, and direct habitat restoration. The West Detour Project expansion is currently being planned to make sure Woodland Caribou’s calving areas are considered. Each year, with the help of trained ecologists, the Detour Lake mine conducts a seed collection program to harvest and process native seeds for most deciduous species on the mine site. These seeds are then added to a “seed bank” which is pulled from every year to plant and sprout saplings in a greenhouse before shipping them to site to plant as part of the site’s progressive reclamation program. The operation progressively reclaims completed rock storage facility areas, including earthworks and revegetation. The mine has also developed a 3D immersive virtual model to help visualize what the site will look like at closure. Wildlife at Detour Lake Mine, Ontario Sea Turtle Conservancy turtle release, Panama First Quantum: Cobre Panama, Panama Cobre Panama lies within the Mesoamerican Biological Corridor of the Panama Atlantic (“MBCPA”) and the Golfo de los Misquitos Forests Important Bird Area. The region supports very high biodiversity and is also home to the Santa Fe and Omar Torrijos National Parks. First Quantum, through its subsidiary Minera Panama, S.A. (“Minera Panama”), has committed to support three protected areas in the MBCPA. Following the creation of the Cobre Panama Foundation in 2019, Minera Panama and the Ministry for the Environment have now signed a long-term agreement to continue to support the protected areas around MBCPA. The areas are the Santa Fe National Park (72,636 hectares), Omar Torrijos National Park (25,275 hectares) and a protected area to be established in the District of Donoso and its coastal marine zone (more than 150,000 hectares). Minera Panama has committed to reforestation of 10,475 hectares (7,375 hectares outside the mine footprint and 3,100 hectares within the mine footprint). The company has also committed to implementing a number of species level management plans. These have been developed with the aim of addressing the management needs of individual species for which the protected areas and reforestation plans may not be sufficient. Each species action plan describes a portfolio of actions aimed at ensuring a net positive impact on species viability. Minera Panama is currently partnered with the Smithsonian Tropical Research Institute of Tropical Investigations (amphibian rescue), the Sea Turtle Conservancy (sea turtles), the Peregrine Fund (Harpy Eagles), Missouri Botanical Gardens (plant life), and Yaguara (jaguars). Biodiversity (continued)

1 6 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Our diversified royalty and streaming portfolio is well positioned to participate in opportunities relating to the transition to a low-carbon economy. The following describes opportunities that we have embraced in our portfolio and that we expect will continue to be available to our company in the short, medium and long-term. Sustainable Investment Opportunities Copper: With superior electrical and thermal conductivity, copper will play a significant role in enhancing energy efficiency and decarbonizing the planet. A 2017 World Bank report* counted dozens of metals which could see a growing market with the increasing reliance on renewable and sustainable energy sources. Copper ranked first (tied with aluminum and nickel) among all metals for its prevalence in low-carbon technologies, including in wind, solar photovoltaic, carbon capture and storage, nuclear power, light emitting diodes, electric vehicles and electric motors. Franco-Nevada’s top revenue generating stream interests are from copper mines, including certain of our Top Mining Assets (Cobre Panama, Antapaccay, Antamina and Candelaria) where we receive precious metal by-products from copper concentrates. In 2021, we acquired another precious metal stream from the Condestable copper mine in Peru and, in 2022, acquired an effective royalty on the Caserones copper- molybdenum mine in Chile. Strong demand for copper increases the prospects of greater production from these operations. We also have royalties on a number of prospective copper development projects, including Copper World (Hudbay), Alpala (SolGold), Taca Taca (First Quantum) and NuevaUnión (Teck and Newmont). We expect that in the future there will be further opportunities for our company to fund copper operations, to receive interests in copper and/or precious metal by-products. Nickel and Clean Energy Metals: While most of the global demand for nickel is for the production of stainless steel, nickel sulphate, a highly purified nickel compound that helps deliver higher energy density in lithium-ion batteries, extending the driving range for electric vehicles, is expected to become the second largest application for nickel in 2030. Our company has royalties on nickel projects, including the Mount Keith nickel mine in Australia, Eagle’s Nest deposit in the Ring of Fire in Ontario, Canada and the Crawford Nickel-Cobalt project in Ontario, Canada. These projects are poised to benefit from increasing demand for nickel and we expect to see more opportunities to fund nickel and other battery metal projects both domestically and abroad. Technologies involved in the clean energy transition are emerging and advancing rapidly through innovation and increased deployment. Over the past few years, our company has evaluated cobalt, lithium, rare earth, uranium and other battery metal and clean energy opportunities. In particular, we are building capabilities to evaluate lithium opportunities, which are in many ways geologically and technically dissimilar to precious and base metals projects. * “The Growing Role of Minerals and Metals for a Low-carbon Future”, World Bank Group, June 2017.

1 7 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Iron Ore: Steel is essential to many aspects of modern life and is a key component for low-carbon technologies from electric vehicles to wind turbines. The production of low-carbon steel will be crucial in the transition to a low-carbon economy and for the achievement of climate goals. Our company has exposure to iron ore operations with a low-carbon footprint and that produce products suited to lower carbon steel production. We have equity ownership in Labrador Iron Ore Royalty Corporation (“LIORC”), which has a minority ownership in Iron Ore Company of Canada (“IOC”) and holds royalties over IOC’s operations in Newfoundland and Labrador, and we have royalty debentures covering Vale’s Northern and Southeastern System operations in Brazil. IOC pellets and concentrate are high grade products with world leading low alumina and ultra-low phosphorus, beneficial to the iron and steel industry. These pellets are high quality with a clean chemistry, which helps to lower the carbon footprint, compared to lower quality grades and forms of iron ore, when used in the iron and steel industry. In early 2021, IOC, operator at Carol Lake where we indirectly hold interests through our LIORC equity ownership, announced an initiative that will explore the viability of transforming iron ore pellets into low-carbon hot briquetted iron, a low-carbon steel feedstock, using green hydrogen generated from hydro electricity in Canada. Vale supplies iron ore products that require less energy use in steel blast furnaces, reducing emissions. One example is its Brazilian Blend Fines, a blend of ores produced in Carajás and Minas Gerais, with a higher iron content and fewer contaminants. Vale has recently partnered with Kobe Steel and Mitsui & Co. with the objective to offer low-carbon solutions and technologies to the steel industry. Natural Gas: The use of natural gas for energy results in fewer emissions of nearly all types of air pollutants and carbon dioxide than burning coal or petroleum products. For this reason, natural gas is viewed by many as a “bridge” fuel as renewable energy sources become increasingly more cost-effective and prevalent. A 2019 World Energy Outlook report* found that from 2010 to 2018, coal-to-gas switching saved around 500 million tCO 2 , an effect equivalent to putting an extra 200 million electric vehicles running on zero-carbon electricity on the road over the same period. Our company’s additions to our energy portfolio have shifted from U.S. oil to natural gas plays, including our 2019 royalty acquisition on Range Resources’ liquids-rich natural gas properties in the Marcellus shale in Pennsylvania and our 2020 royalty portfolio acquisition in the Haynesville shale, Texas, one of the most active gas plays in North America. In 2022, natural gas accounted for approximately 45% of our energy revenues and approximately 11% of our overall revenues, a significant increase from prior years, due to elevated natural gas prices for the year. * “The Role of Gas in Today’s Energy Transitions”, World Energy Outlook, July 2019. “Our diversified royalty and streaming portfolio is well positioned to participate in opportunities relating to the transition to a low-carbon economy.“ Sustainable Investment Opportunities (continued)

1 8 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Innovative Technologies: We have royalty interests and a working interest on Whitecap Resources’ Weyburn Unit in southeast Saskatchewan, which is a CO 2 injection enhanced oil recovery development. According to Whitecap, Weyburn is the largest carbon capture, utilization and storage project for enhanced oil recovery in the world using anthropogenic CO 2 . CO 2 is transported as a liquid from two separate industrial sources. At the source, the CO 2 is captured and compressed before transmission via pipeline to Weyburn. The CO 2 in liquid form is then injected at high pressure into the Weyburn Unit. The gas stream that is recovered with the oil production is processed for natural gas liquids and the remaining CO 2 volume is reinjected into the formation on an ongoing basis. Accordingly, with minor adjustment for losses, all of the CO 2 purchased and transported by pipeline for injection at Weyburn constitutes additional CO 2 volumes stored each year. Since its inception in 2000, more than 36 million tonnes of CO 2 , or an average of 1.7 million tonnes of CO 2 per annum, from two separate industrial sources have been captured and stored 1.5 km underground, the equivalent of taking 8 million cars off the road for an entire year. In addition to having carbon storage benefits, injecting CO 2 helps oil come to the surface more easily and improves the efficiency of production, maximizing the ultimate recovery of oil originally in place. The sequestered emissions attributable to our royalty and working interests in the Weyburn Unit, are 252,924 tCO 2 for 2021. For greater certainty, we do not reduce or set-off our Financed Emissions with sequestered emissions. We continue to monitor GHG Protocol guidance for direction on the treatment of eliminated GHG emissions, including sequestered emissions, in connection with our calculation of overall Financed Emissions. Mining and energy operators utilizing lower emission and emissions reduction processes and technologies demonstrate their adaptability to climate change. As decarbonisation continues to take centre stage, we will continue to look to partner with and deploy capital to these companies and projects, which involvement will improve our own sustainability profile. Sustainable Investment Opportunities (continued) “Since its inception in 2000, more than 36 million tonnes of CO 2 , or an average of 1.7 million tonnes of CO 2 per annum, from two separate industrial sources have been captured and stored 1.5 km underground, the equivalent of taking 8 million cars off the road for an entire year.” CO 2 Injection and Enhanced Oil Recovery at Weyburn

1 9 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Supply Chain We have a Supplier Code of Conduct, which sets out our expectations for organizations, including their employees and representatives, who supply goods and services to us (collectively, our “Suppliers”). The Supplier Code of Conduct is to be delivered to Suppliers who acknowledge in our contractual arrangements that they have received and will comply with the Supplier Code of Conduct. Although Franco-Nevada has certain suppliers of office supplies for our corporate operations, most of our Suppliers are technical, ESG and other consultants who provide information and advice to our company to support and supplement our due diligence when evaluating royalty and stream opportunities. Suppliers are expected to: • Conduct their business activities in compliance with laws and standards in the jurisdictions in which they operate; • Prevent conflicts of interest with Franco-Nevada; • Employ individuals above the legal age of employment, not to use forced or slave labour, meet minimum wage requirements and not exceed working hour and day regulations; • Recognize freedom of association and the right to collective bargaining; • Refrain from discriminating against their employees; • Respect the dignity of their own employees and others, adhere to principles of diversity and maintain a respectful workplace; and • Afford equality of opportunity to all people. Suppliers are also encouraged to: • Reduce GHGs; • Preserve water and minimize water pollutants; • Maintain soil, biodiversity and ecosystem quality; • Reduce resource waste and foster optimal resource use; • Incorporate climate change risk assessment into their risk management procedures; and • Measure and publicly report on their climate change risk and environmental performance. In addition, in accordance with our Climate Action Policy (described on page 36 ), before transacting with any significant provider of goods for our corporate operations, we ensure that such supplier has commitments, plans, targets and initiatives aligned with net-zero emissions by 2050 or sooner. Failure of any of our Suppliers to comply with our Supplier Code of Conduct may result in the termination of our relationship with the Supplier. To date, we have not been aware of any such failure by our Suppliers to comply with our Supplier Code of Conduct. Workers at the Antapaccay project, Peru “The Supplier Code of Conduct is to be delivered to Suppliers who acknowledge in our contractual arrangements that they have received and will comply with the Supplier Code of Conduct.” • Supplier Code of Conduct • Climate Action Policy Related Policies and Statements:

Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Responsible Capital Allocation 2 0 Community Contributions Community Contributions We are committed to contributing to our communities and engaging with our operators to partner in community and other initiatives where our royalty and stream assets are located. Students in Enseña Peru education program, Peru Contents Community Support 21 Industry and Other Support 22

2 1 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Community Support We are committed to partnering with operators on community and environmental initiatives near their projects where we have royalty and stream interests. These partnerships benefit local communities and environmental initiatives and also strengthen our company’s and the mining industry’s reputation in the regions in which we invest. Such initiatives have included educational initiatives, water infrastructure, recycling programs, workplace tragedy support, mental health, and COVID-19 relief efforts. Beyond the community contributions funded in 2022 and described on this page, we have recently made new commitments with the following operators, which we expect to advance over the coming months: Enseña Peru Since 2018, we have partnered with Compañía Minera Antamina S.A., the joint venture company that operates the Antamina project in Peru, in supporting Enseña Peru. Enseña Peru aims to improve education at existing schools in the region which Compañía Minera Antamina S.A. has historically supported and has the goal that by 2032, 8 out of 10 Peruvian youth will receive a quality education. Enseña Peru’s main objective is to supplement the Peruvian education ministry’s efforts in guiding volunteer teachers and other professionals through a three-month leadership program and then posting them in different schools and communities. Their other effort is to train existing teachers and increase cooperation through their Qué Maestro Program. Alto Huarca Water Project In 2022, we funded our commitment to partner with Glencore’s Compañía Miñera Antapaccay S.A., the operator at the Antapaccay project in Peru, to build a water system in order to provide potable water to the 288 inhabitants of the nearby Alto Huarca community and to safely remove waste. The initiative involves the construction of an 8.4 kilometer conduction line (with air passes, flow distribution chambers and valve chambers), a 22 kilometer distribution network with residential connections, and basic sanitation units. “Every Student, Every Day” In 2022, as part of a five-year commitment, we sponsored Victoria Gold’s “Every Student, Every Day” initiative, which works with the community to raise awareness and funds to support increased student attendance throughout the Yukon. To date, the initiative has distributed C$1.85 million to support over 180 grassroots projects. Alto Huarca Water Project, Peru Enseña Peru initiative, Peru “We are committed to partnering with operators on community and environmental initiatives near their projects where we have royalty and stream interests.”

2 2 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Industry and Other Support We provide ongoing support to several mining industry, diversity-related and other organizations and initiatives, some of which are described below. Since 2019, we have supported Threads of Life, a Canadian charity dedicated to supporting families after a workplace fatality, life-altering injury or occupational disease. We are a proactive member of the World Gold Council (“WGC”) Board and, in 2019, Franco- Nevada played a leading role at the World Gold Council during the establishment of the RGMPs, which principles must now be implemented by all World Gold Council members. Paul Brink, President & CEO of Franco-Nevada Corporation, is currently a director of the World Gold Council, serves on its Compensation Committee and is a member of its Gold247™ Working Group. In 2022, we supported Mining4Life, an initiative backed by the global mining industry with the goal to invest in the economic and social well-being of communities around the world by helping to create and support sustainable health and education solutions for children in need. We have several diversity and inclusion related contributions and initiatives, including our Franco-Nevada Diversity Scholarship, our BlackNorth Initiative pledge commitments, and The Prosperity Project sponsorship. These are described on page 31 of this ESG Report. We are the primary sponsor of the Prospectors & Developers Association of Canada (PDAC) annual awards that recognize industry successes in exploration, development, safety, environmental stewardship and aboriginal cooperation. David Harquail, Chair of the Board of Franco-Nevada Corporation, is a PDAC board member and Eaun Gray, Senior Vice President, Business Development of Franco-Nevada Corporation, sits on the PDAC Convention Planning Committee. Diversity Scholarship Franco-Nevada team members supporting WoodGreen Community Services Paul Brink and Feroz Shah, the first Franco-Nevada Diversity Scholarship recipient

Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Community Contributions Responsible Capital Allocation 2 3 Good Governance & Shareholder Alignment Contents Corporate Governance 24 Integrity and Compliance 25 Shareholder Alignment 26 Information Security 27 Good Governance and Shareholder Alignment We are committed to responsible governance practices to ensure integrity in our dealings, compliance with our undertakings, and alignment with our shareholders. Franco-Nevada 2022 AGM, Canada

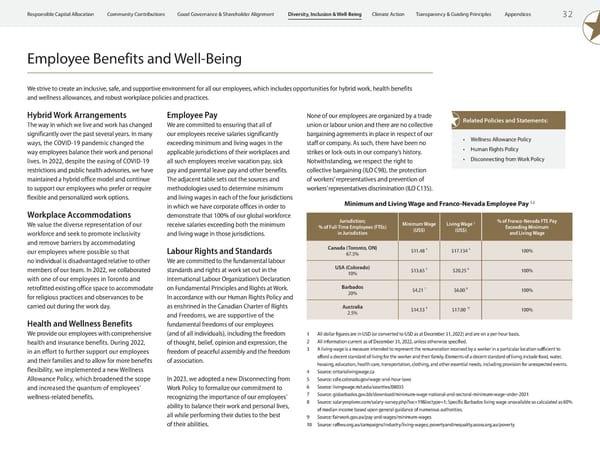

2 4 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Corporate Governance Our corporate governance structure is designed to encourage informed and effective decision- making and appropriate monitoring of compliance and performance, to serve the best interests of our shareholders. ESG matters are overseen and managed at the Board and management levels within Franco-Nevada. Board Oversight The Board and its Committees provide oversight of our strategic approach to all aspects of our business, which includes ESG-related risks and opportunities. The Board’s two committees, the Compensation and ESG Committee (“CESGC”) and Audit and Risk Committee (“ARC”) have oversight of ESG risks, opportunities and disclosures, which responsibilities are embedded in each committee’s charter. The CESGC develops and recommends to the Board our approach to ESG issues, reviews the adequacy of our ESG practices and policies and recommends any changes to the Board, approves the adoption of any ESG-related standards or initiatives, adopts ESG-related corporate goals used to evaluate management’s performance for executive compensation decisions and engages with our stakeholders in respect of ESG issues. The ARC oversees our ESG risk management. Management’s Role The Board and its Committees oversee senior management, who are responsible for the day-to-day management of ESG risks and opportunities. Our Chief Executive Officer is responsible for leadership on ESG matters and our Chief Legal Officer has executive responsibility over such matters. ESG-related risks and opportunities are overseen by our executive team, including our Senior Vice President, Business Development, Senior Vice President, Diversified, Chief Financial Officer and Chief Legal Officer, having stewardship over our organization’s units (including within our subsidiaries), each being responsible for implementing our ESG strategy and managing risks within their units. Our Board oversight and management leadership, including with respect to ESG-related issues, is depicted in the chart below. Board and Management Engagement All of our executives regularly attend Board and Committee meetings, including to provide updates on royalty and stream acquisition opportunities, which include ESG-related considerations. To the extent that a materially adverse ESG issue or consideration arises during the due diligence process in respect of a royalty and stream opportunity, management and the Board may decide not to proceed with the opportunity. On a number of occasions, our Company has passed on otherwise prospective opportunities due to ESG risks. The Board and its Committees also frequently meet with senior management to determine our strategy with respect to our risks and exposures. In November 2022, management met with the ARC to discuss ESG-related risks and strategy and with the CESGC to discuss strategy for improved ESG reporting in 2023. Most recently, in March 2023, management met with the CESGC to discuss Franco-Nevada’s ESG strategy, including, among other things, climate initiatives and commitments, community contributions, and diversity and inclusion goals and targets for the company. Accountability for ESG Performance ESG is a specific corporate goal used to evaluate management’s performance for executive compensation decisions. On an annual basis, the CESGC evaluates management’s performance in connection with ESG due diligence processes, reporting and compliance, community contributions, diversity and inclusion and ESG rankings. Business Development Team Senior Vice President, Business Development Diversified Team Senior Vice President, Diversified Compensation and ESG Committee* Finance Team Chief Financial Officer Audit and Risk Committee* Chief Executive Officer** Board of Directors* Legal Team Chief Legal Officer*** * Board and Committees have oversight over ESG and climate-related risks and opportunities ** Chief Executive Officer has responsibility for leadership on ESG and climate-related matters *** Chief Legal Officer has executive responsibility over ESG and climate-related matters